2011 Q2 | A Passing Economic Soft Spot

The economic recovery that began in Q1 2009 slowed unexpectedly in the first half of 2011. Reported growth of the GDP in Q1 2011 was only at an annualized rate of 1.9%, and a similar modest increase is anticipated for the second quarter. At the beginning of the year, a Bloomberg survey had consensus number for the quarter at 2.5%.

The economic recovery that began in Q1 2009 slowed unexpectedly in the first half of 2011. Reported growth of the GDP in Q1 2011 was only at an annualized rate of 1.9%, and a similar modest increase is anticipated for the second quarter. At the beginning of the year, a Bloomberg survey had consensus number for the quarter at 2.5%.

The shortfall caught the stock markets by surprise, and after reaching a high of 12,810 on April 29, the Dow Jones Industrial Index fell 3.1% to 12,414 to end the quarter. For the quarter, the Dow was up 1.4%, and up 8.6% for the first half. The S&P 500 was also up a hair, 0.22% for the quarter. Although there was a lot of volatility this quarter, stocks ended up where they started.

On the other hand, interest rates, sensing an economic slowdown, fell to new lows for this cycle. The 10 year U.S. Treasury note closed at a low of 2.86% on June 24th. Returns of short term Treasury notes (U.S. government securities with maturities less than a year) were even more startling. On May 27th and again on June 24th, yields on short-term U.S. Treasury notes were actually negative! Investors were actually paying the U.S. government to hold their funds. Negative returns on overnight monies are rare in any currency.These conditions occur only when investors are extremely nervous about the future.

Today, investors are confronted with a long list of economic variables that are at their flashpoints.U.S. housing results remain abysmal, as the latest figures indicate housing prices have declined to 2002 levels. The typical American house has declined from a peak value of $263,000 in 2007 to $223,000 today, down over 15%. Neither the level of unemployment nor total employment numbers saw a material benefit from the economic recovery that began two years ago. Unemployment levels moved up to 9% in May.Of concern is the sharp increase in the time it is taking to reemploy the unemployed workers. Currently the average unemployed worker is out of work for 39 weeks, much higher than any prior recession except for two periods in the depression of the 1930’s.

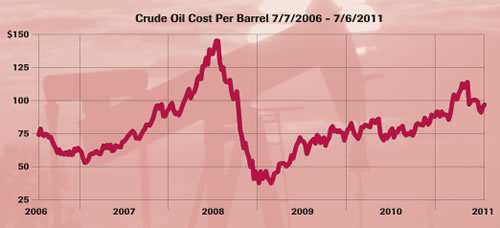

In 2011, the price of gasoline has had a significant impact on our economy. As one may remember, in 2008 the price of oil spiked to $147 a barrel (from $70 a barrel), sending the economy into a tailspin. Gasoline prices exceeded $4 a gallon in many parts of the country, and consumer spending fell sharply during the summer of 2008.

This year, a series of events resulted in another sharp upward move in energy prices. Reacting to military and political unrest in the Middle East, oil prices again spiked from $80 a barrel in February to a peak of $115 a barrel in May (see chart). The price of gasoline increased from $2.80 a gallon to a peak of just over $4 a gallon, based on a national survey. Each penny increase in the price of gasoline equates to a $3 billion annual cost to the American consumer. At $4 a gallon, the pessimist saw a $360 billion annual drag on consumer spending and the likelihood of a sharp reduction in economic growth.

In June, two events occurred to lower the price of oil significantly. First, the Kingdom of Saudi Arabia announced plans to increase oil output by 2-4 million barrels a day, and President Obama released 60 million barrels from the U.S. strategic oil reserves for American consumption. The two events resulted in a quick decline in the price of oil from $115 a barrel to $90, which translates into a $0.40 per gallon decline at the pump. This fattened the American consumer’s wallet by $120 billion on an annual basis. Further, we expect another 20-40 cents per gallon price reduction in the next several weeks, and this will certainly benefit the American consumer sector sufficiently to turn the U.S. economy on a firm upward trajectory.

——————————————————————-

Each penny increase in the price of gasoline equates to a $3 billion annual cost to the American consumer.

——————————————————————-

At quarter’s end, there was growing evidence of stepped up demand for automobiles and even some indication among large home builders that the worst correction in housing since the Depression may have witnessed a glimmer of light at the end of a long tunnel.

Also contributing to the economy’s woes has been a series of natural disasters, the worst of which was the terrible earthquake and tsunami in Sendai, Japan that struck on March 11. The immediate economic impact of the earthquake was to lower the expected Japanese growth rate for 2011 from 1.5% to 0.4%. But the Japanese economy supplies many key components to numerous economic sectors around the world. Auto, electronics, and industrial goods manufacturers have all been disrupted by supply dislocations caused by the calamity.

Then there was a series of tornados that struck many states. The worst of these hit Joplin, Missouri on May 26, destroying or damaging 40% of the city’s 40,000 households and killing 150 people. Even Massachusetts, far from tornado alley, was not spared as Springfield, Massachusetts was hit by a level 3 storm in June. The weather service has declared this year as the worst tornado season since 1937, and as this is written the season has not yet ended.

Inflation measurements picked up during the first half. The consumer price index moved above 3% on an annualized basis for the first time since 2008, led by sharp increases in food and energy prices- particularly for gasoline. The producer price index, a measure of industrial cost, increased at an even faster rate of 6.5% in the 12 months ending May 2011, pointing to further price increases in the consumer index.

Here, we disagree with the consensus. Inflation rates should begin to decline, as energy has peaked. Food prices also have risen as a consequence of the violent weather conditions that have been accompanied by severe drought conditions in the western beef-producing states. Given expected improvements in weather conditions, the outlook for the agricultural harvest could turn positive, resulting in a fall in food prices. Lower food prices coupled with lower energy costs could moderate the level of consumer price increases, providing stimulus for the economy in the second half of 2011.

Overlooked by the negative forecasters is the favorable outlook for corporate earnings for not just 2011 but also for 2012. The Dow Jones earnings estimates for this year are almost exactly $1000 per share, indicating the index is selling at approximately 12 times this year’s earnings estimates.

Preliminary forecasts for 2012 call for another increase of 10% in earnings per share to $1,100, indicating a price/earnings multiple of 11 times next year’s projected earnings. Historically, stocks have traded between 10 and 20 times earnings, with the higher multiples being achieved during periods of low inflation (less than 3%) and the lower end of the range being associated with higher levels of inflation (greater than 6%). Given our relatively low expectations for inflation (averaging 2.5% in 2011 and 2012) we are comfortable with our forecast of 13,000 to 14,000 for Dow average for this year and 15,000 for 2012. The Dow closed the quarter at 12,414 or 16% below the midpoint of our 2011 projections and 25% below our 2012 forecast.

Our interest rate outlook is more complicated and less certain than our stock forecast. An expected uptick in economic activity should see increased credit demands accompanied by higher interest rates. However, our low inflationary expectations support a continuation of the current low-interest environment. Factoring these cross-currents, we believe that, for the second half of 2011, rates have a higher probability of moving up moderately (less than one-half of one percent on the ten-year Treasury). Please note our conviction level in this forecast is not high at this point.

——————————————————————-

Overlooked by the negative forecasters is the favorable outlook for corporate earnings.

——————————————————————-

So, what does an investor do, given this outlook? We think that this economic soft spot will pass. Even though to some, things appear grim now, we see improvement on the horizon. Inflation is under control, and companies’ core valuations are such that we think there is still plenty of room for valuation growth in the equity markets. We will continue to monitor the situation closely, but we believe there is no reason to adjust our asset allocation guidelines at this time.

Closing on a positive note, I am happy to announce that Barbara Rishel has joined our firm as Senior Portfolio Manager and Research Associate. Barbara brings more than 20 years of investment experience to the firm and will assume management of selected existing accounts and will serve new relationships as they are initiated. She will focus her research abilities in the energy and industrial sectors of the economy. Barbara is married to Jim Rishel, and they have two children. They live in Howard County. Barbara will assume her duties on July 1 and will contribute to this letter in the future.