How The New Tax Plan Affects You

by Neill Peck

Just before Christmas, President Trump scored his first major legislative victory when he signed the Tax Cuts and Jobs Act. The bill dramatically reworks the U.S. tax code and promises to immediately alter the financial lives of families across the economic spectrum.

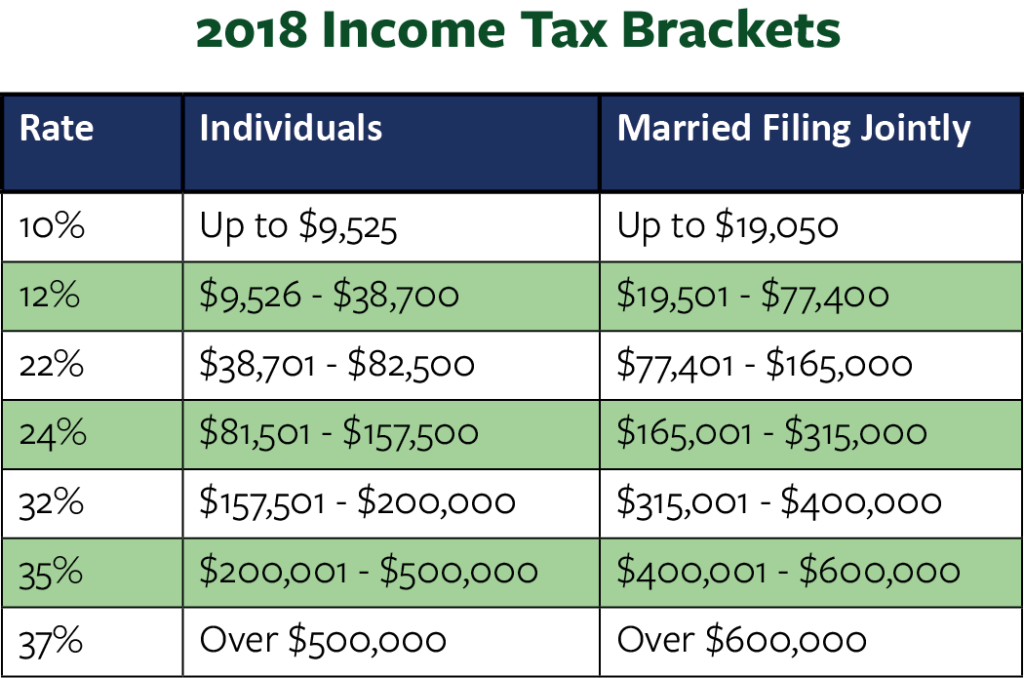

The Tax Cuts and Jobs Act represents the largest one-time reduction in the corporate tax rate in U.S. history, lowering it from 35% to 21%. The 503-page bill also lowers taxes for a majority of American households, as well as for small business owners – at least until the personal tax cuts expire after eight years. The bill lowers taxes for top income earners. Prior to its passage, couples earning over $470,000 per year paid 39.6% in federal income taxes. The GOP bill drops that rate down to 37% and increases the threshold at which that rate kicks in to $600,000 for married couples. This new break for millionaires is intended to ensure that wealthy earners in highly taxed states such as New York, Connecticut, and Maryland don’t end up paying substantially higher taxes. Moving forward, taxpayers will only be able to deduct $10,000 in state, local, and property taxes.

The final tax plan lowers taxes for most Americans until 2026, since it will decrease rates for every income level. Even though the personal exemption is being scrapped going forward, the plan nearly doubles the standard deduction. It also doubles the child tax credit that parents receive to $2,000, and it increases the credit’s income threshold from $75,000 to $200,000. The bill also creates a new $500 temporary credit for non-child dependents (children 17 or older, a disabled adult child, or an ailing elderly parent). Moving forward, the new plan lowers the cap on the mortgage interest deduction on a first or second home. Now, homeowners will only be allowed to deduct interest on the debt up to $750,000, down from $1 million today. While early versions of the bill had proposed repealing deductions on medical expenses and student loan interest, these changes did not make it into the final version.

Republicans in Congress had originally wanted to do away with the estate tax entirely but ended up settling on increasing the taxable threshold from $5.5 million per person to $11 million. Going forward, a wealthy couple will be able to pass $22 million on to their heirs tax free. Small businesses are getting a big tax break under the new plan. Pass-through companies (LLCs, S corps, partnerships, etc.) will receive a 20% reduction under the new tax code.

Investors saving for retirement will not expect many changes under the new tax plan, since it makes no changes to the tax-free amounts they can put into 401(k)s, IRAs, and Roth IRAs.