The Weekly View (3/11/19)

Last Week’s Highlights:

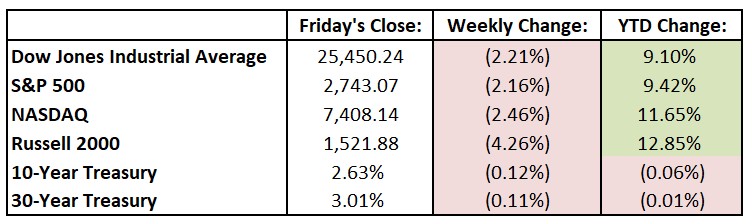

Major U.S. equity markets closed out their worst week since December, largely due to increasing worries about slowing economic growth around the globe. Investors grew more concerned about the fate of a trade agreement between the U.S. and China, and Thursday’s decision by the European Central Bank (ECB) to deploy additional stimulus contributed to global economic concerns. Domestically, Labor Department data released on Friday showed that U.S. nonfarm payrolls rose a seasonally adjusted 20,000 in February, falling well short of economists’ expectations for 180,000 new jobs. The economic news wasn’t all gloomy, however, as the unemployment rate decreased to 3.8% from 4% the preceding month, while wages grew 3.4% from a year earlier – the strongest pace since April of 2009. For the week, the Dow Jones Industrial Average (DJIA) fell 576.08 points, or 0.2%, to 25,450.24, while the S&P 500 declined 2.2% to 2743.07. The tech-heavy NASDAQ led the weekly declines, closing down 2.5% to 7408.14. The markets, however, still sit on nice gains for the year, with both the Dow and S&P still up over 9% for 2019. Saturday marked the 3,653rd day since domestic markets began their bull run in the wake of the financial crisis. The S&P 500 index has returned 400% (including reinvested dividends) since the March 9, 2009 market bottom.

Looking Ahead:

Earnings season winds down with several financial reports this week, including ADT (ADT), Stitch Fix (SFIX) and Coupa Software (COUP) on Monday. The Census Bureau reports retail sales data for January – economists forecast a flat reading after a 1.2% decline in December. Excluding autos, retail sales are seen rising 0.2% after falling 1.8% in December. Try to stay awake on Monday, as it’s National Napping Day. The U.K.’s House of Commons will vote on Prime Minister Theresa May’s revised Brexit deal on Tuesday, as the deadline for Britain’s exit looms. Dick’s Sporting Good (DKS) releases its quarterly earnings results. On Wednesday, the Bureau of Labor Statistics reports its producer price index (PPI) for February – economists forecast a 0.2% rise after a 0.1% decline in January. Adobe (ADBE), Broadcom (AVGO) and Dollar General (DG) release their financials on Thursday. The Census Bureau announces new-home sales data for January – expectations are for an annual rate of 615,000, down from December’s 621,000 print. The business week ends with Friday’s report by the Bank of Japan of its monetary policy decision. The central bank is widely expected to leave its key interest rate at negative 0.1%.

The Tufton Capital Team hopes that you have a wonderful week!