Chatting Our Way to Productivity

By: Alex Olshanskiy

In a world where inflation is uncertain and a recession seems very possible, productivity is essential for growth and stability. The U.S. Bureau of Labor Statistics states “with growth in productivity, an economy is able to produce—and consume—increasingly more goods and services for the same amount of work.” One potential catalyst to limit the possibility of “low economic growth” and perhaps a recession comes from advancements in the technology sector—more specifically—Artificial Intelligence or AI.

Generative Artificial Intelligence (AI) has been in the headlines lately, especially since the release of the ChatGPT chatbot in 2022. AI can perform a range of tasks! It can create new content such as texts, images and even write code based on the data that it has available. In addition, behind these products are large language models (LLMs) that can take a text prompt and generate a human-like response to that prompt. In 2023, Microsoft released a new Bing chatbot powered by an improved version of ChatGPT. Google promptly responded with a chatbot named Bard. These products could enhance the search experience, facilitate more comprehensive answers and assist the end user in creating more effective and detailed content. These products will hopefully expand productivity for the end user and ultimately for the economy as a whole.

There are various ways that AI could increase productivity. It could be used to automate mundane tasks such as data entry, scheduling and customer service that are currently done by humans. This could free up certain workers to concentrate on creative and strategic tasks which are vital for the long-term growth of any company. However, this also raises the risk of some workers losing their current jobs. AI could also be utilized to analyze large amounts of data to help the user make more informed and accurate decisions. Furthermore, there is also the possibility that AI could create new services and products that could potentially lead to new markets and opportunities for businesses. Taking it a step further, AI could bring about new types of businesses with brand-new positions!

AI has the potential to boost efficiency and productivity, but it still faces some challenges. AI systems are not always accurate, AI can make mistakes, it can sometimes be biased, and it is constrained by its data. It is imperative to be mindful of AI’s limitations and to take precautions to avoid the spreading of misinformation and propaganda. Currently, companies are investing a great deal of money to develop, operate and maintain these products. These costs are expected to decrease over time as technology advances – think televisions!

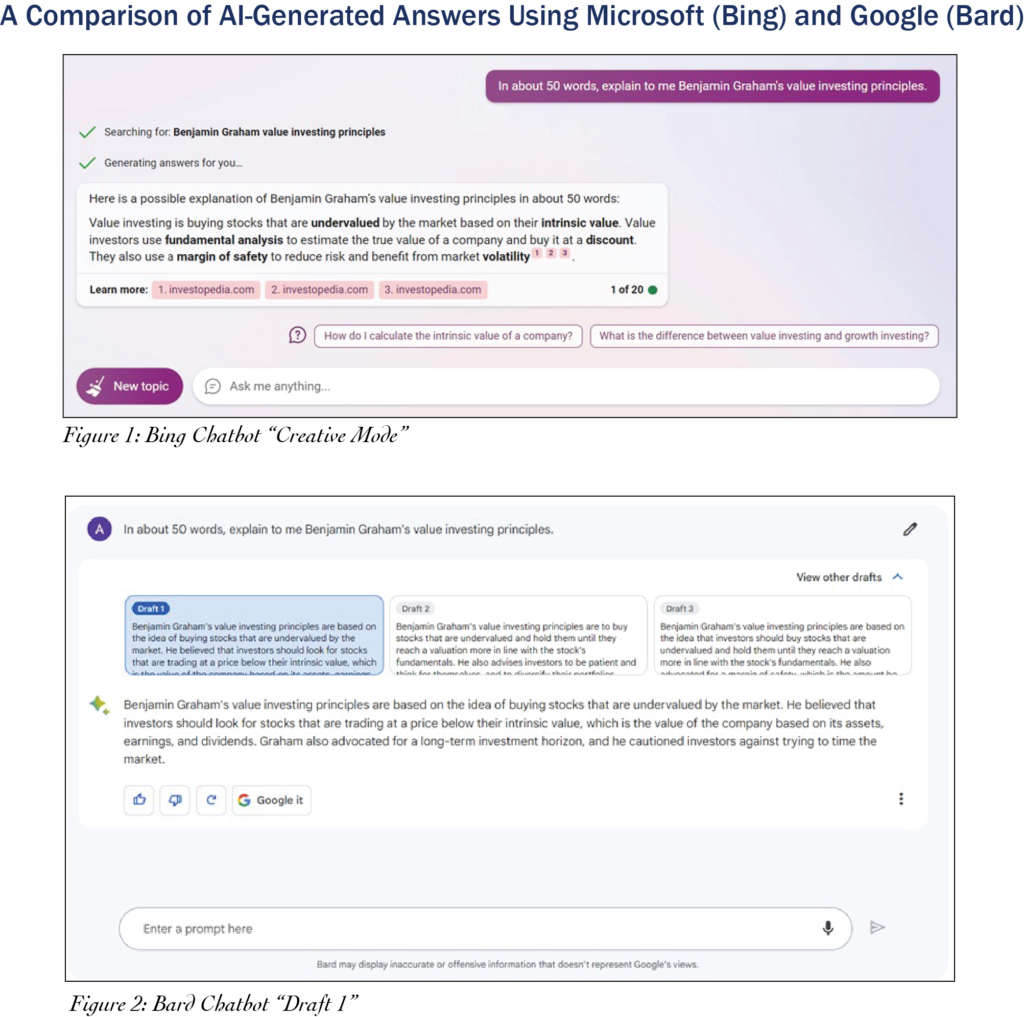

Putting AI to the test was fun! I fed Bing and Bard the same information, which was to elaborate on one of Tufton’s core mantras – value investing. For this exercise, I prompted both Bing and Bard with an identical task: “In about 50 words, explain Benjamin Graham’s value investing principles.”

The first example from Microsoft’s chatbot lets you choose from three modes which are creative, balanced and precise. For this example, creative mode was selected. The answer that it spun was as follows: “Value investing is buying stocks that are undervalued by the market based on their intrinsic value. Value investors use fundamental analysis to estimate the true value of a company and buy it at a discount. They also use a margin of safety to reduce risk and benefit from market volatility.” The short response also had citations included (but are excluded for this example).

Google’s chatbot only had one mode but gave three drafts to pick from. Bard’s answer was as follows: “Benjamin Graham’s value investing principles are based on the idea of buying stocks that are undervalued by the market. He believed that investors should look for stocks that are trading at a price below their intrinsic value, which is the value of the company based on its assets, earnings and dividends. Graham also advocated for a long-term investment horizon, and he cautioned investors against trying to time the market.”

The question I asked was fairly basic, but nevertheless it only took a matter of seconds to receive both responses. This technology is indeed extraordinary, and it certainly has the potential to boost and improve productivity in the future. We at Tufton, however, will remain careful and diligent as we continue to research and examine these new technologies. Our diligence will enhance our knowledge of the benefits and risks of AI in our ever-changing world.