Company Spotlight: Intel Corp. (Ticker: INTC)

by John Kernan

We have held shares of Intel (Ticker: INTC) for many years at Tufton Capital. Intel has undergone fundamental changes and continues to adapt to the future of computing. We think that these changes merit a closer look at what is a trophy company.

Intel is the leader in its field, has a strong balance sheet, and carries an above-market yield. Furthermore, Intel is the greatest second-party beneficiary to the automation as well as the “Internet of Things” (having many types of devices connected to the Internet), trends that are coming more quickly than many realize.

We believe that the addition of more high-performance computers in daily life (e.g., cars and trucks) and the exponentially expanding need to process all of this data in large datacenters will create a huge market opportunity for Intel.

While the excitement around self-driving cars seems like a lot of hype, Intel has put down some convincing numbers for us to consider. In ten years, Intel estimates cars will need to process 250 gigabytes (GB) per second of data. For scale, an iPad holds in total 32-128 gigabytes of data. Other areas, such as manufacturing, will also adopt large-scale processing and automation. Furthermore, by 2020, Intel estimates each self-driving car will generate 4000 GB of data per day. All together, it believes that self-driving technology will require $2000-3000 worth of silicon in every car. How many cars will get this amount of silicon? The low end of Intel’s estimate for 2020 is 100 million cars in the total addressable market. That sounds like a lot, but we must remember that there are ~1.3 billion vehicles on the road today.

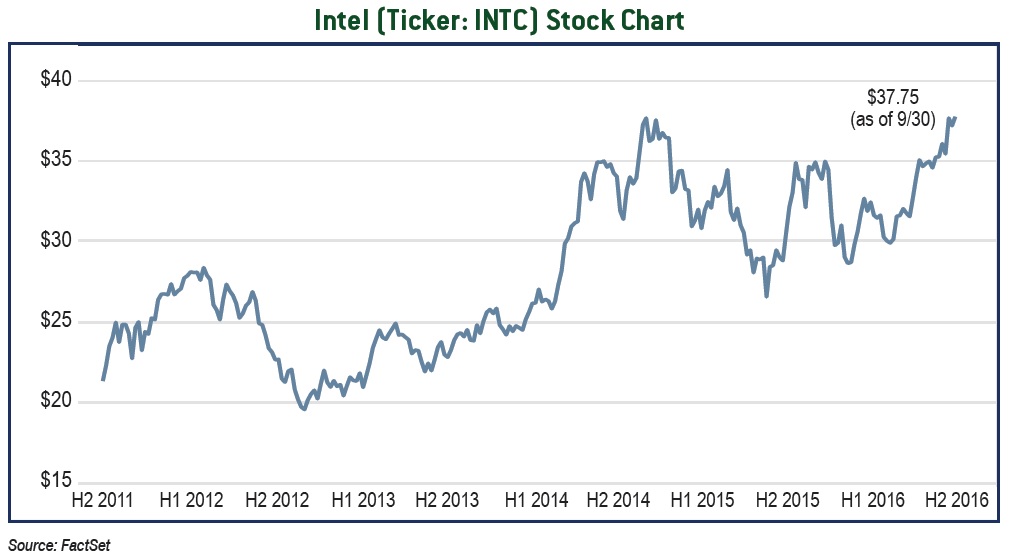

Some of the growth in these segments is likely priced in to the stock, especially vis-à-vis the declining PC market. However, the current valuation does not look stretched by any means, and the PC market’s decline seems to be slowing. We believe that this decline of Intel’s legacy market has led to a severe depression in the valuation given to the Client Computing segment. While the segment’s current customer base (Dell, HP, etc.) is in decline, the same infrastructure can be used for Intel’s growth markets. We believe that the stock, while not depressed to the point we would recommend buying more, is at least in part undervalued.

We are recommending that clients continue to hold Intel. It is already a significant holding in our accounts. We will continue to watch valuation and developments in the semiconductor chip industry, but we do not anticipate recommending a sale of the stock in the near future.