Diversification: Investing’s “Free Lunch”

by John Kernan

Diversifying a portfolio is a relatively simple concept. If you have more securities and one goes bad, it won’t sink your whole ship. Diversification is often called investing’s “free lunch” for good reason. You get the benefit of lower risk with little extra cost to you as the investor.

Proper diversification isn’t always as straightforward, and investors can get themselves into a mess while thinking they’re doing the right thing by holding lots of funds. For example, any investor choosing a mix of assets has certainly heard of diversification, but while looking at a menu of 50+ mutual funds, how to diversify might not be so clear. He or she might “wisely” choose several funds that look to be different. Looking at Vanguard’s “Stock Funds” menu, it would be easy to pick the following list of funds:

- U.S. Growth

- U.S. Value

- FTSE Social Index

- Mid-Cap Strategic Equity

- Strategic Small-Cap Equity

Once we choose, how much money goes in each fund? The answer isn’t obvious, so investors often just split them up evenly1. Let’s take a look at some problems with the resultant portfolio:

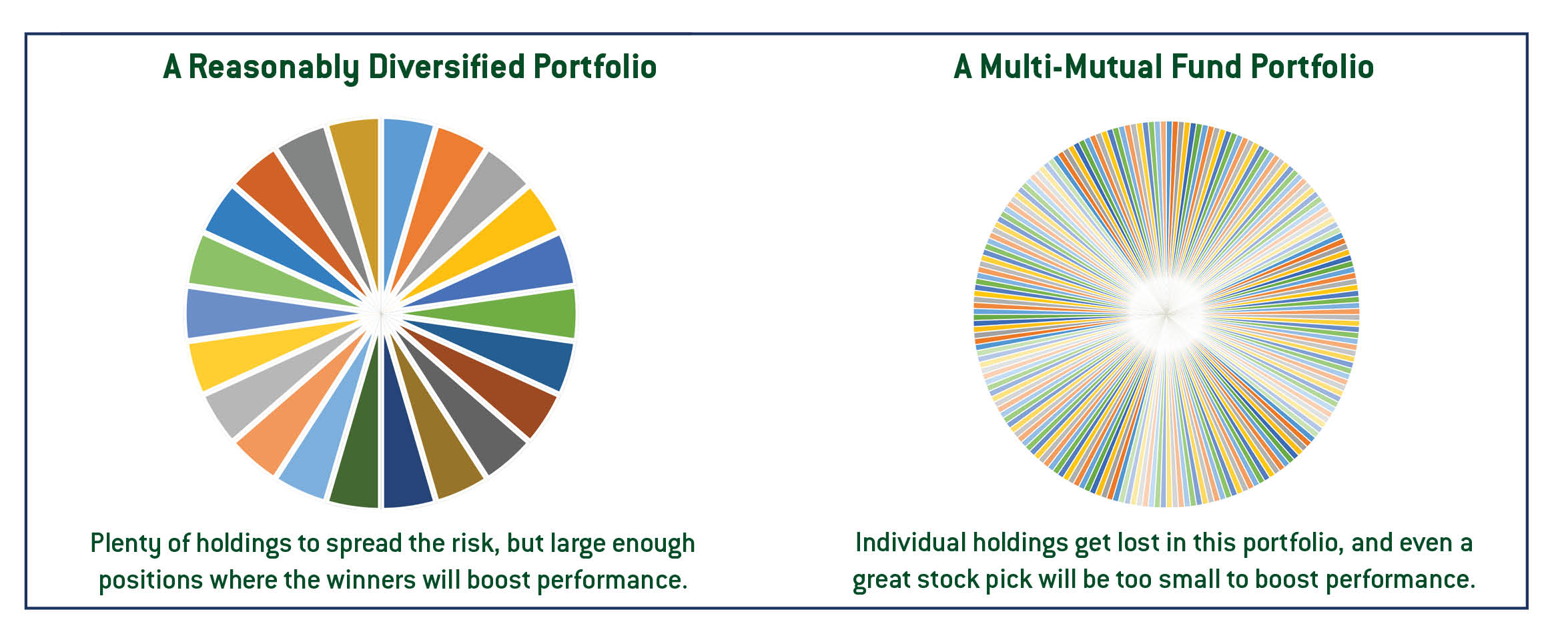

Overdiversification

This is the biggest and maybe most common issue. This portfolio holds 947 stocks. Plus, we often find the same stock in many of the funds. Sure, Apple is a common holding because it’s so large, but four out of five of these funds holds Quintiles IMS Holdings Inc. – not exactly a household name. What’s the value of holding 1000 stocks in five different funds? Does it justify paying extra fees, or are you just indexing? These questions lead us to our next problem, which is “diworsification.”

Diworsification

A subtle facet of overdiversification is the fact of “diworsification,” where adding more correlated assets just moves an investor closer to the index without adding any risk reducing benefit. To reduce risk, assets must be at least partially uncorrelated. Some event that causes one stock to go down won’t necessarily cause another stock in the portfolio to do so. For example, a crash in Americans’ appetite for chocolate won’t make a Japanese confectioner’s stock go down as much. This relates to our next problem.

Geographic Concentration

U.S. investors want to buy what they know, and the vast majority of Americans have overweight positions in U.S. companies. It makes some sense, especially given the trouble that other economies have had in the last decade. But history tells us that the U.S.’ relative performance won’t last forever, and there are plenty of investment opportunities abroad that have low correlations with U.S. assets – just the protection we are looking for.

Asset Allocation

Finding the right mix of stocks, bonds, and other assets is a challenge, to say the least. Our theoretical investor didn’t think about what happens if the stock market tanks starting tomorrow. Can he afford the ten or so years to make up that loss before retirement?