First Quarter 2023: Rock and a Hard Place

By: Eric Schopf

The first quarter of 2023 delivered strong returns in the stock and bond markets. The Standard and Poor’s 500 total return was 7.5%, while the Bloomberg Aggregate Bond Index return was 2.69%, which was a welcome relief following a 13.01% loss in calendar 2022. These strong returns masked the turbulence created by the latest Federal Reserve inflation-fighting interest rate increases. Casualties from the fight included two large regional banks, and the Fed must now contend with both persistent inflation and a vulnerable banking sector. The remedies for each seem to be contradictory.

The Fed instituted two additional 25 basis point increases to the federal funds rate during the quarter. The key rate filters into loans ranging from automobiles to credit cards. Unlike the first seven rate increases of this cycle, the last two have exposed cracks in the financial system. Silicon Valley Bank, headquartered in California and the 16th largest bank in the United States with more than $200 billion in assets, failed on March 10. New York City-based Signature Bank, with over $110 billion in assets, was shuttered just two days later. Both institutions suffered a classic bank run, which occurs when depositors lose their confidence and rush to withdraw their money. The banks, highly leveraged by the nature of the industry, were forced to sell assets to meet withdrawals. Assets, in this case, were United States Treasury obligations and mortgage-backed securities that were trading at big discounts due to the rise in interest rates over the past twelve months. The losses wiped out all shareholder equity.

Systemic risk was quickly addressed. Working together, the Federal Reserve, Treasury Department and Federal Deposit Insurance Corporation instituted measures to bring stability back to the banking system. The Fed created the Bank Term Funding Program which allows banks to borrow based on the full par value of assets in their investment portfolios. The program helps banks maintain liquidity in the face of deposit flight. The FDIC also eliminated deposit insurance limits. Prior to the change, deposits of more than $250,000 were not covered in the event of a bank failure. This unlimited coverage has reduced the threat of additional bank runs.

Although the Fed lending program and the FDIC extension of insurance on all bank deposits have settled markets for now, the risk of further disruption remains. The Fed continues to see inflation as an ongoing problem. Their primary tool for reducing inflation is higher interest rates to reduce aggregate demand, but higher rates will continue to exacerbate bank issues. The problem extends beyond the asset-liability mismatch at Silicon Valley Bank and Signature Bank. Deposits are a bank’s lifeblood. Higher short-term interest rates make competing money market mutual funds much more attractive. Savers will continue to shift money out of low-yielding bank savings accounts into money market funds that are yielding around 4.5%. The exodus of deposits will reduce the amount of credit banks can extend, and a credit crunch could have severe economic consequences.

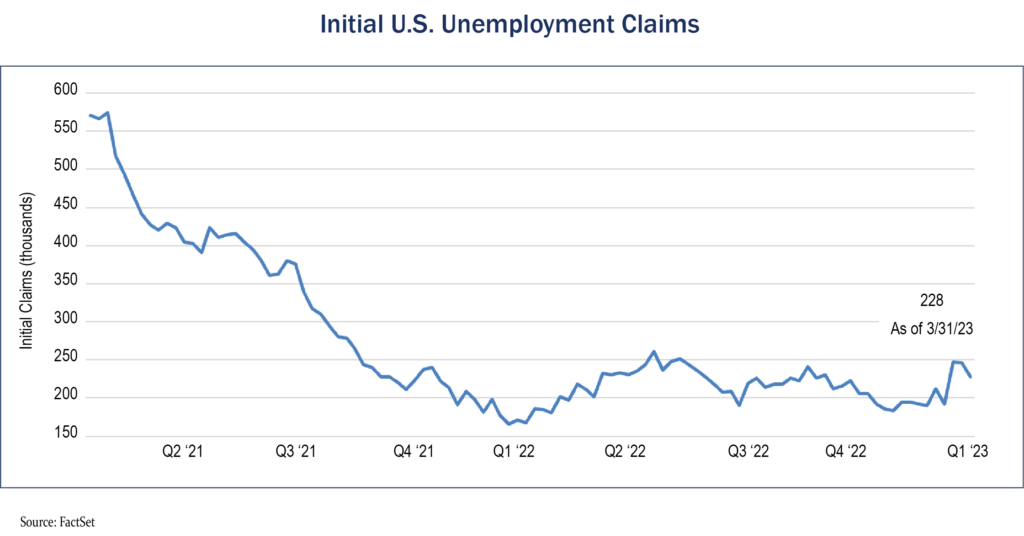

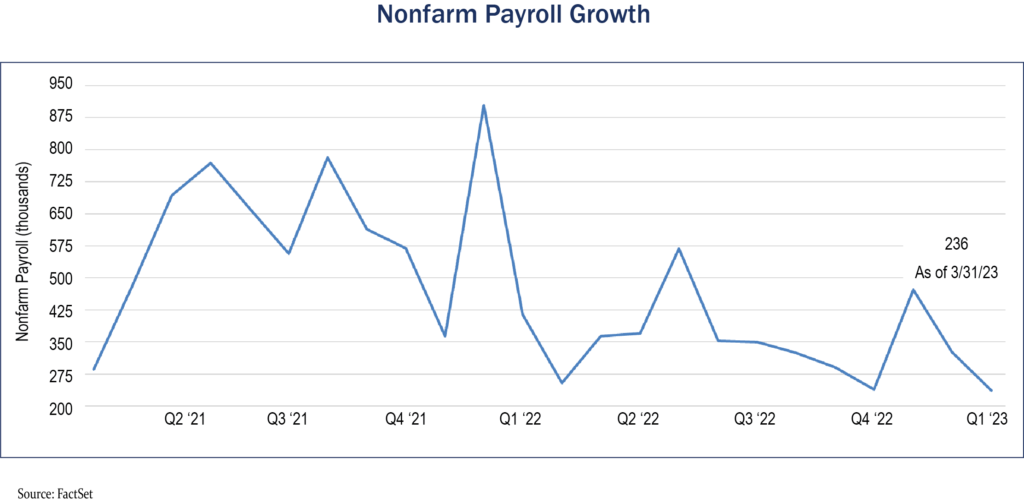

Our focus continues to be on the job market and inflation given that the Fed’s dual mandates are maximum employment and stable prices. Their current course of action is to slow the economy while allowing unemployment levels to rise. With nine interest rate hikes now in the rear-view mirror, the impact on the labor market has been almost imperceptible. Initial claims for unemployment have increased but have remained in a tight range following the pandemic years. Job creation has shown similar dynamics. Nonfarm payroll growth has slowed, but the growth is still solid. Baby boomers retiring en masse and curtailed immigration have greatly altered labor force fundamentals. Inflation, although moderating, is still well above the Fed’s 2% target. The consumer price index and the personal consumption expenditure price index both reflect the inflation reality. Goods price inflation is fading as supply chains are restored, but service price inflation remains hot.

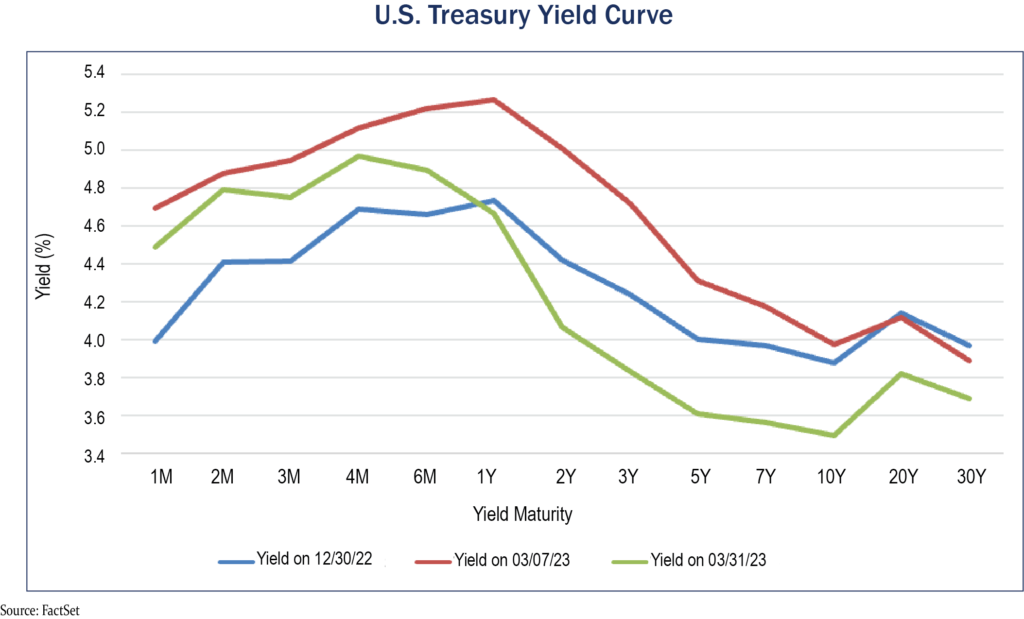

As reflected by the yield curve, the market had agreed with the Fed’s course of action right up until the bank failures in early March. Interest rates moved higher during the quarter in recognition that the Fed would continue to aggressively combat inflation. However, following the bank failures, the market realized that there is a limit to how far the Fed can go. Interest rates have tumbled precipitously since then with only the shortest bond maturities offering rates that are higher than where they were prior to the banking scare. The market is now pushing against prevailing policy. Monetary policy works through the financial markets, and an unwarranted easing in conditions may further complicate the Fed’s position.

While we continue to monitor monetary policy, geopolitical events are also on our radar. Relations with China, the second largest economy in the world, continue to deteriorate. Although our relationship with the communist nation has always been a bit uneasy, the sweeping tariffs imposed on Chinese imports during the Trump administration in 2017 made matters even more uncomfortable. From that point, things just kept getting worse. Covid blame, President Biden’s maintenance of tariffs, the diplomatic boycott of the 2022 winter Olympics in Beijing and China’s refusal to condemn the Russian invasion of Ukraine seemed to make things worse. Last October, the United States upped the ante by restricting the export of U.S.-made advanced computer chips and other related equipment to China. Our relationship with China appeared even bleaker when the Defense Department announced that an F-22 fighter jet shot down a Chinese spy balloon.

Any remaining peace dividend following the dissolution of the Soviet Union in 1991 may be gone. Increases in military spending, at the expense of other programs, are almost certain. This comes at a precarious time, as the federal government is now in debt to the limit set by Congress—$31.4 trillion. There is no reason to believe that the debt ceiling won’t be raised again, just like it has been raised consistently over the years. Budget priorities are sure to set off fireworks later this year when serious party negotiations begin. The rate of debt growth is unsustainable, and the cost of funding the debt continues to climb. A profligate fiscal policy resulting in a weaker dollar and higher inflation puts further pressure on the Fed to carry out their dual mandate.

There are a few very important lessons investors can learn from the recent bank failures. First, assets and liabilities need to be matched. Silicon Valley Bank liabilities consisted largely of customer deposits. Bank assets included long-term United States treasury obligations and mortgage-backed bonds. Deposits can be withdrawn quickly and easily while long-term assets are most susceptible to fluctuations in interest rates. The mismatch led to problems when many of the depositors simultaneously headed for the door. Although risky assets like stocks or long-term bonds play an important role in the long-term success of an investment portfolio, short-term liabilities should be matched with highly liquid investments and reliable cash flow such as interest and dividend income. This is especially relevant for retired individuals who depend on portfolio distributions to help fund living expenses. Forced asset sales to fund withdrawals is a recipe for disaster.

The second lesson is the value of diversification. Nearly all deposits at Silicon Valley Bank exceeded the Federal Insurance Deposit Corporation threshold. A more diversified customer base may have offered greater stability. A diversified investment portfolio can also provide greater stability through less volatility. Our portfolio managers work with you to make sure that liabilities are well understood, and investment objectives are met through a diversified portfolio.

Current events highlight just some of the risks that investors face. While acknowledging the risks, it is important to remember the potential rewards. Stay focused on your long-term goals, and don’t let your emotions derail your plans.