Our Interest in Bonds

By: Alex Olshanskiy

Bonds, commonly referred to as fixed income securities, play an important role within a well-diversified investment portfolio. They offer a consistent and predictable stream of income, potentially enhancing the stability and financial security of investors. Moreover, the maturity of bonds ensures that investors receive timely cash flows, allowing for strategic reinvestment or to fulfill financial obligations. Traditionally, bonds often represent a potentially safer and less volatile investment avenue compared to the more dynamic world of common stocks. Bondholders, or creditors, hold a senior position in the capital structure, meaning they have a prior claim to company assets in case of financial distress. In essence, bondholders are placed ahead of shareholders in the pecking order, an advantageous position that grants them an additional layer of security.

A bond is essentially a debt security that represents a loan made by an investor to a borrower. Corporations, governments and municipalities all issue bonds to fund projects and programs. An investor puts money into a bond, and they lend their funds to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Every bond has its own unique tune, and understanding its melody is key to appreciating this financial instrument. The components of a bond’s symphony include the face value, coupon rate, maturity date and yield.

- Face Value, also known as the par value, represents the bond’s worth at maturity.

- Coupon Rate is the fixed annual interest rate disbursed to bondholders, traditionally expressed as a percentage of the bond’s face value, and it plays a key role in determining the bond’s regular income for investors.

- Maturity Date signifies when the bond reaches the end of its term, allowing the investor to redeem the principal.

- Yield represents the effective rate of return derived from the bond, taking into account the current market price and the coupon rate.

Bond prices sway with the breeze of market dynamics. The key actors in this performance are interest rates, credit quality and economic factors. When market interest rates rise, existing bonds with fixed coupon rates become less attractive, which leads to a decrease in their value. Conversely, when market interest rates fall, bonds with higher coupon rates become more sought after.

The creditworthiness of the bond issuer also impacts performance. Bonds issued by entities with superior credit ratings command higher prices in the market. Additionally, news and economic events can also influence bond prices. Economic growth, inflation and geopolitical events can all cause bond prices to rise and fall.

Over the past year, there has been a historical rise in interest rates. This increase can be attributed to a combination of factors. Rising inflation expectations have led to fears that the purchasing power of fixed interest payments may erode over time, prompting investors to demand higher yields on bonds. Moreover, the supply of bonds has surged, especially in response to increased government borrowing. When the supply of bonds outpaces demand, prices tend to fall, driving up yields. Many corporations took advantage of historically low interest rates during the pandemic to issue debt. Central banks have initiated the process of unwinding their extensive bond-buying programs. This reduction in demand for bonds has led to higher yields as well.

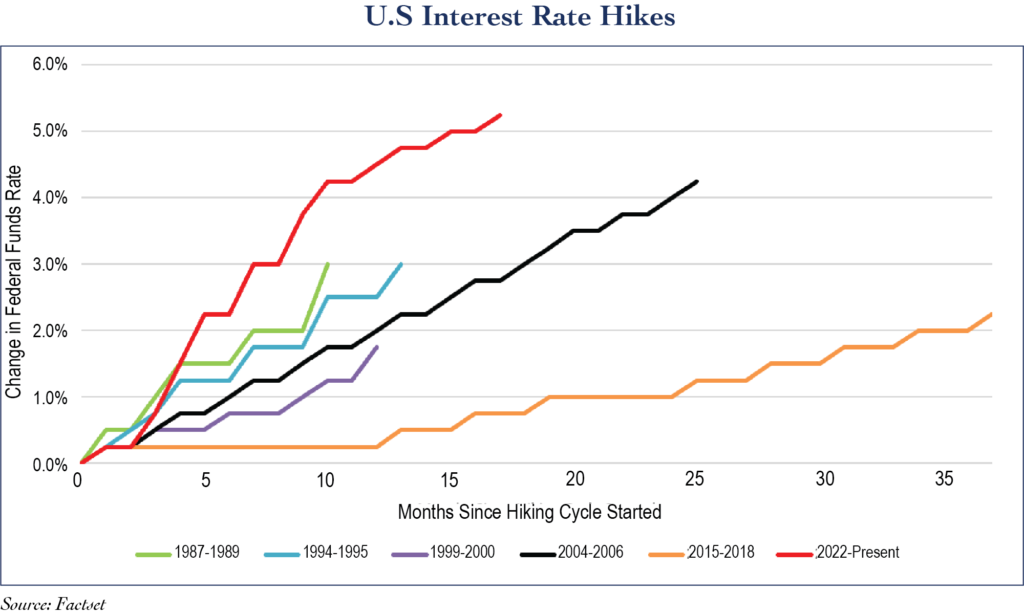

The “U.S. Interest Rate Hikes” chart (on the previous page) provides a visual illustration of the speed and magnitude of the Federal Reserve’s actions from 2022 to the present. The current federal funds target rate stands at 5.25-5.50%, leaving many to ponder how far will the Fed go in its battle against inflation. A year ago, the prevailing assumption was that interest rates would reach their peak in 2023, with expectations just shy of 5%. However, by using the Fed’s dot plot chart as a gauge for future interest rates, we could potentially see higher rates in 2024, with the range expanding to as high as 6.0-6.25%. The possibility of the Federal Reserve having to sustain a longer period of restrictive policy to curb inflation from exceeding 2% is still on the table.

Higher interest rates exert a profound influence on the economy, much like a conductor’s baton in a complex orchestration. When rates ascend, borrowing costs surge, casting a shadow over consumer spending and business investments. The housing market’s vitality wanes as mortgages become less affordable, while a stronger currency can also hinder exports. Paradoxically, higher rates are also a shield against inflation’s crescendo. To thrive in this symphony of economic dynamics, our investment committee must conduct a harmonious strategy, embracing both challenges and opportunities as interest rates evolve.

Controlling risk is essential to preserving and growing our clients’ wealth. To navigate the current interest rate environment, we employ a multi-faceted approach:

- We prioritize investment-grade bonds in our portfolios, reducing credit risk exposure and enhancing the stability of our clients’ investments.

- We actively manage the duration and maturity of our client’s bond portfolios to align with specific investment objectives. This prudent approach aims to potentially provide more effective control over our clients’ exposure to interest rate risk.

- Our portfolios are carefully diversified across various bond types and sectors to spread risk and capture opportunities in different market conditions.

While interest rate fluctuations certainly pose some hurdles, they can also provide opportunities. Our experienced team is steadfast in its commitment to navigating these challenges on our clients’ behalf. We combine sound investment strategies with rigorous risk management practices to carefully navigate in this ever-evolving landscape.