The Third Quarter of 2017: The Irrepressible Stock Market

by Eric Schopf

The third quarter gave us yet another solid advance in the stock market. The Standard & Poor’s 500 delivered a total return of 4.5%, and for the year in full, the broad-market benchmark has delivered 14.3%. Also keeping in line with the first half, the S&P saw little volatility in the quarter. Wanting to give us at least a little excitement, the bond market gyrated throughout the past three months. However, by September 29, intermediate- and long-term interest rates closed essentially unchanged from June 30. Short-term interest rates continued to move higher in reaction to Federal Reserve policy. And so, we march steadily upward.

The stock market’s lack of volatility is truly remarkable given the wide range of social, geopolitical, and meteorological events that punctuated the quarter. The largest setbacks in the markets occurred in mid-August, when tensions with North Korea rose. Reports from the self-isolated nation revealed that it was examining an operational plan to strike areas around the United States’ territory of Guam with medium-to-long range strategic ballistic missiles, enough to rattle any market participant. Then, a week later, it was rumored that Gary Kohn, the Director of the National Economic Council and a chief economic advisor to President Trump, was considering resignation after the President failed to blame neo-Nazis for the Charlottesville, VA violence. The resultant selloff was short-lived, though, and the stock market was within a few points of its all-time high by the end of the month. The Category 5 forces of Harvey, Irma, Jose, and Maria only fueled the market’s advance. Investors looked past the short-term effects and saw that building reconstruction and automobile replacement will more than offset the temporary slowdown in economic activity.

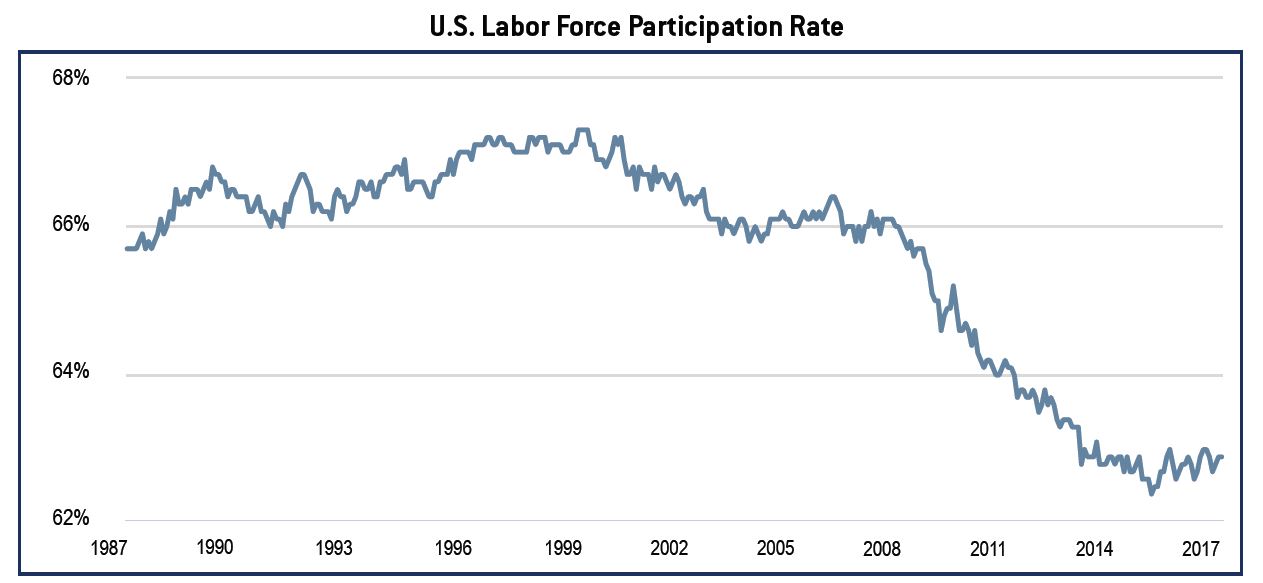

Falling in line with the squadron of ho-hum, the interest rate backdrop changed little during the quarter. Rates remain at historically low levels. The Federal Reserve did announce plans to begin winding down their $4.3 trillion bond portfolio by letting bonds mature without reinvestment. This development didn’t raise rates, though, as the pace of contraction will initially be so slow as to be almost undetectable. Inflation is also keeping rates down below the Fed’s 2% target, despite a low unemployment rate of 4.3%. Low unemployment rates belie the true state of the labor market, which is likely looser than we’d prefer, given the labor force participation rate.

Labor force participation, the ratio of payrolls to the working age population, is a clear indication that there is still slack in the work force (see chart). The broader deflationary themes of an aging population (and thus, work force), globalization, and technological innovation continue to play a significant role in the disinflationary environment. Low inflation undermines the Fed’s case for interest rate hikes. Low interest rates in turn support higher stock valuations. Thus, we seem to be stuck with low inflation, low interest rates, and a richly-valued market.

Source: FactSet

Source: FactSet

We turn now from the “boring” market to the piece of modern America that seems more turbulent than it has ever been – politics. Washington’s focus has now shifted from the Affordable Care Act to tax reform. Potential changes in the tax code have replaced the Fed as the primary influence on interest rates for the balance of the year. If these reforms were both successfully passed and meaningful, they would be a major catalyst for the equity and credit markets. The ultimate scope of reform will depend on Congress’ ability to compromise on change, something that has been rare of late to say the least. The very idea of implementing a complex reform versus a simple tax cut gives some uncertainty to any such proposal. The more variables that are added to any plan, the less certain economic growth becomes. A tax reform cannot avoid adding many unknowns.

The current tax thinking goes like this. Seeking to reshape both tax structure and the U.S.’ prosperity, the heart of reform lies in reducing corporate tax rates. Our statutory rate of 35% puts America at a competitive disadvantage with nearly all global peers. So, the plan is to reduce corporate rates to a level that makes it economically feasible to keep jobs at home. These additional jobs would lead to a greater collection of personal income taxes. If the Administration’s math is to be believed, the larger take on personal income taxes will largely offset the loss of corporate taxes. Thus, a balance is achieved, and everyone is happy.

However, there is also discussion of lowering taxes on individuals. Lowering personal taxes strains the Administration’s math, which to begin with is somewhat tenuous. Many experts do not think that the taxes from the higher spending that are supposed to come on the back of greater growth will compensate for the proposed cuts in tax rates. To help bring taxation and spending more into line, the elimination or reduction of tax deductions will be required. This is the part that requires compromise and is so difficult, since no taxpayers want to give up their deductions. Furthermore, reductions in Federal spending have been absent from the conversation.

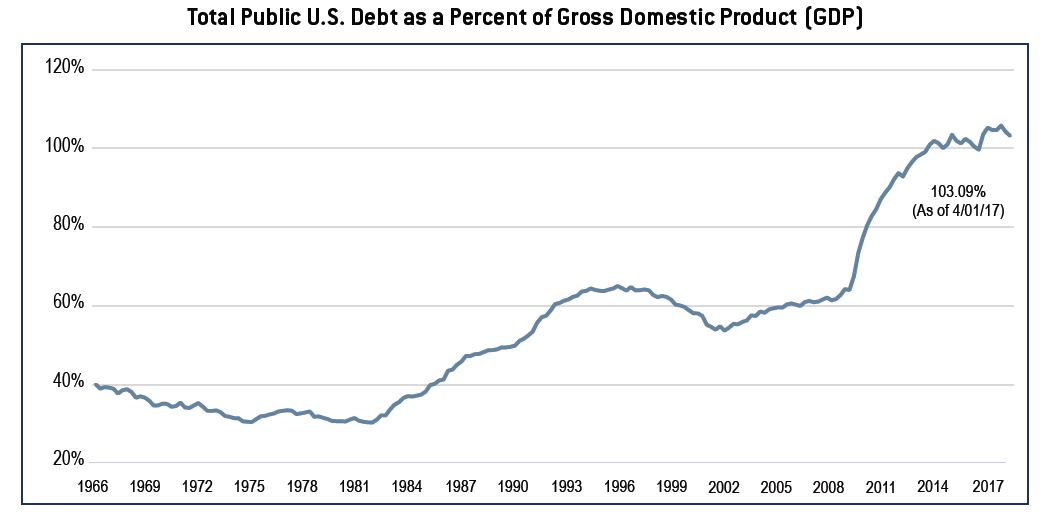

We have no doubt that the economy could benefit, at least in some small measure, from changes in the tax code or a tax cut. There is little room for error though. Should tax reform not generate the desired growth, the national debt will balloon (see chart). A greater national debt at a time when the Federal Reserve is reducing their net holdings of Treasury securities will most likely push interest rates higher. The Fed could always modify their strategy and slow the pace of balance sheet reduction. Low rates have been the catalyst for the stock market for a long time. The question is whether the economy and the stock market can support higher rates.

While Washington squabbles, the economy continues to churn upward in unimpressive but steady fashion. Annual gross domestic product growth in the range of 1.5% – 3%, par for the course since the end of the Great Recession, appears to be the new normal. However, accommodative monetary policy, gridlock in Washington, falling unemployment, and this slow but steady economic growth have provided a powerful foundation for stocks and bonds. The trends are still in place but the sands are beginning to shift.

We are at an inflection point with Fed policy. If the Fed raises interest rates, they would eventually become an economic headwind. But higher rates could also impact corporate profits in the near term, because higher rates would likely mean a stronger U.S. dollar. A stronger dollar makes corporations’ exports more expensive to foreign buyers, and thus less competitive.

Corporate profits have been aided by a dollar weakened by the Fed’s pivot to a slower monetary policy pace in 2017. Also menacing are the classic late-cycle signs throughout the markets. Stock valuations are elevated, the yield curve has flattened, and balance sheets are more levered. We remain cautiously optimistic but mindful of the environment as we work hard to grow and preserve your capital.