The SECURE Act 2.0: The Law of the Land

By: Rick Rubin, CFA

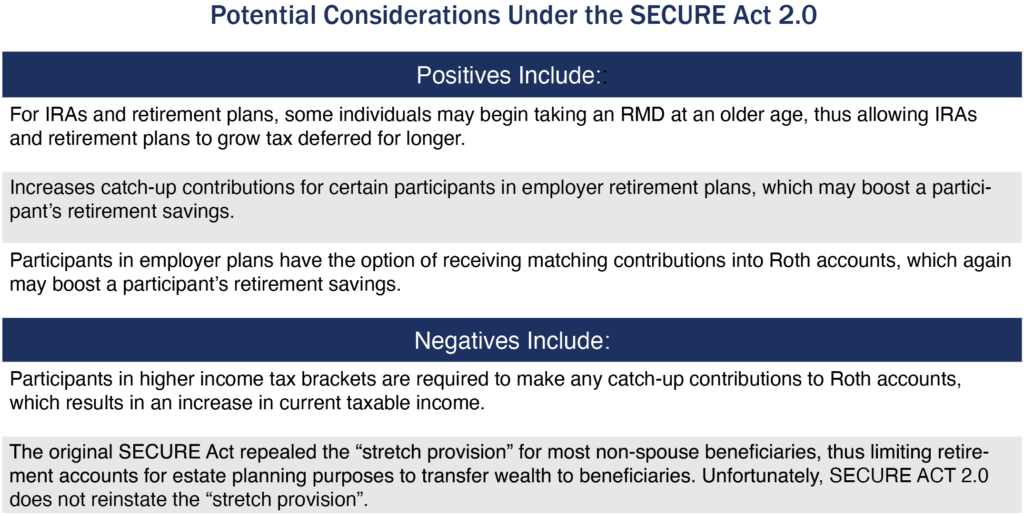

The SECURE Act 2.0 (Setting Every Community Up for Retirement Enhancement) builds on the SECURE Act of 2019 and was signed into law on December 29, 2022. The legislation provides many changes that could help strengthen and improve the retirement system in America.

Significant Provisions

- The age to start taking RMDs (required minimum distributions) increases to age 73 in 2023 and to age 75 in 2033.

- Penalties for failing to take an RMD will decrease to 25% of the RMD amount. It is currently 50%, and 10% if fixed in a timely manner.

- Beginning in 2024, RMDs will no longer be required from Roth accounts in employer retirement plans.

- Beginning in 2025, catch-up contributions will increase for most employer plans and IRA accounts.

- Defined contribution retirement plans will be permitted to add an emergency savings account associated with a Roth account.

The legislation contains many provisions, but some highlights include extending the age at which retirees must begin taking RMDs from IRA and 401k accounts and increasing the amounts of catch-up contributions for older workers with employer plans. Other changes will help younger people keep saving while paying down student debt. It will also make it easier to move an account from employer to employer and allow people to save for emergencies within a retirement account.

The key changes between two groups of people:

For individuals in or nearing retirement

- Big changes to RMDs: The age at which owners of retirement accounts must start taking RMDs will increase to age 73 beginning January 1, 2023, and to age 75 beginning in 2033. Individuals will have an additional year to delay taking a required withdrawal of tax-deferred savings from their retirement accounts.

- Higher catch-up contributions: Beginning January 1, 2025, people ages 60 through 63 years old will be permitted to make catch-up contributions of up to $10,000 annually to an employer plan, and the amount will be indexed to inflation. The catch-up amount for people aged 50 and older in 2023 is $7,500.

- Matching for Roth Accounts: Employers will be able to provide employees the option of receiving matching contributions to Roth accounts. Previously, matching in employer plans were made on a pre-tax basis. Contributions to a Roth retirement plan are made after-tax, and earnings can grow tax free.

For individuals years away from retirement

- 529 plans: 529 plan assets can be rolled over to a Roth IRA for the beneficiary after 15 years. The rollover is subject to annual Roth contribution limits with an aggregate lifetime limit of $35,000. Rollovers cannot exceed the aggregate before the five-year period ending on the date of the distribution. The rollover is treated as a contribution towards the annual Roth IRA contribution limit.

- Automatic enrollment and plan portability: Starting in 2025, SECURE 2.0 requires businesses adopting new 401k and 403b plans to automatically enroll eligible employees, beginning at a contribution rate of at least 3%. It also permits retirement plan service providers to offer employers automatic portability services, transferring an employee’s low balance retirement accounts to a new plan when he or she changes jobs.

- Student loan debt: Beginning in 2024, employers will be able to match employee student loan payments with matching payments to a retirement account. This gives workers an incentive to save while paying off educational loans.

- Emergency savings: Defined contribution retirement plans will be able to add an emergency savings account that is a designated Roth account eligible to accept employee contributions for non-highly compensated employees starting in 2024. Contributions would be limited to $2,500 annually, and the first four withdrawals in a year would be tax free and penalty free. Contributions may be eligible for an employer match depending on plan rules.

The new law provides a great reason to review your retirement planning. Please reach out to your Tufton investment advisor, attorney and/or accountant with any questions. Tufton has provided highlights of SECURE Act 2.0 provisions that we consider most important for our clients, prospects and readers. This article is not intended to be a comprehensive review of all of the SECURE Act’s provisions.