Company Spotlight: Microsoft (MSFT)

By Ted Hart

Many investors may remember the mid to late 1990s when Microsoft (MSFT) first started firing on all cylinders. Founder and then CEO Bill Gates and President Steve Ballmer were dancing on stage to the Rolling Stones’ song “Start Me Up” before introducing Windows 95. Consumers lined the sidewalks outside of computer stores eagerly awaiting the release of the new operating system as if it were a new iPhone. Today, Microsoft investors are reliving those glory days, but it is not without a decade and a half of pain and heartache.

In the 1990s, Microsoft’s Windows software dominated the desktop computer market, while Windows NT had strong hold on server operating systems. By September of 1998, in the midst of the Tech Bubble, Microsoft overtook General Electric as the world’s most valuable company, despite having just 15% of General Electric’s sales. Sales and market share grew so rapidly that the company quickly became the target of antitrust concerns, much like the leading technology companies are facing today. Nevertheless, with Gates’ 20% stake in the company, it seemed that not even a breakup of Microsoft could stop their product adoption.

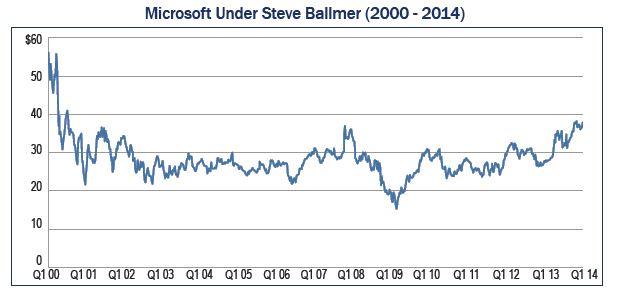

In January of 2000, Bill Gates retired as CEO and Steve Ballmer entered the role. As the personal computer market matured, Microsoft rested on its laurels, gaining sales from Windows upgrades, but it lacked any further software innovation. Under Ballmer, the company attempted to expand into other business segments outside of their bread-and-butter software. In 2001, Microsoft launched the gaming platform Xbox, and though it was widely adopted by consumers, these devices were nowhere near as profitable as software products. The organization also reorganized its management structure to ensure that all seven businesses reported directly to Ballmer. Despite the change, no new ideas were able to move the company’s sales needle and antitrust issues persisted, especially in Europe.

By the mid 2000s, as growth continued to slow, Wall Street and investors speculated that a large acquisition was on the horizon. The company began paying a dividend, which often signifies that a technology company’s growth has matured, and Ballmer began bringing executives from the likes of Walmart and International Paper to control costs. With their powerful search engines, Google and Yahoo began to eat away at the market share of Microsoft’s MSN.com. Meanwhile, Steve Jobs and Apple were in the midst of a major comeback with the launch of the iPhone. Investors found that there were simply more innovative companies than Microsoft in which to invest their money.

After the Financial Crisis, Ballmer and Microsoft began playing catch-up as mobile took over the technology landscape. The company teamed up with mobile phone company Nokia in 2011, whose market share was rapidly shrinking. To make matters worse, the release of the operating system Windows 8 proved to be one of their worst launches in history. Consumers were rife with complaints. Adding fuel to this already hot fire, Microsoft went on to buy Nokia while Apple’s iPhone shipments continued to reach record heights.

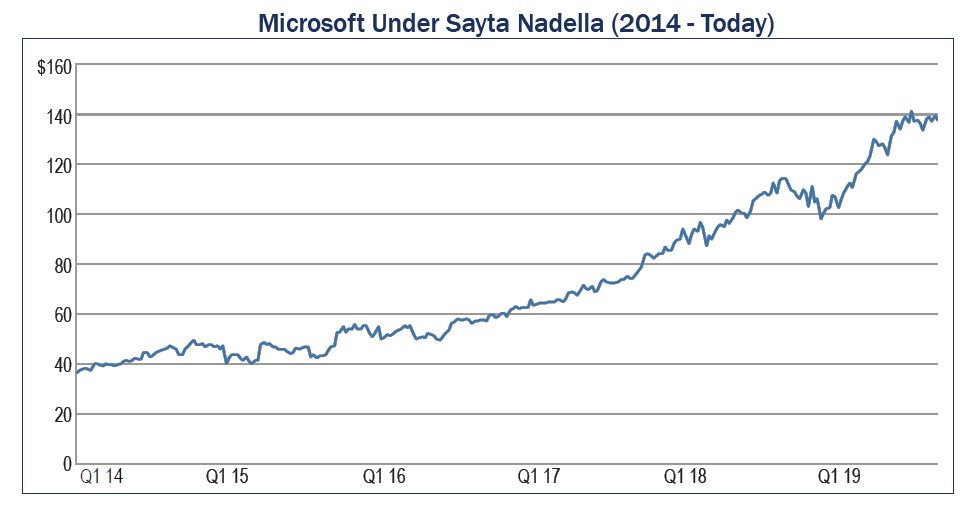

On August 23, 2013, the company announced that Steve Ballmer would be retiring within twelve months. To investors’ joy, the stock climbed 7.3% in response to the news. Current CEO Sayta Nadella began his tenure in February of 2014 and immediately began to reform the company. His vision was to get back to the basics and take Microsoft from the licensed based over-the-counter software product company of the 1990s to a global computing powerhouse that allows consumers to subscribe to the company’s world-class software and online data storage business.

Accomplishing this objective would be no walk in the park. It would require moving the company’s largest products, Microsoft Office and Windows, to the cloud (which is essentially having your work stored in a data center and accessed via the internet rather than in the hard drive in the computer underneath your desk). In addition, the company wrote-down the value of Nokia and made some of the largest acquisitions in the company’s history. In 2016, Microsoft announced the acquisition of the business social network LinkedIn with the vision of combining the most utilized business email platform (Outlook) with the most utilized business social network. So far, so good! In 2018, the company bought GitHub to further enhance their software development.

Today, Microsoft is split into three separate businesses: More Personal Computing (MPC), Productivity & Business Processes (P&BP) and Intelligent Cloud (IC). We at Tufton Capital Management use MPC when we purchase a new computer. Encompassing Windows software, Devices, Gaming and Search, sales in this segment have been essentially flat over the past five years. However, the business’ earnings have nearly doubled due to a favorable mix of higher profit margin products, such as cloud-based software. The segment is also no longer weighed down by the troubled phone segment. In the most recent quarter, sales were up 8% year over year while operating income was up 25%.

Tufton Capital utilizes P&BP for our Email and Microsoft Office products. This business is comprised of Office Commercial (Office 365), Office Consumer, LinkedIn and Dynamic Business Solutions. Sales have grown roughly 7% annually, but in the most recent quarter, they grew 14% year over year. The segment’s income was up an astonishing 28% year over year as Office 365 Consumer reached nearly 35 million subscribers.

Lastly, Tufton draws on IC when we purchase a new server. This segment includes server products and cloud services such as SQL server and Azure. Sales have been growing about 10% per year in this segment but grew 22% year over year in the most recent quarter. Growth was driven by 27% growth in server and cloud services and 64% growth in Microsoft Azure, which is the company’s offering for infrastructure-as-a-service, platform-as-a-service and software-as-a-service. Operating income has been growing about 8% per year but surged 21% year over year mainly due to a greater mix of cloud offerings and per user services.

Mr. Nadella believes that the transition to the digital cloud is a $4.5 trillion opportunity. Obviously, Microsoft cannot own the whole sky. However, with this sales momentum – and these investment returns – we’ve enjoyed this journey to the cloud(s) and hopefully beyond.