Bottleneck in the Supply Chain

By Barb Rishel

Why are there so many trucks on the road and why are the store shelves so empty? Why is it taking so long to get my stuff? And why does everything seem more expensive?

These are questions we find ourselves asking almost every day. The U.S. economy is strong, with gross domestic product (GDP) up 12.2% in 2Q21. People are going back into the office (more traffic!), and the holidays are fast approaching. So why are there so many shortages?

We can sum it up in one word: COVID. After the world went into lockdown in March 2020, many factories closed or slowed output. As a result, U.S. GDP dropped 31% in the 2Q20, the largest drop since the Great Depression. As consumer demand snapped back during the summer of 2020, thousands of empty containers were stuck in the U.S., and exporters in China faced long waits for boxes to ship their goods. For goods to move seamlessly from overseas factories to the United States, the shipping vessels, cargo terminals, truckers and railroads all must work together, like runners in a relay race. If there are any disruptions, the delays ripple throughout the supply chain.

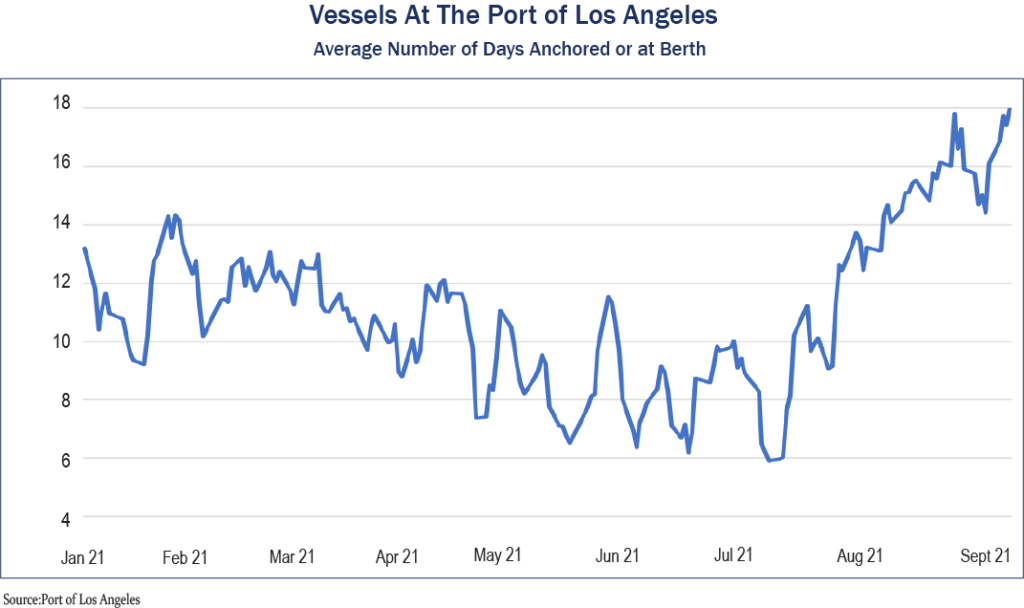

And there have been A LOT of disruptions! Many companies are having difficulties finding workers, especially truckers. The trucking industry estimates that it needs to hire 80,000 drivers in order to meet consumer demand. The six-day blockage of the ship Ever Given in the Suez Canal this past March stranded over $9 billion of goods headed for the United States. Costs keep rising, especially for shipping containers. The cost to ship a 40-foot container is now a record $20,000, compared to $5,000 in January. Railyards in Chicago have trains backed up for twenty-five miles, and there are now over seventy-three container ships sitting near the port of Los Angeles that have been there for an unprecedented two weeks or more, waiting to be unloaded. Ports on the west coast represent about 36% of all U.S. imports and act as a crucial entry point for our nation’s product demands from overseas.

While all of this disruption is costly and inconvenient, the impact on the semiconductor industry is especially daunting. While this chip shortage affects many industries including electronics and appliances, it especially impacts the auto industry. Chip lead times, or the period between ordering semiconductors and delivery, rose to a record twenty-one weeks in August, up from six weeks in July. Car manufacturers bought roughly $43 billion of chips in 2019, or about a tenth of the global semiconductor market. United States auto sales rebounded faster than expected over the summer, as buyers snapped up sport-utility vehicles and trucks. Some parts suppliers were skeptical that new-car demand would fully rebound as quickly as it did and were reluctant to order chips in the volumes that the car companies directed, which also contributed to the shortages. As a result, new car prices rose 8.7% in September.

Other companies are doubling down on orders to make sure at least some of their orders are filled, and this only compounds the problem. Consumers end up paying higher prices for the goods that do arrive, and the shortages of goods, such as automobiles, children’s shoes and exercise gear are continuing to rise. Retailers are struggling to get inventory and are raising prices 20%-25% to compensate for the lower inventory and higher freight and raw material costs. Cotton prices are up over 9% this year alone. Transportation companies, such as United Parcel Service (UPS) and Norfolk Southern Railroad (NSC) are also grappling with labor shortages, higher wage costs and difficulty in accessing the goods.

Most experts believe that the supply chain logjam will continue throughout most of 2022 but that companies will figure out a way to get back on track. In the meantime, there are several operators that should continue to benefit from the disruption, especially those in the service industry. AT&T (T), Verizon (VZ) and Walt Disney (DIS) have little exposure. Various tech companies, such as Apple (AAPL) and Microsoft (MSFT), benefit from strong demand for their services. Financial companies such as JPMorgan Chase (JPM), Bank of America (BAC) and Chubb (CB) have a large domestic presence similar to the Health Care Sector (JNJ, ABT, ABBV). Chevron (CVX) benefits from the higher oil prices.

Federal Reserve Chairman Jerome Powell is on record saying that the increase in inflation is temporary and that prices will return to their average annual rate of around 3% next year. JPMorgan Chase CEO Jamie Dimon agrees with him. Either way, your diversified portfolio at Tufton Capital is positioned to benefit from these disruptions.