The First Quarter of 2019: Message Received

By Eric Schopf

The first quarter delivered a reversal of fortune for equity investors as the Standard & Poor’s 500 provided a total return of 13.65%. The dismal fourth quarter of 2018 is now in the rear-view mirror and almost completely out of sight. The market is just slightly below its all-time high reached in September. Fixed income investors were also rewarded this quarter when the 10-Year U.S. Treasury yield fell from 2.68% to 2.42%.

The strong gains in the securities markets followed the abrupt pivot executed by the Federal Reserve. Our concern entering 2019 was that monetary policy was too restrictive. The Fed instituted their fourth interest rate hike of 2018 in December. At the time they also signaled the possibility of two additional rate increases in 2019. Following a slew of weak economic data and the stock market selloff in December, the Fed quickly changed course. They became far more dovish and began preaching patience. The Fed clearly signaled that further interest rate increases would be put on hold. To show that they really meant business, the Fed also announced that quantitative tightening would end and that quantitative easing would return. Quantitative easing is the strategy of purchasing fixed income assets in the market place to help control interest rates. Quantitative tightening is the process of allowing those purchased securities to mature without reinvesting all of the proceeds. Maturities, net of reinvestment, were reducing the Fed’s portfolio by $30 billion per month. Portfolio shrinkage will drop to $15 billion per month in May, and all maturity proceeds will be reinvested beginning in September.

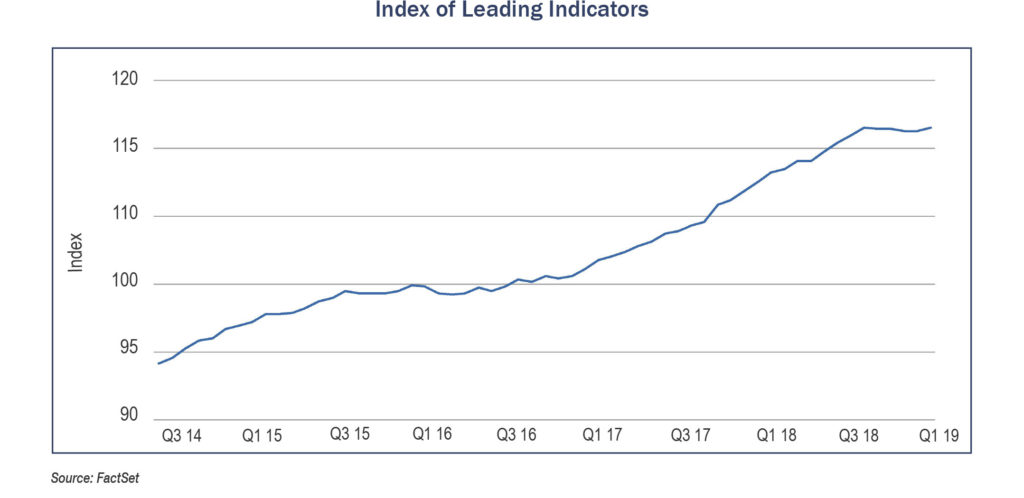

The push and pull between the market and the Fed revealed a real difference of opinion. The Fed expected only a modest slowdown since non-farm payroll jobs remained strong. The partial government shutdown and global factors were viewed as merely speed bumps on the way to policy normalization. The market, however, was fixated on hard data. Holiday retail reports were weaker than expected. Business confidence began to erode as housing starts and home sales declined. The Index of Leading Economic indicators began to head south in October and posted consecutive monthly drops through February. Industrial commodity prices declined in unison with the leading indicators. Even the Federal Reserve Bank of Atlanta cut their fourth quarter GDP growth estimate. The Fed finally got the message and reversed course. Fed Chairman Jerome Powell went so far as to make a guest appearance on “60 Minutes” to let the world know that the Fed had received the message.

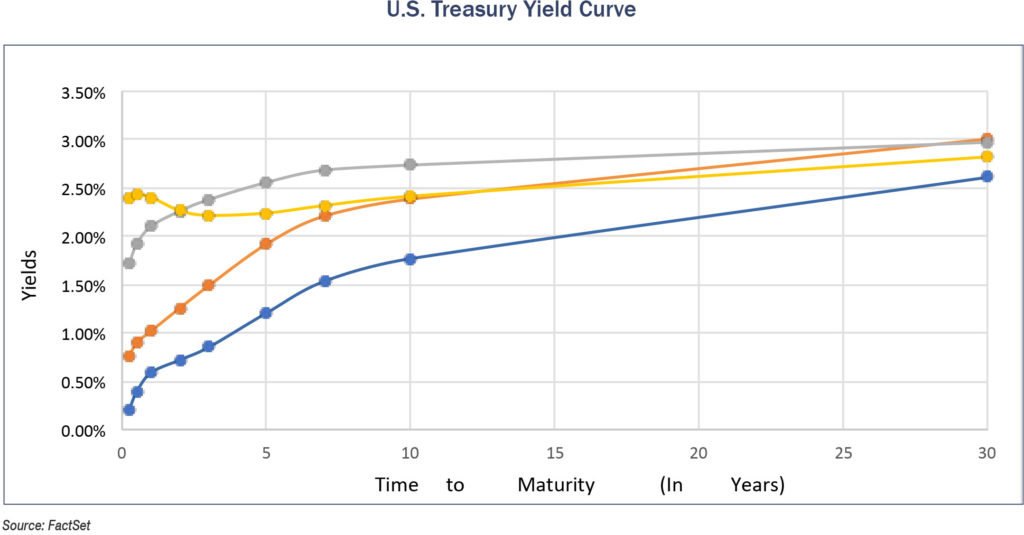

The deficit-financed tax cuts pumped up economic growth to unsustainable levels. The Fed needed to look through the short-term economic stimulus in setting monetary policy. Although the Fed has hit the pause button, there is still a fair amount of uncertainty. No consensus has emerged on the next move in interest rates. Some, including members of the White House economic team, are calling for a 50 basis point cut in interest rates to help bring the yield curve back into a healthier alignment. A rate cut would also acknowledge the economy’s inability to reach the Fed’s inflation target of 2%. The Fed believes that further patience is required and a wait-and-see approach is appropriate as the economy recovers from a brief slowdown. Still, others believe that one more interest rate hike is in the offing when the economy rebounds in the second half of the year. One way or the other, something has to give. The current inverted yield curve is unsustainable and dangerous. An inverted yield curve doesn’t cause a recession but reflects the conditions that may lead to one. Long-term interest rates reflect investors’ expectations for the economy in the future. If investors are correct, the Fed will eventually cut interest rates. If investors are wrong, long-term interest rates will move higher. In either scenario, the yield curve will steepen which is positive for the stock market. Although policy risk still lingers, the Fed’s pivot has increased the odds of a soft economic landing.

With the Fed currently on hold, trade negotiations with China have moved to center stage. It is difficult to gauge progress due to erratic meetings schedules and halting news flow. Global growth has suffered under the uncertainty and welcomes a resolution. The Eurozone is struggling the most. The unemployment rate is close to 8% and forecasted 2019 GDP growth is only 1.1%. Even Germany, the economic engine, delivered zero year-over-year growth in the fourth quarter. The weak economic performance coupled with negative interest rates, is taking a toll on European banks. The banks are required to hold a portion of regulatory capital in sovereign debt. With negative interest rates they actually have to pay to hold the securities. Troubles in the European Union run deep, but a stronger global economy could only help alleviate these concerns. China is also feeling the impact of slow trade and has been impacted to a greater degree than the United States. The situation may force China to be a little more conciliatory as the trade negotiations grind forward.

The trade negotiations are taking place at a time when earnings expectations in the U.S. are falling. Blue Chip Economic Indicators is a monthly survey and associated publication by the Blue Chip Publications division of Aspen Publishers. The survey polls America’s top business economists and collects their forecasts of a host of critical indicators of future business activity. Earnings growth is expected to fall to just 4.6% in 2019 and 2.2% in 2020. With the Presidential election on the horizon, a sense of urgency will emerge to help get the economy chugging once again to gain the hearts and wallets of voters. There is an incentive for the current administration to reach a trade agreement and terminate the various tariffs that have been imposed.

Immigration reform and threats of border closures will also need to be addressed. According to the U.S. Census Bureau, population growth was just 0.62% in 2018. Economic expansion is a function of increasing population and productivity. We need either greater labor force participation or more immigration to stoke this growth.

Our collection of thoughts and assessment of the future always contemplate the risks we face as investors. In the short run, we are in a better position now than just three months ago. It now appears that the Fed has pulled off the elusive soft landing. Stable inflation and moderate growth has been the calling card of this economic cycle, and there is no reason why the cycle cannot be sustained. Nonetheless, things can change very quickly. It is the uncertainty that creates opportunity, and we will continue to do our best to make the right investments for you.