The Second Quarter of 2019: Time To Act

By Eric Schopf

Stock market strength continued in the second quarter with the Standard & Poor’s 500 delivering a total return of 3.11%. The bond market was even stronger as interest rates fell across the yield curve. The yield on the 10-Year U.S. Treasury fell from 2.42% to 2.00%. The increase in 10-Year Treasury bond prices corresponds with a total return of over 4.0% in the quarter. Although the numbers look solid in retrospect, the quarter was filled with drama. The stock market climbed over 4.0% in the month of April, only to fall 6.6% in May. The market rallied once again and advanced 7.3% in June.

In our first quarter newsletter, we concluded that the Federal Reserve had received the message regarding interest rate levels and needed to change policy to prevent the economy from falling into recession. While slow to act, Federal Reserve Chairman Jerome Powell established in a late June press conference that the committee was prepared to lower rates in order to ensure full employment. Now, the market is fully expecting a rate cut in July, with additional moves in September and possibly December. The rate cuts could be as much as 1% in aggregate.

The Fed has been called to the rescue due to flagging economies, both domestic and international. Global weakness, in no small part, can be attributed to the ongoing trade dispute between the U.S. and China. President Trump stoked the fire in a Twitter message posted in early May. Frustrated with the slow pace of negotiations and the perceived back-pedaling on previous pledges to protect intellectual property, he threatened to increase tariffs on Chinese goods from 10% to 25%. Five days after his tweet, the U.S. followed through with the threat and raised the tariff to 25% on $200 billion of Chinese imports. Furthermore, President Trump again floated the idea of leveling tariffs on all Chinese imports. China retaliated by increasing the tariffs from 5%-10% to 20%-25% on $60 billion of American imports. Citing national security concerns, President Trump escalated the situation by banning Huawei, a Chinese technology company, and more than five dozen of its affiliates from buying American technology components. China returned the volley by establishing a list of “unreliable entities” or foreign companies that could damage Chinese interests at home. The stock market retreat in May was directly linked to the escalating trade hostilities.

The President opened a second front in the trade wars on May 31 by announcing 5% tariffs on all goods imported from Mexico beginning June 10. Trump was applying leverage to stem the tide of illegal aliens entering the U.S. through our common border. Although Mexico threatened to retaliate, both sides were able to reach an agreement and avert the punitive measures. Mexico agreed to reduce or eliminate illegal immigration coming from Mexico. The implementation of the tariffs would have been very disruptive, since Mexico is our third largest trading partner only behind China and the European Union.

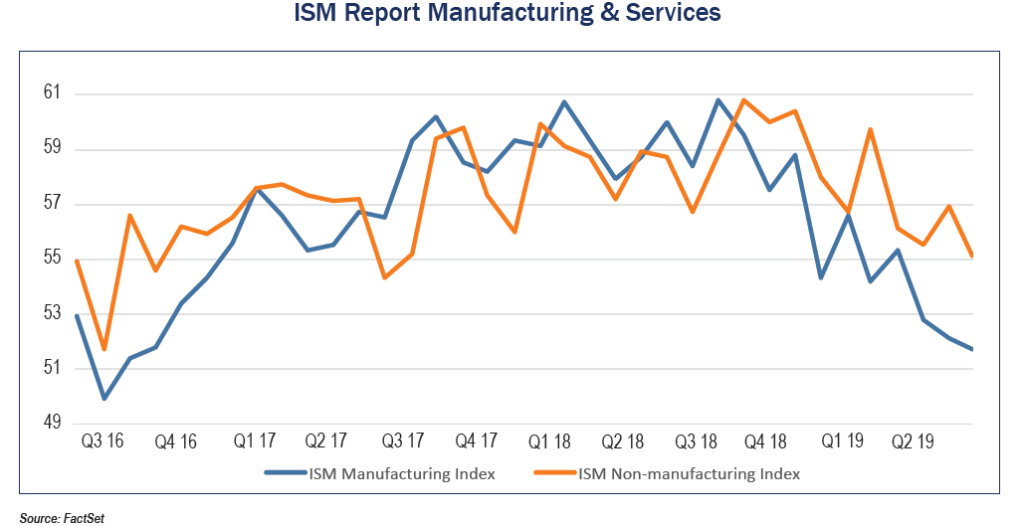

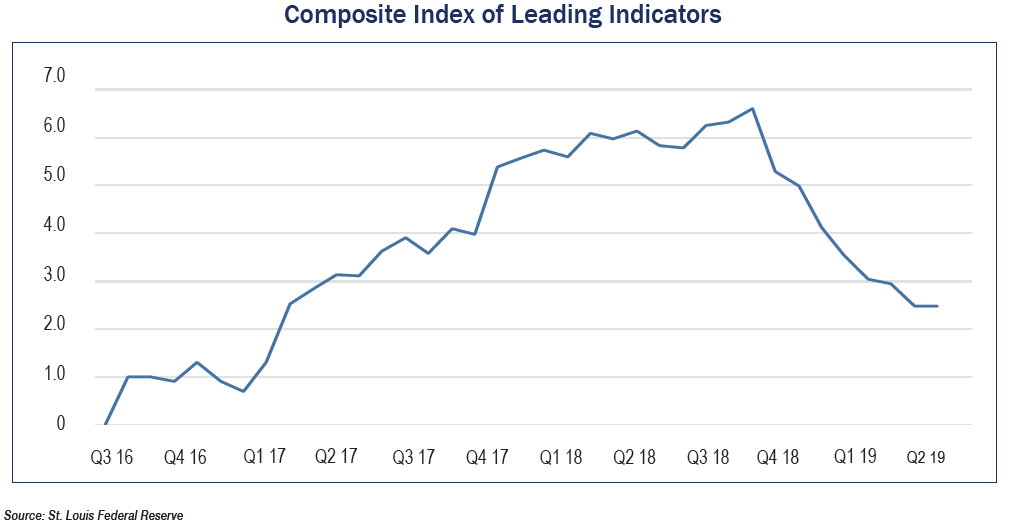

The good news is that the Federal Reserve is poised to make money cheap once again. The bad news is that the economy appears to need cheap money to say afloat. Or does it? Our sense is that the Fed really doesn’t want to raise interest rates. As we have noted before, using all conventional monetary policy tools now leaves little room for future action should the economy truly falter as interest rates approach zero. Why use a fire hose when a fire extinguisher will suffice? Chairman Powell pointed to the cross currents that the Fed currently faces. Economic indicators have delivered mixed signals. The Atlanta Fed revised estimated GDP growth lower in early April. The index of leading indicators peaked last September and has been declining every month since then. Manufacturing and service sectors have been trending downwards since last fall with manufacturing showing the greatest signs of weakness. The rate of job gains has also slowed. More importantly for the Fed, inflation is nowhere close to their goal of 2%. It is clear that the economy is slowing. Add it all up and it is very easy to make the case that it is time for the Fed to act.

The stock and bond markets are fully expecting action from the Federal Reserve. This expectation is what has driven the market so much higher, even in the face of deteriorating economic conditions. Powell & Company may have been buying time in hopes of a U.S.-China trade deal. With no resolution in sight, the Fed may have no choice but to cut rates. The loss of economic momentum and a deceleration to stall speed would require much greater monetary measures to jump-start growth again. Therefore, an “insurance cut” of 25 basis points seems inevitable to address economic slowing and to placate the market. If the Fed waits too long, they face accusations of playing politics as the 2020 presidential election approaches.

As investors, we face the same cross currents as the Federal Reserve. Economic fundamentals are weakening, and corporate profit growth is coming back to earth following the first quarter tax cuts in 2018. The stock market is approaching all-time highs, and bond yields are plummeting. As a result of these factors, finding value in the markets has become more challenging. Nonetheless, we continue our search for opportunities that deliver high quality returns at reasonable prices with above average dividend yields.