The Second Quarter of 2021: Open For Business

By Eric Schopf

Investors were rewarded once again in the second quarter. The Standard & Poor’s 500 provided a total return of 8.55%, bringing the year-to-date return to 15.25%. The S&P 500 is now 90% higher than the pandemic low point of March 20, 2020 and 30% higher than the February 14, 2020 pre-pandemic high. The reward for risk has been substantial. Fixed income investors were not left out as yields on ten-year United States Treasury bonds fell to 1.45% from 1.74% during the quarter.

Strength in the stock market has been accompanied by a very strong economy. Gross domestic product growth in the first quarter was 6.4%, and the quarter-over-quarter growth rate has only been exceeded on seven other occasions over the past thirty years. The manufacturing index compiled by the Institute for Supply Management reached its highest level since 1983. The strong economic activity has led to robust job growth, while initial and continuing claims for unemployment benefits are trending lower. Solid job prospects and improving consumer confidence have led to a red-hot real estate market. In April, the Federal Housing Finance Agency price index recorded a 1.8% increase in home prices from the previous month and a 15.7% year-over-year price increase. The U.S. economy is open for business, and a wave of expansion has been set into motion.

The wide availability of Covid-19 vaccines is at the heart of the economic reopening. According to the Centers for Disease Control and Prevention, 55% of the U.S. population has received at least one vaccine dose and 48% of the population is fully vaccinated. Vaccination rates at the state level are spotty, and herd immunity is still aspirational. Nonetheless, we can now move about more freely and gather again with others.

If vaccine availability threw open the economic doors, past and continuing stimulus has provided consumers with the wherewithal to spend. A Brookings report estimates that the total U.S. fiscal response has been $5.2 trillion. The first salvo was the $2.3 trillion appropriated by the Coronavirus Aid, Relief and Economic Security Act under the Trump administration. President Biden followed up by appropriating $1.9 trillion through the American Rescue Plan. Economic strength should continue once global economies resynchronize. The uneven rollout of vaccines, especially in Asia, has led to supply bottlenecks for products and commodities. The lack of product availability has impacted numerous industries, such as automobile manufacturers, and the paucity of computer chips has idled assembly lines around the world. The expression “we are not okay until we are all okay” has been on full display.

Continued market strength will depend on the successful transition from massive monetary and fiscal support to a level of self support by individuals and businesses. The transition will be engineered in a slow, deliberate and well communicated fashion to avoid unnecessary market shocks. The likely first step in monetary policy will be a reduction of asset purchases. The Federal Reserve is currently purchasing $80 billion of Treasury securities and $40 billion of mortgage-backed securities every month. We anticipate an announcement in September laying out a systematic plan for the tapering process. Actual tapering should begin later this year or in early 2022. The long runway will eventually lead to increases in short-term interest rates once the economy is closer to reaching full employment.

Fiscal distributions continue to be rolled out, just in lesser amounts. Child tax credits began in July and are worth up to $3,000 per child ages 6 to 17 and $3,600 annually for children under the age of 6. Half of the benefits will be dispersed in monthly installments through December, and the balance will be given in the form of a tax refund with the 2021 tax return filing. It is estimated that more than 36 million families will qualify for the credit. At the same time, other benefits are being reduced or eliminated, such as the enhanced unemployment benefits that were included in the American Rescue Plan. This benefit is scheduled to completely end in September. The Biden-led infrastructure proposal is still waiting in the wings. The size and scope of the legislation is still a work in progress, but a bill of any size will add economic support.

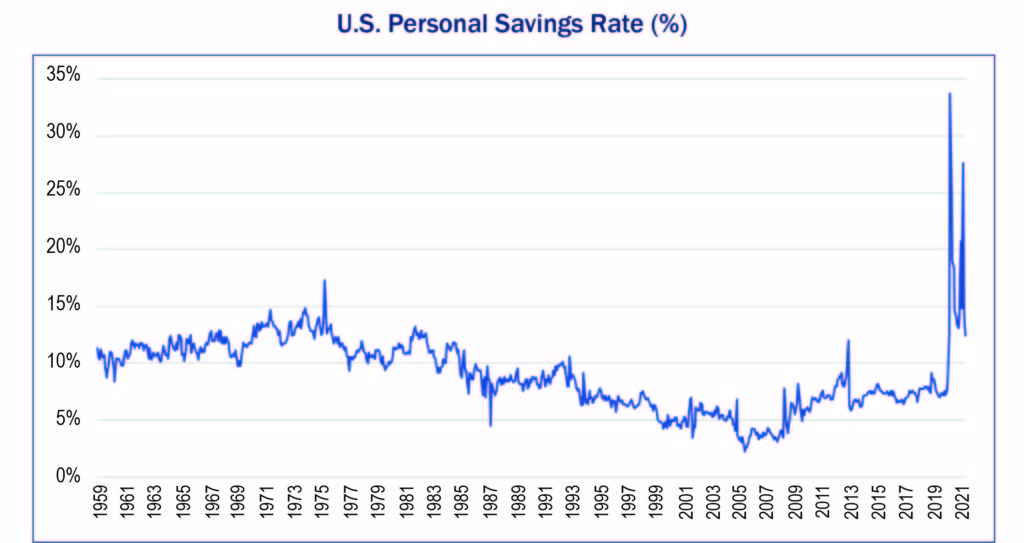

The gradual reduction in stimulus could very easily be offset by additional consumer spending. Historically high savings rates during the pandemic have left consumers flush with cash. The St. Louis Federal Reserve estimates personal savings of about $2.3 trillion, nearly twice the level of February, 2020. Falling unemployment and rising incomes bode well for a resumption in spending.

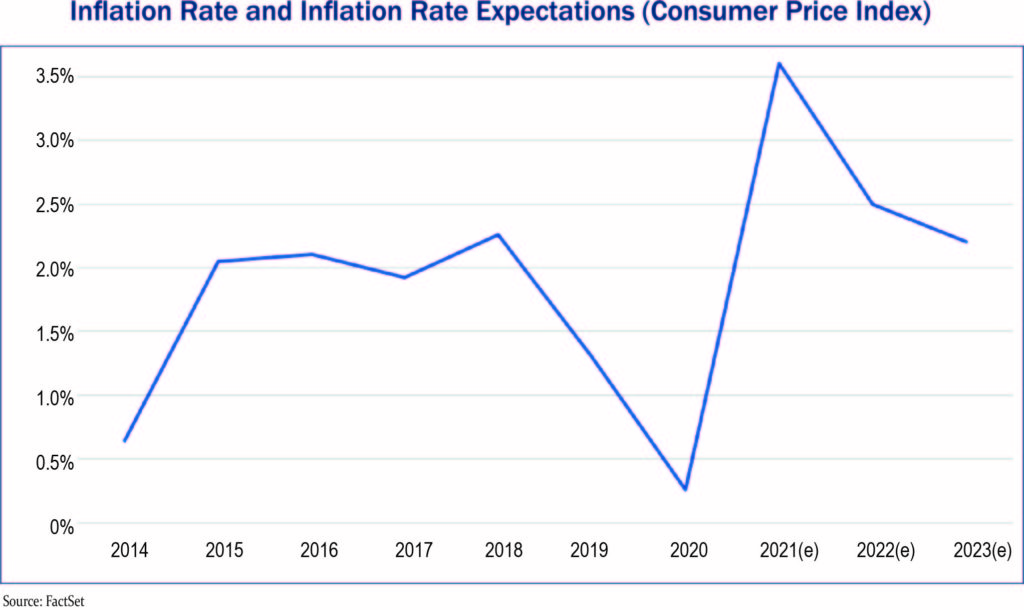

For all of the good news driving the market, a few seeds of doubt have been sown. Inflationary concerns have emerged as the greatest risk. Demand for intermediate and finished goods is outpacing supply. Supply and demand for labor is also unbalanced due in part to lower labor force participation. Higher prices have permeated everything from wages to shipping costs to commodities. The Federal Reserve believes that the price pressures are a consequence of the economy reopening so quickly and unevenly, and is confident that the supply and demand unbalances will resolve themselves over time. Labor issues will ease as children return to school and parents return to work. The end of supplemental unemployment benefits will drive more people back into the labor force. The reopening of central business districts will bring a vibrancy back to urban areas and a resumption of the services that support the areas. The transitory nature of the higher prices will not be addressed in the near term through higher interest rates – the traditional monetary policy. The risk is an inflationary environment that proves to be more than transitory. A key variable in validating the Fed’s patience with the emerging inflationary pressure is growth in the employment participation rate. Getting people back to work and preventing a wage/price spiral will allow the Fed to remain accommodative.

The Covid-19 virus percolates in the background and is a risk that we will have to live with – medically and financially. The Delta variant is the latest strain to ripple across the globe, and the uncertainty of mutations and vaccine efficacy creates an environment for increased volatility.

Equity valuations are stretched. Low interest rates continue to force investors into the stock market in search of yield. Dividend yields are low, and the price we need to pay for a dollar’s worth of earnings are at record levels.

Data from the 2020 census paints a troubling picture for longer term economic growth. Population growth between 2010 and 2020 was just 7.4%. Declining fertility rates, rising deaths and less immigration have resulted in the lowest decennial growth rate since 1940. Productivity enhancements will be required to help grow output.

The challenges change but our goal remains the same – to deliver reasonable returns and to be cognizant of the prevailing risks.