SECURE Act 2.0: A Step Forward for the SECURE Act

By Rick Rubin

In Tufton’s Winter 2020 newsletter, we provided an overview of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which was signed into law in late 2019. The SECURE Act allows more individuals to access workplace retirement plans and to increase retirement savings. Many of the provisions became effective on January 1, 2020. But in response to the Covid-19 pandemic in the U.S., new legislation (the CARES Act) was enacted in March 2020 that delayed many of the SECURE Act’s provisions for 2020.

The CARES Act included emergency fiscal stimulus packages to help battle the disruptive economic effects of Covid-19 for individuals, businesses and state and local governments. While the CARES Act proved to be a financial lifeline for some, many individuals continue to have weak finances and less savings for retirement. United States lawmakers are again taking on the challenge of improving retirement outcomes for Americans. In fact, Congress recently proposed new retirement legislation to build upon the SECURE Act.

In May 2021, the House Ways and Means Committee unanimously passed the Securing a Strong Retirement Act (SSRA) of 2021- widely known as SECURE Act 2.0. The SSRA bill enjoys strong bipartisan support and is expected to be considered by the full House this year. More recently, three U.S. senators introduced a bill called the Improving Access to Retirement Savings Act, which is similar to the House’s bill. The prospects are good for bipartisan retirement reform taking place this year.

The SSRA encourages more small businesses to offer retirement plans, expands availability of these plans to employees and makes significant changes to Individual Retirement Accounts (IRAs) and retirement plans. Some key items that the SSRA implements include:

- Gradually increasing the beginning age for Required Minimum Distributions (RMDs) from 72 to 75 over the next decade.

- Promoting the use of Roth accounts (after-tax) in retirement plans.

- Automatically enrolling employees once they are eligible for retirement plans.

- Creating a national online database to connect individuals with lost retirement accounts.

While most provisions of SSRA would apply to plan years starting after December 31, 2022, certain provisions would begin after December 31, 2021.

Improvements to individual retirement savings

The SSRA provides certain benefits for individuals who participate in traditional IRAs, SIMPLE (Savings Incentive Match Plan for Employees) IRA plans and Simplified Employee Pension (SEP) IRA plans.

- Increases the beginning age for RMDs from the current age of 72. SSRA increases the age to 73 on January 1, 2022, to age 74 on January 1, 2029 and to age 75 on January 1, 2032.

- Reduces tax penalties for not taking an RMD in a timely manner.

- Increases catch-up contributions for workers in SIMPLE IRA plans at ages 62, 63 and 64. The catch-up contribution for SIMPLE IRA plans increases from $3,000 to $5,000 at these ages.

- Provides for indexing of $1,000 IRA catch-up contributions for inflation for those ages 50 and older starting in 2023.

- Expands the qualified charitable distributions (QCDs) to allow a one-time distribution of up to $50,000 to a charitable gift trust or charitable gift annuity. It also indexes to inflation the current $100,000 annual limit for QCDs.

Improvements to employer retirement plans (including 401(k) and 403(b) plans):

The SSRA allows greater access for workers to participate in employer retirement plans for businesses, non-profits and government entities. Also, SSRA provides certain benefits for participants in 401(k), 403(b) and 457(b) plans.

- Requires 401(k) and 403(b) plans to automatically enroll employees in the plans once they are eligible. There are exceptions for existing plans, smaller plans (ten or fewer employees), newer businesses (operating less than three years), government plans and church plans.

- Increases tax credits for businesses starting plans. The current tax credit is based on 50% of administrative costs over three years, limited to $5,000 per year. The bill increases the credit to 100% of administrative costs for businesses with up to fifty employees.

- Increases catch-up contributions for workers in a retirement plan at ages 62, 63 and 64. The catch-up contribution in a plan increases from $6,500 to $10,000 at these ages.

- Allows small employers to band together to offer a multiple employer 403(b) plan (MEP) and to invest in collective investment trusts.

- Improves access to long-term, part-time workers by reducing the service requirement to two years (500 hours/year) for eligibility in an employer retirement plan.

- Allows for student loan payments to count toward a plan’s matching contributions. This is an optional provision that allows employees to receive matching contributions by way of repaying their student loans. This provision should help younger employees who may not be able to save for retirement because they have large student loans to repay.

Expansion of Roth accounts:

SSRA expands the use of Roth accounts in retirement plans, and in certain instances, SSRA makes use of Roth accounts mandatory. Congress encourages participants to use Roth accounts, which boosts current tax revenues for government.

- Starting on January 1, 2022, catch-up contributions to qualified retirement plans would be required to be made into Roth accounts within the plan.

- Currently, employer matching contributions are required to be made into pre-tax accounts. SSRA allows defined contribution plans to provide participants the option of receiving matching contributions into Roth accounts.

- The option to contribute to Roth accounts would be added to SIMPLE and SEP IRA plans.

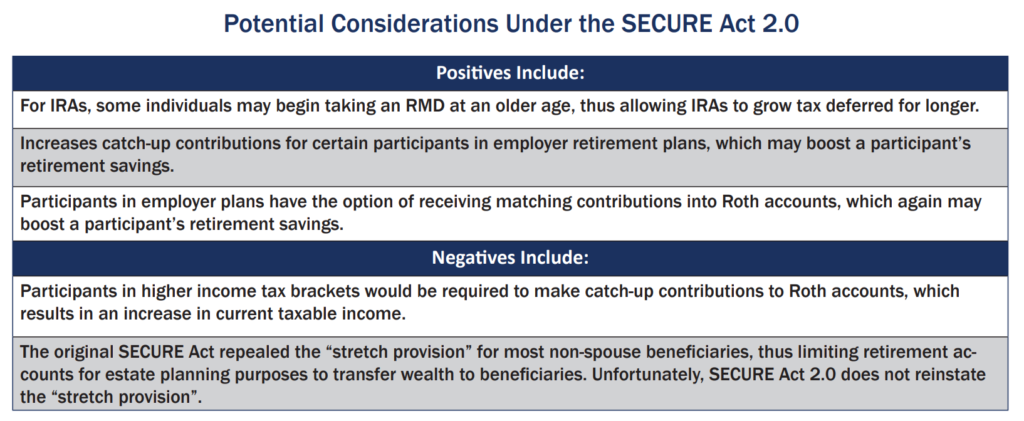

At Tufton Capital, we believe that prospects are very good for bipartisan retirement reform to pass this year. The SECURE Act 2.0 has proposed provisions that may modestly benefit many individual retirement savers. Some participants in retirements plans and IRAs may soon be permitted to boost catch-up contributions, hold off taking an RMD and expand use of Roth accounts. Tufton will monitor the progress of Congress’s retirement legislation and keep our clients and readers informed about potential impacts to their retirement planning.