The Fourth Quarter of 2017: Consistent Returns, Low Volatility

by Eric Schopf

The frigid weather that ushered in the New Year has been no match for the red hot stock market. The Standard and Poor’s 500 delivered a total return of 6.6% for the fourth quarter and 21.8% for the year. As many expected, the fourth quarter continued the trend of consistent returns with little volatility. Although technology stocks led the way with returns in excess of 38%, the rally was broad with most sectors posting double-digit returns. This widespread improving economy, combined with low interest rates and benign inflation, continues to attract investors to the equity market.

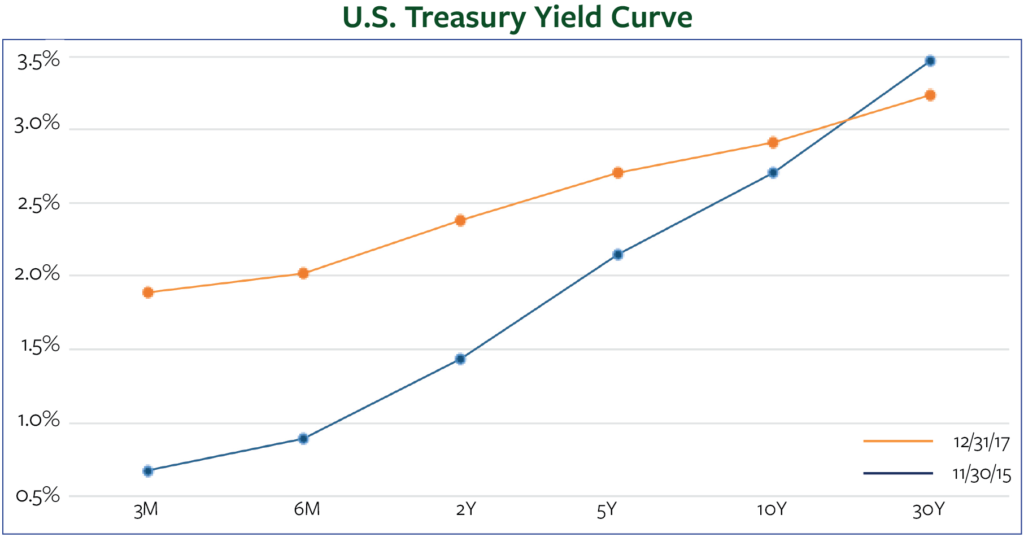

Interest rates were once again on the move, with the Federal Reserve raising the Federal Funds rate to 1.5% in December. This rate increase was the fifth since the Fed began tightening two years ago. Despite the increases, interest rates are not yet attractive enough to entice investors to move out of stocks and into bonds. Longer-term interest rates continue to be a challenge. Although the Fed has raised the Fed Funds rate from .25% to 1.5% since the tightening cycle began in 2015, longer-term rates (maturities of 10 years or greater) have essentially remained unchanged. Although the business cycle is approaching maturity, which would normally suggest some shift to bonds, we thus have little appetite for the longer-term instruments that offer returns that are just slightly higher than the rate of inflation. Higher rates on the short-end are a welcome relief. It is nice to actually earn something greater than zero on cash held in money market funds.

The major news headline in the quarter was tax reform. The Tax Cut and Jobs Act was passed along party lines in late December and provides some tax relief for many individuals. However, the lion’s share of the law was designed to reduce corporate taxes. Although the corporate rate has been reduced to 21% from 35%, the impact will vary from company to company. Legions of accountants are employed to minimize corporate taxes, so most corporations have not been taxed at the 35% level. Nonetheless, extra cash generated through any tax savings may be deployed in a shareholder-friendly fashion. Investment in plant and equipment made to produce future earnings or reduce costs, share buybacks, and higher dividends are all potential uses of the extra cash. President Trump and his administration expect the lower tax rate to help “make America great again” by attracting more business back to our shores from abroad and igniting economic growth.

While lower corporate taxes are a good thing, there is no such thing as a free lunch. Unless spending is reduced or economic growth truly does generate enough incremental tax revenue to allow the tax cuts to be self-funding, the Treasury will need to issue a lot of debt to cover the expected expansion of our nation’s deficit. The Congressional Budget Office estimates that the deficit will grow by $1 trillion over the next decade. The issuance of debt to cover the deficit will come at a time when the Federal Reserve is winding down their balance sheet amassed during quantitative easing. The end result will most likely be higher interest rates.

Low interest rates have not been the only pillar of the soon-to-be nine year old bull market. The economy has improved, which has had a tremendous impact on the equity market. Gross domestic product grew in excess of 3% in the second and third quarters. This is the first time our economy has grown at these rates for consecutive quarters since 2014. Additionally, consumer confidence has bubbled higher. Confidence hasn’t been this high since the dotcom era of 1997 to 2000, and it may further improve once individuals feel the impact of lower taxes. Corporate earnings growth has also provided a stable footing for the stock market. Wall Street estimates going forward are strong, and the rebound in energy prices should drop to the bottom line for a wide range of companies that support the industry.

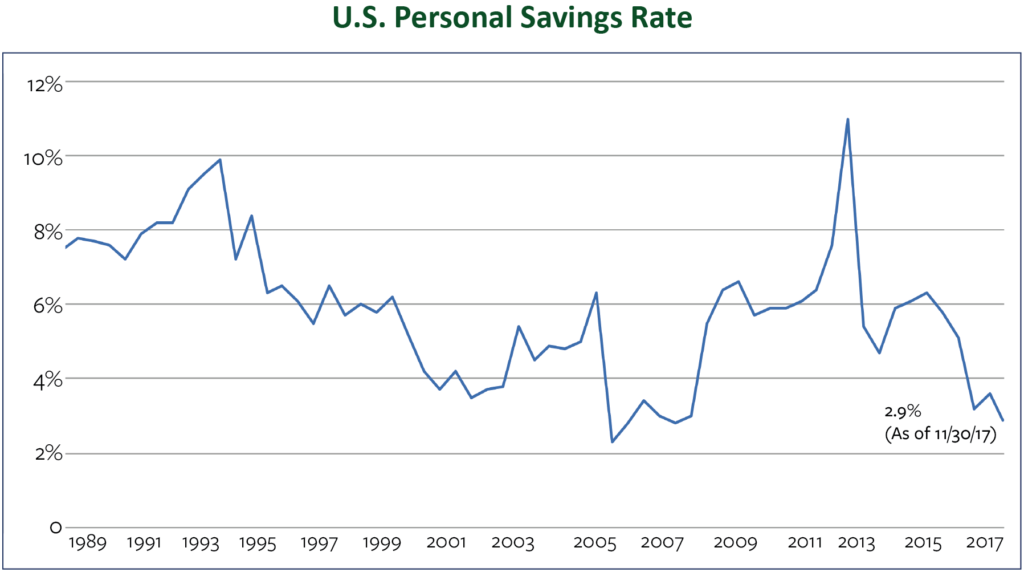

Our optimistic outlook for the near term reflects the mosaic of earnings growth, low inflation and interest rates, along with the continuation of a strengthening economy. We temper our enthusiasm knowing that the business cycle is not extinct. The five interest rate hikes initiated by the Federal Reserve have not put a damper on the economy. However, with three or four more hikes potentially in the cards for this year, the impact may be more apparent. We must also pay attention to the fact that the growth in share prices has been much greater than underlying earnings. Stocks are just more expensive. It is becoming increasingly difficult to find quality investments at reasonable prices. Finally, consumers are very confident and are spending freely. The U.S. savings rate has dipped below 3%, the lowest levels since 2005 – 2007, prior to the Great Recession.

Soaring consumer confidence and dwindling personal saving leave little room for future improvement. It may seem that all these factors together suggest imminent recession. However, history has proven that these conditions may persist for many years.

Although we turn the calendar to a new year, our investment style and strategy remain consistent. We continue to seek quality companies that are trading at temporarily depressed levels. We place a premium on above-average dividends and sound balance sheets. Portfolios are maintained within asset allocation guidelines spelled out in our clients’ investment policy statements. This consistent and disciplined approach has served Tufton’s clients well over the numerous business cycles throughout our firm’s twenty-two year history.