Recession and Depression Trends. A Positive?

By Ted Hart

One hundred years ago, our country embarked on a decade now referred to as the “Roaring Twenties”, a period that encapsulated a new era of consumerism and extravagance to the American culture. New technologies and mass production made new products more affordable to the middle class. Armed with the right to vote, American women felt liberated to try out new fashion trends, which gave rise to the widespread use of makeup. A new trend in the American home emerged with an increased desire for home furnishings and decor.

Though the Great Depression left many Americans out of work, it did not stop the momentum of these trends. Instead, it actually increased the development of new products. Many new items were launched during that recession that we still use today. For example, furniture company La-Z-Boy (LZB) was founded to take advantage of the demand for home furnishings. Consumers were so enthralled by the product that they sold their farm animals in order to buy the new reclining chair. To capitalize on ongoing beauty trends, brothers Charles and Joseph Revlon and chemist Charles Lachman started Revlon (REV) with the release of assorted colors of nail polish.

Subsequent recessions were no exception and often led to the acceleration of new product innovation. By the mid-1940s, many Americans were accustomed to President Franklin Roosevelt’s “Fireside Chats” that he delivered via radio broadcast. Like the products mentioned above, radio took off in the 1920s, but listening to it was usually restricted to a consumer’s car or a certain room in the home. During the recession of 1953, Texas Instruments (TXN) released the Regency TR-1 – the first portable transistor radio. Though TXN was first to the punch, it was Sony (SNE) that caught the consumer’s eye with their mass production and high-performance TR-63 that was bought by millions of Americans.

Fast forward to the turn of the century. Music is rapidly being offered digitally, and consumers are impatiently trying to consolidate their compact disc (CD) libraries. The leading electronic titans, including Sony and Compaq (HPQ), were busy developing MiniDisk and MP3 players to take advantage of the changing landscape. Enter Apple (AAPL) with the release of the iPod – in the midst of a recession and barely a month after 9/11 – that revolutionized how we listen to music. With the launch of iTunes, not only did Apple change the way we listen but the way we purchase music as well.

During the Great Recession of 2008-2009, no single company launched a revolutionary product that changed our lives. However, given that many consumers were facing the worst economic hardship since the Great Depression, we witnessed a change in behavior as consumers began to rein in spending. The “bargain shopper” and “treasure hunter” emerged as discount retailers began to flourish, with the likes of TJ Maxx (TJX) and Target (TGT) experiencing record years of sales throughout the downturn and the recovery. In addition, consumers began to find better prices from online retailers. As a result, online shopping grew significantly as we entered the recession (especially on Amazon (AMZN)). What was 3.5% of total retail sales before the recession grew to 4.1% exiting the downturn. Today, the percentage is nearly 15%.

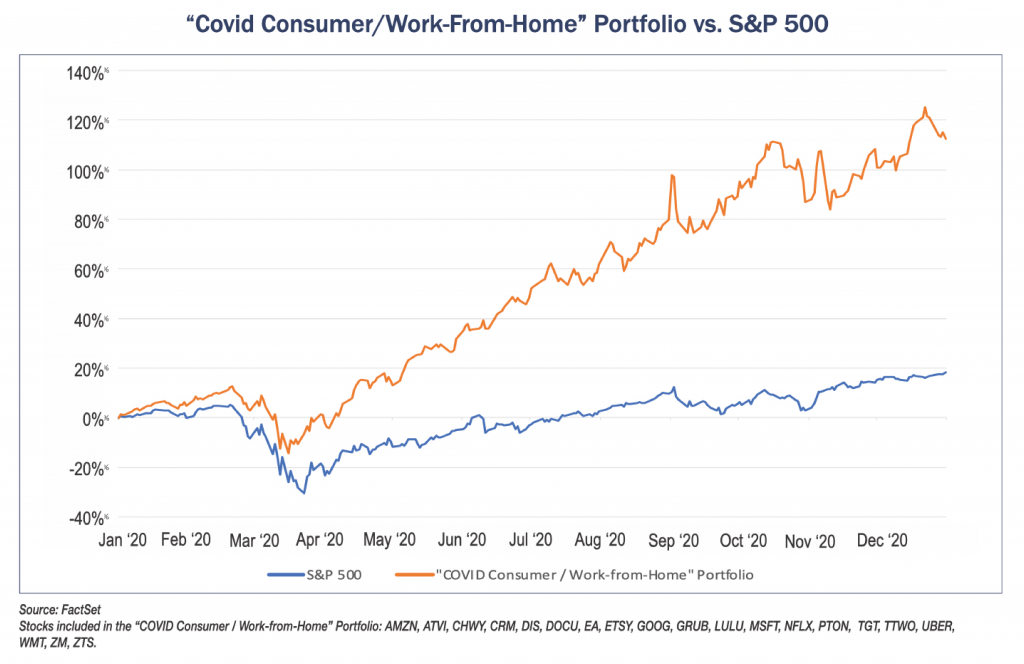

This pandemic-induced recession should accelerate some trends dramatically given how quarantines, lockdowns and social distancing have forced consumers to change their behaviors. Many gyms were shut down and people rushed to buy the Peloton (PTON) or the MIRROR (which is now owned by Lululemon (LULU)). In the media world, the quarantine helped introduce millions of viewers to streaming services, and now many are “cutting the cord” all together. While streaming services may have seen a surge in subscribers due to content, the offerings from Netflix (NFLX), YouTubeTV (part of GOOG) and Disney+ (part of DIS) are becoming more attractive and often less expensive options to the traditional bundled cable service. Similar to the last recession, online shopping has continued to gain market share of retail sales since consumers are avoiding brick and mortar stores. While the online experience has traditionally been dominated by Amazon and Target, Walmart (WMT) has made impressive moves to remain not just relevant, but competitive in the online shopping space.

Lastly, the work-from-home trend could continue, and for some companies, become permanent. This should benefit the more product-specific companies such as Zoom (ZM) and DocuSign (DOCU), while the well-diversified technology companies like Microsoft (MSFT) and Salesforce (CRM) should expect customer cloud adoption to accelerate. No matter what the trend, good or bad, you can rest assured that your investment team at Tufton Capital will be hard at work identifying the companies that will be the beneficiaries, and we will be ready to buy them at the right prices!