Fourth Quarter of 2020: The Stock Market Has Gone Viral

By Eric Schopf

The stock market posted strong returns in the fourth quarter. The Standard and Poor’s 500 reached record levels in December and finished the year with a total return of 18.4%. The recovery from the March 20 low was a robust 65.2%. The 10-year U.S. Treasury yield continued to march higher with a year-end yield of 0.92%. The yield is up from a low-water mark of 0.50% in March and 0.68% at the beginning of the quarter. We are, however, still a long way from the 1.92% yields offered at the beginning of the year.

News flow during the quarter was dominated by the elections and the pandemic. The presidential election was a source of daily speculation by political pundits, and the contested results added to the theater. Bloomberg News estimated that voter turnout was 66% – 72%, the highest since the election of 1900. Control of the United States Senate shifted to the Democrats following two run-off elections in Georgia. The political differences and competing agendas between the Republicans and Democrats were on display during the protracted negotiation for additional stimulus. Republicans held out for lower stimulus checks and Covid-related liability immunity. The Democrats wanted larger checks and fiscal aid to states and cities. Although compromise was reached to enact year-end stimulus measures, the Democrats now control the agenda. With the change in power, the narrative on Wall Street has changed.

Spending and taxation priorities under the new administration will impact the economy and the securities markets. President-elect Biden stumped on the expansion of healthcare access through the Affordable Care Act. Government’s expanded role in healthcare funding may result in greater pricing pressure and expanded coverage. Environmental and climate issues will come back into focus with energy, transportation, industrial and utility companies likely feeling the impact of policy reversals. Infrastructure spending on roads and bridges has also been highlighted, as have student loan forgiveness and free community college educations. In the near term, additional Covid-19 fiscal stimulus via a third round of stimulus checks is almost a certainty. It is just a matter of when and how much. Regulatory changes in the financial and technology industries are also possible. The tax cuts and deregulation enacted during the Trump administration will begin to be reversed. Immigration restrictions are also ripe for change.

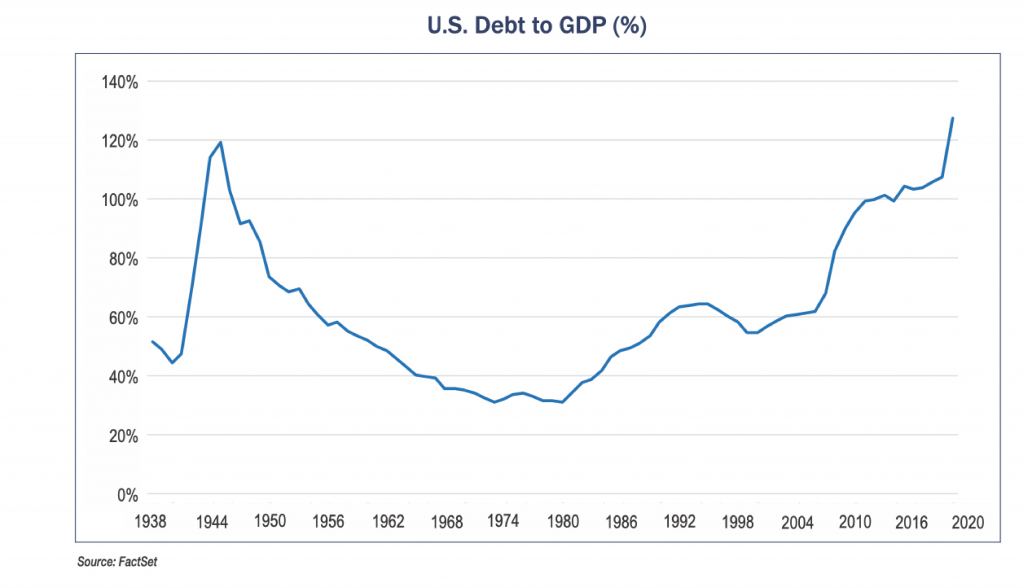

Additional revenue to pay for the various initiatives could be levied through higher corporate and personal income taxes. Changes to capital gains tax rates are also a possibility. Raising tax rates while the economy is still recovering from the virus lockdown-induced recession is a risky proposition, so we expect little change in the near term. The level of taxation will depend not only on the government’s appetite for risk, but on the willingness of investors to continue funding the debt. Coronavirus fiscal stimulus, along with enhanced unemployment benefits, have driven fiscal deficits and debt to unprecedented levels. The deficit in the month of December alone was $144 billion. U.S. debt reached 136% of gross domestic product (GDP) in the second quarter and now stands at about 128%. GDP will continue to grow following the 32% contraction in the second quarter, which will help reduce the debt burden. However, these are debt levels not seen since World War II. The Federal Reserve has filled the demand gap by purchasing Treasury securities, and in the process, has kept interest rates low. An exit strategy that balances economic growth with inflationary-induced money printing will require a deft hand.

Trade negotiations with China under the Biden administration will be very interesting. China was able to string along a tough-negotiating Trump in hopes of his departure after one term. China avoided broad trade commitments and their strategy paid off. It is unclear if Biden will maintain the hawkish stance or will acquiesce to assure access to the second largest economy in the world.

The political rhetoric was matched only by news on the pandemic. And the news was not good. From the first reported case in America on January 21, we closed the year with new daily reported cases exceeding 200,000. Reports of variant strains of the virus have been reported and further lockdowns have been ordered. The emotional and financial hardships have been extraordinary. The good news is that Covid-19 vaccines have been approved and are in the process of being rolled out globally. Although infection rates are sure to escalate following the holiday, there appears to be a light at the end of the tunnel.

The restatement of measures to reduce the spread of the virus impacted the economy during the quarter. Initial claims for unemployment began to tick higher, and economic growth began to decelerate. Retail sales contracted in October and November. The additional economic aid passed by Congress late in the year was a much-needed benefit to the nearly 11 million people still unemployed.

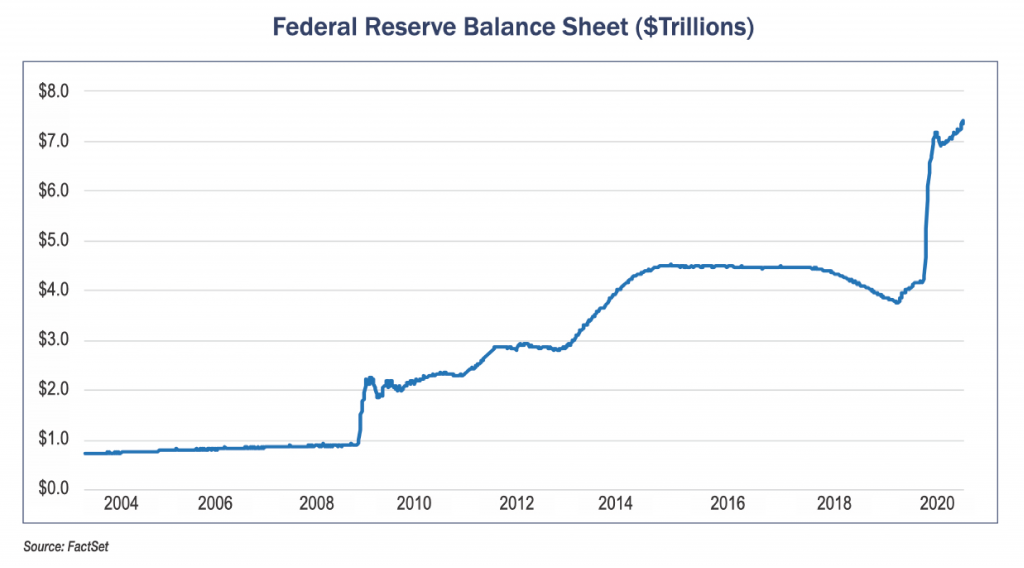

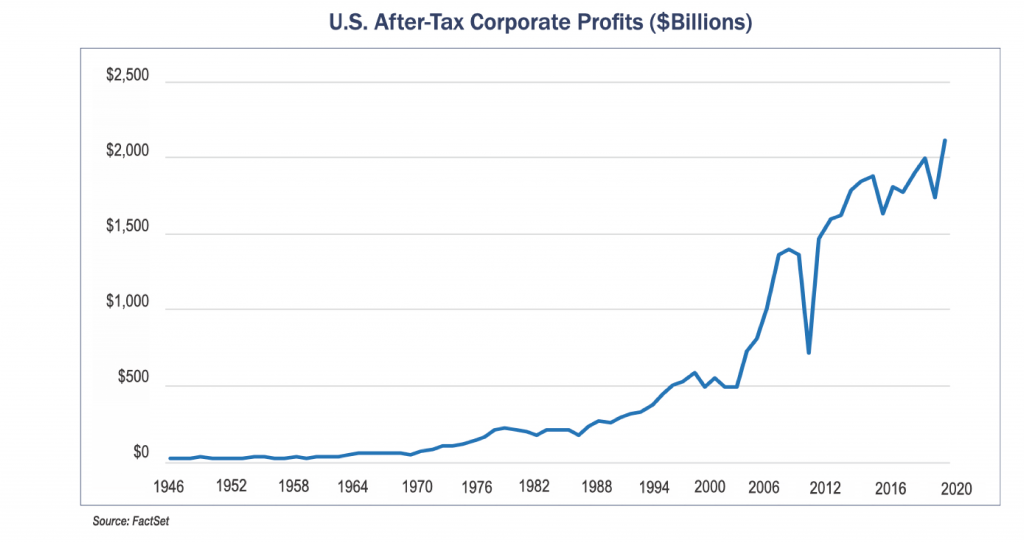

It has been the combination of monetary policy and fiscal stimulus that has prevented the pandemic from becoming a more widespread financially ruinous event. Despite the number of unemployed people being twice what it was in February, personal income is still well above pre-pandemic levels due to government transfer payments. The move in the stock market has been supported by record corporate profits. Third quarter core profits reached an all-time high of $2.32 trillion. The prior record of $2.31 trillion was set in the fourth quarter of 2019. But make no mistake, very low interest rates and the economic stimulus have provided the backbone for this record stock market run. President-elect Biden has nominated Janet Yellen to serve as Secretary of the Treasury. Yellen served as chair of the Federal Reserve between 2014 and 2018 and as vice chair from 2010 to 2014. Her unique perspective should allow a close relationship between the Treasury Department and the Federal Reserve to maintain expansionary policies. Current Fed policies include keeping the federal funds rate within a range of 0.00% – 0.25% and purchasing Treasury securities and mortgage-backed securities at rates of $80 billion per month and $40 billion per month, respectively. The Fed remains committed to an accommodative policy to usher the economy through these difficult times. We do not see this strategy changing in the short term.

The stock market is feeling good. Interest rates trending higher is a sign that investors foresee better growth on the horizon. Credit metrics throughout the financial industry are strong, and delinquencies are low due to loan payment deferrals and forbearance programs. Forced saving during pandemic lockdowns has created a mountain of cash waiting to be spent once the economy reopens. However, we are keenly aware that the Fed’s rescue efforts in the past have resulted in asset bubbles, and signs of over-exuberance are beginning to emerge. Equity valuations are lofty. The market value of stock prices relative to corporate profits and to gross domestic product are stretched. The initial public offering market has been white hot as investors monetize positions. Despite this bullish mood, we remain vigilant. We stay grounded by maintaining investment policies and investment objectives in good times and bad.

I concluded my Winter 2019 Viewpoint article by welcoming the New Year and the challenges that it would surely bring. I will not make that mistake again, as I think it is safe to say that we are glad to bid goodbye to 2020. With the new year will come great change with many moving parts. Your team at Tufton Capital Management will continue working hard to respond to these changes in order to fulfill and hopefully exceed your investment goals.