The Weekly View (2/26/18)

What’s On Our Minds:

As stocks have zigged and zagged in recent weeks, it is likely that some investors can’t help but worry. While we do not take market declines lightly at Tufton Capital, we are stressing the importance of staying the course over the long haul. We understand that it can be a bit worrisome when market pundits are stoking investors’ fears. As long-term investors, however, we must force ourselves to wear “blinders” in order to avoid this type of media hype. Instead of getting caught up in short-term market moves, our Investment Committee continues to rely on its fundamental market research. We suggest that our clients and friends do the same.

Investors Take Note: Blinders keep racehorses focused on what is ahead, rather than what is at the side or behind.

Ten percent corrections like the one we experienced earlier this month are common and have occurred about once every two years since 1957. Selling or trimming positions during these correction is one of the worst investment decisions one can make. Rather than running for the sidelines, history has shown that during these brief periods of investor panic, it’s best to get tough and stay in the game.

Historically, it is in the stock market’s nature to fluctuate sharply during the short term, making volatility inevitable. The market’s volatility is often measured by its standard deviation, a formula that shows how results differ from the expected average. Periods when prices fall or rise quickly can cause spikes in volatility and take time to revert back to the norm. While driven by many factors, uncertainty is a primary culprit.

But what drives uncertainty? Everything from investors’ emotional responses to differing opinions from experts. Investors tend to overreact to specific events in the market, causing a contagion-like episode that spreads from one institution to another. The 24-hour news cycle and differing opinions from market experts also complicate matters. Emotional reactions along with oversaturation with financial information drive volatility.

Investors must understand their personal risk tolerance levels to succeed during volatile times. Remaining disciplined to proven strategies can be effective if you force yourself to stick to your plan in the face of short term volatility. It’s vital to remember that the short term is merely a blip on the market’s long-term journey.

Given the absence of a change in fundamentals, Tufton Capital’s investment approach will mimic our advice, “Stay the Course”.

Last Week’s Highlights:

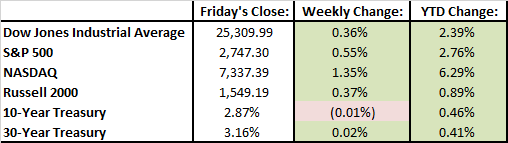

Stocks remained volatile last week but finished in the green. Investors grew jittery as the 10-year treasury bond increased to almost 3%. The Federal Reserve signaled that it saw broad improvement in the U.S. economy and pointed to a pickup in inflation toward the end of last year. However, it didn’t suggest that a rise in prices warranted more aggressive policy action. This dovish view helped ease investor concerns later in the week.

Looking Ahead:

A full economic schedule will have investors on their toes this week.

On Monday, investors will likely be reviewing Warren Buffet’s annual letter to shareholders, and the U.S. Census Bureau will release January new home sales figures. On Tuesday, Fed Chairman Jerome Powell is set to deliver his first semiannual monetary policy report. Fourth quarter GDP estimates will be released on Wednesday, followed by personal income and spending levels on Thursday. On Friday, we will wrap up the week with University of Michigan’s Consumer Sentiment number.

And while Friday does mark the first Friday of the month, we will not get the February jobs report until the following Friday, news that will come just a few days ahead of the next monetary policy announcement from the Federal Reserve.