The Weekly View (11/2/20)

Last Week’s Highlights:

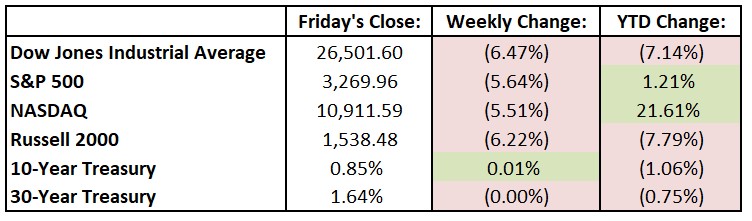

Wall Street closed out a tough week, as fear returned to the markets, fed by rising Covid-19 cases, no relief bill and the upcoming election. Third quarter earnings season continued with mixed results. On the economic front, gross domestic product (GDP) rose 7.4% in the third quarter. While this is a strong number, the result followed a 9% plunge in GDP in the previous quarter. For the week, the Dow Jones Industrial Average (DJIA) lost 1,844 points, or 6.5%, to 26,502, while the S&P 500 fell 5.6% to 327. The tech-heavy NASDAQ tanked 5.5%, closing at 10,012. Merger mania continued with numerous acquisitions and mergers announced. Chip maker Advanced Micro Devices (AMD) agreed to pay $35 billion in stock for Xilinx (XLNX). In a second chip deal, Marvell Technology Group (MRVL) announced that it would pay $10 billion for Inphi (IPHI). LVMH Moet Hennessy Louis Vuitton and Tiffany (TIF) neared an agreement on a price reduction for their contentious $16.6 deal.

Looking Ahead:

Third-quarter earnings season continues with a number of S&P 500 components releasing results this week, including Clorox (CLX), Ingersoll-Rand (IR), Mondelez International (MDLZ) and SBA Communications (SBAC) on Monday. The Institute for Supply Management announces its Manufacturing Purchasing Managers’ Index for October – consensus estimates call for a 56 reading, just above September’s print. Eaton (ETN), Emerson Electric (EMR) and McKesson (MCK) report financial results on Tuesday. Americans head to the voting booths on Election Day – the latest polls lean towards a Biden presidency, a Democratic House of Representatives and a close-call for control of the Senate. Wednesday brings earnings reports from MetLife (MET), Qualcomm (QCOM), Expedia Group (EXPE) and Public Storage (PSA). ADP releases its National Employment Report for October – economists forecast an increase of 875,000 in private-sector employment, up from September’s 749,000 increase. Thursday is the busiest day of the week for earnings reports, including results from Alibaba Group Holding (BABA), Cardinal Health (CAH), Uber Technologies (UBER), Zoetis (ZTS), and many more. The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the central bank is expected to keep the federal-funds rate near zero until at least 2023 to boost the economy. American International Group (AIG), CVS Health (CVS) and Marriott International (MAR) release financials on Friday.

All of us at Tufton Capital wish you a safe and healthy week.