The Weekly View (1/18 – 1/22)

What’s On Our Minds

Last week, our Weekly View urged readers to “hold tight” and based on last week’s volatility, it looks like we got it right. Media pundits had many panicking last week as we saw a major sell off mid-week only to finish the week in positive territory. Yes, volatility can be very stressful for investors, but in situations like last week, we continue to stress the importance of keeping a long term view on your investment portfolio.

Last Week’s Highlights

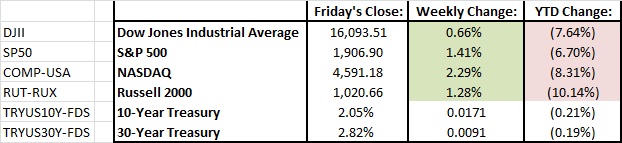

The S&P 500 closed out the week up 1.4%. The market kicked its 2016 weekly losing streak and finished in the green, but it wasn’t easy. Concerns over global economic growth continued and depressed oil prices worried investors. It was a wild week. On Wednesday, the Dow sank 1.6% on a day when oil hit $26.55 per barrel at one point, the lowest “black gold” has traded since May of 2003. By the end of trading Friday, oil rallied back to $32.16 per barrel, which helped the markets recover. As of the close Friday, the S&P 500 was still down 6.70% year to date.

Looking Ahead

The Federal Reserve will release its Federal Open Market Committee Statement on Wednesday afternoon and Fourth Quarter GDP numbers on Friday morning. This week we will also be watching fourth quarter earnings releases from notable companies such as Apple, Johnson & Johnson, Proctor & Gamble, and Microsoft.