The Weekly View (3/30/20)

Last Week’s Highlights:

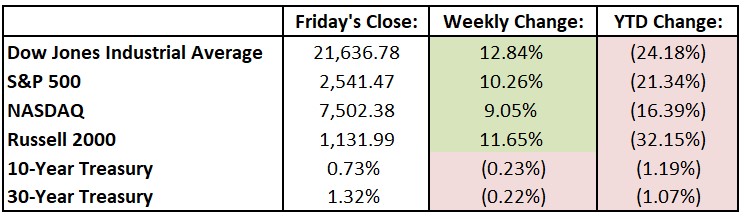

Fiscal and monetary policies helped lift equity markets, as the Dow Jones Industrial Average (DJIA) posted its biggest weekly gain since 1938. The Federal Reserve has dropped interest rates to near zero and is purchasing large quantities of Treasuries and other securities. Congress passed a $2 trillion spending package worth about 9% of U.S. gross domestic product. For the week, the Dow rallied 2462.80 points, or 12.8%, to 21,636.78, while the S&P 500 gained 10.3% to 2541.47. The tech-heavy NASDAQ rose 9.1%, closing at 7502.38. Even after last week’s market rally, equities are still down 25% from the peak reached a month ago. The coronavirus pandemic has forced widespread shutdowns and has ground much of the U.S. economy to a halt, and last week 3.28 million people filed for unemployment benefits, well above previous records.

Looking Ahead:

Global investors are preparing for another volatile ride this week. On Monday, the National Association of Realtors reports pending home sales for February – economists forecast a 1.3% decline, after a 5.2% jump in January. Broadcom (AVGO) hosts its annual shareholder meeting. Spice maker McCormick (MKC) and Conagra Brands (CAG) report quarterly results on Tuesday. The Institute for Supply Management (ISM) releases its Chicago Purchasing Managers’ Index for March – economists forecast a 39 reading, well below the expansionary level of 50. Wednesday brings earnings reports from Lamb Weston Holdings (LW) and PVH (PVH). Hewlett Packard Enterprise (HPE) and Schlumberger (SLB) hold their annual shareholder meetings. CarMax (KMX) and Walgreens Boots Alliance (WBA) announce financial results on Thursday. The Department of Labor reports initial jobless claims for the week ending on March 28th. Constellation Brands (STZ) holds a conference call on Friday to discuss quarterly earnings results. The ISM releases its Non-Manufacturing Index for March – economists look for a 45 reading, well below February’s 57.3 print.

All of us at Tufton Capital wish you a safe and healthy week!