The Weekly View (3/13/17)

What’s On Our Minds:

Many investment companies will advertise their strategies as “value” or “growth.” According to standard definitions, these two types of investment strategies stand opposite to one another. Each uses its own elements and metrics to determine a sound investment, and each has its own standards and expectations for returns.

Defining “Value” and “Growth”

In traditional terms, “value investing” is the purchase of stocks or other securities that are currently undervalued by the market. To make a value investment, an investor must find a security that is being sold for less than what its calculated and/or historical value suggests. Value investing works off a person’s logical expectation that a security will return to a normal price. At Tufton, our value philosophy takes advantage of the emotions in the market. The price of a stock gyrates around its intrinsic value as investors’ emotions cause them to make irrational decisions. We try to buy securities when the market has given up on them – when it feels “dread” and “desolation”. Later, when the market is “deliriously” happy with an investment, we look to sell. We don’t chase hot stocks higher.

On the other end, “growth investing” is the purchase of shares in a company that is expected to grow in importance or become more valuable than it is now. To pursue growth investment, an investor seeks out companies that have excellent potential to expand. The current cost of their shares are not undervalued, their growth has simply not yet been realized. Growth investing is based on the optimistic anticipation of a company’s future.

Differences

Investors will undoubtedly notice that several firms and funds will either label themselves “value” or “growth.” In general, this reflects the funds volatility: value funds are often less volatile than growth funds. Though growth funds make up for their risk by offering the potential for higher returns, economic downturn can cause them significant losses. By purchasing securities at a significant discount, Tufton provides a “margin of safety” which provides downside protection.

Similarities

In recent years, several well-known investors, including Warren Buffet, have stated that the difference between “value” and “growth” investing are arbitrary. A company’s shares might be a good deal because they are undervalued, but an investor is expecting some form of growth or performance to push it back to its normal value. Similarly, if an investor feels a company’s growth is certain, then he or she sees its shares as undervalued at their current price.

The differences between “value” and “growth” are only noticeable if an investor is speculating on growth or continued performance. An experienced and well-informed investor will consider a company’s past and future before purchasing a security. After taking everything into account, it becomes a simple judgment of whether the company’s expected future is worth the current price, market risk and length of time.

If you have questions about your current market positions or would like to learn more about Tufton’s value strategy, please give us a call today!.

Last Week’s Highlights:

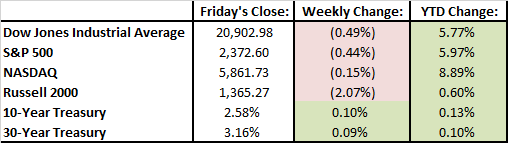

Stocks broke their six-week winning streak last week. The S&P 500 and Dow Jones both fell by less than 0.5%. Both remain up roughly 6% year to date. Oil prices declined by 9.1% last week which pulled shares of energy companies lower. Healthcare stocks moved up and down as President Trump and the GOP proposed major changes to Obamacare. On Friday, we closed out the week with a solid jobs report.

Looking Ahead:

Earnings season is wrapping up. Tiffany, DSW, and Oracle report earnings this week. The Federal Reserve is expected to increase interest rates on Wednesday. Investors are viewing a 25-basis point increase as an almost certainty after last week’s strong jobs report.