The Weekly View (5/25/20)

Last Week’s Highlights:

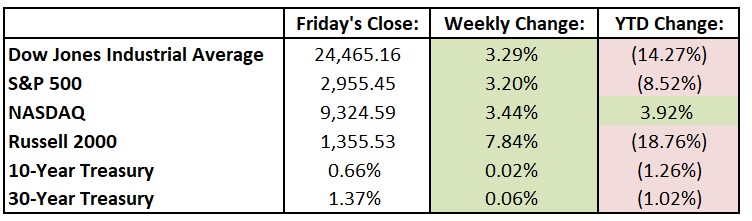

Equities started the week with a bang (the Dow surged over 900 points Monday) after Moderna (MRNA) reported a promising Phase 1 trial on its Covid-19 vaccine and Jerome Powell said the Federal Reserve still had tools available to fight the economic crisis. Stocks gave back some of these gains later in the week as more skepticism on the vaccine emerged and tensions with China rose. Equity markets had a very solid week with the Dow Jones Industrial Average (DJIA) rising 779.74 points, or 3.3%, to 24,465.16. The S&P 500 rallied 3.2% to 2955.45, and the NASDAQ advanced 3.4%, closing at 9324.59.

Looking Ahead:

U.S. equity and bond markets are closed on Monday in observance of Memorial Day. AutoZone (AZO), Bank of Nova Scotia (BNS) and Keysight Technologies (KEYS) report earnings results on Tuesday. The Conference Board releases its Consumer Confidence Index for May – the consensus estimate calls for a 87.3 reading, about even with April’s 86.9 print. Wednesday is busy with earnings as investors will focus of financial results from HP, Inc. (HPQ), Royal Bank of Canada (RY), Amerco (UHAL) and Bank of Montreal (BMO). Amazon.com (AMZN), Chevron (CVX), Exxon Mobil (XOM) and Facebook (FB) hold their annual shareholder meetings. Dell Technologies (DELL), Ulta Beauty (ULTA) and Costco Wholesale (COST) release financial results on Thursday. The Census Bureau announces April’s durable-goods report – economists look for a 15% drop in new orders for manufactured durable goods, to $173 billion – similar to March’s 15.3% decline. On Friday, the Institute for Supply Management releases its Chicago Purchasing Managers’ Index for May – a 40 reading is expected, up from April’s 35.4 print.

Happy Memorial Day! All of us at Tufton Capital wish you a safe and healthy week.