The Weekly View (7/11/16 – 7/15/16)

What’s On Our Minds:

Are we done talking about Brexit yet?

The US and worldwide news cycle might lead you to believe that we’re in turmoil, but the markets beg to differ. The gravity of the issues that face our country and our world shouldn’t be downplayed. There are a lot of things going on surrounding Brexit, and investors have come to us with questions. We thought this would be a good place to address some of them.

Is Brexit good or bad?

This is the political question of the day. Economic theory states that free trade is always better for society overall. For example, say that a country can import 1,000,000 TVs for $400 each, or make them at home, where they will cost $425 each. That’s a $25 million savings for the country overall- but that one company that just lost out on $425 million of sales is going to make a lot more of a fuss than a bunch of people who probably don’t even realize why they saved $25 on a TV. The country then has to decide if it’s worth having more expensive products in order to save a few jobs (for each product).

Then, with free trade comes the freedom of movement afforded by the EU. This means that once a person is inside the EU, he or she is free to move between countries without any border controls, much like the movement between states here. It is also an economic fact that an influx of workers willing to accept lower wages will lower the median wage for everyone. Since countries in the EU retain a lot of sovereignty and identity, they don’t think of it as giving jobs to other Europeans; they think of other countries taking their jobs. We in Maryland don’t worry about “no-good Alabamans” taking our jobs, because we think of everyone as part of one country. But in the EU, countries still think of themselves as very separate.

Trying to have a unity between countries in Europe like we did between states after the Civil War is not something that will come quickly, without tension, or without political and cultural change.

What does Brexit mean for the US?

Well, as it turns out, not much. As we discussed last week, markets panicked at first, but then seemed to realize that things here will be good, with or without a united United Kingdom. UK markets, too, recovered (see below).

So why all the fuss?

England is only about 4% of the world’s GDP. But the EU as a whole is larger than the United States. If there is contagion and a breakdown of the ties between EU countries generally, it could spark a worldwide financial and economic crisis perhaps worse than the 2008/9 one here in the US. Needless to say, a big deal. As it stands, though, we don’t think and EU meltdown is in the cards.

Last Week’s Highlights:

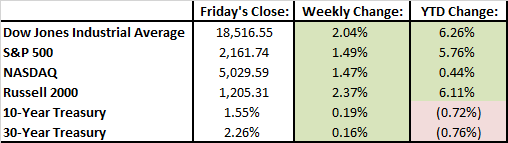

For the third week in a row, stocks were up. With last week’s 1.5% gain in the S&P 500, markets have rebounded 8% since the big drop following the Brexit. Since then, U.S. jobs numbers have showed strength, retail sales numbers beat expectations, we have had a good start to earnings season, and foreign governments have committed to stimulating their weak economies abroad. It was a record-breaking week, as for the first time since 1998 the S&P 500 hit intra-day record highs each day. In company news, Germany’s Bayer increased its offer to purchase seed-maker Monsanto to $125 per share. Disney issued corporate bonds with record-low yields. The company issued a 10 year debt with a 1.85% yield and 30 year debt at 3%.

Looking Ahead:

Even with tragedy last week in France, an attempted coup in Turkey over the weekend, and another horrific attack on police in Louisiana on Sunday, Wall Street remains optimistic on stocks. A good start to earnings season has helped boost investor sentiment. This week, we enter the second week of Q2 earnings season, and our analysts and portfolio managers will be busy listening to earnings calls and reviewing results. After last week’s positive results, we will see if momentum continues. On Monday, we will hear from Bank of America, IBM, and last year’s darling stock, Netflix. On Tuesday, Goldman Sachs and Microsoft release results. Halliburton and Morgan Stanley will release their earnings on Wednesday, followed by General Motors and Capital One on Thursday. We will wrap up the week with General Electric on Friday.