The Weekly View (8/7/17)

What’s On Our Minds:

One of the most interesting aspects of investment and the stock market is its ability to show trends. Any given company on any given day has a stock value that behaves individually. However, there are certain characteristics that people might expect to see from companies depending on their size.

Commonly referred to as its “market cap,” a company’s market capitalization is the total value of all shares of its stock (both common and preferred). Though market cap is easy to calculate (shares multiplied by price), determining why a company holds its current share price is much more difficult.

In general, companies are classified into one of four categories: large-cap, mid-cap, small-cap and micro-cap. Large-caps (sometimes called “big-caps”) typically have a value of over $10 billion. Mid-caps span approximately $2-$10 billion. Small-caps are usually below $2 billion, with micro-caps being smaller than $250 million. Sometimes the terms “mega-cap” or “nano-cap” are also used; these are reserved for truly gigantic and extremely small companies, respectively.

Characteristics of each Cap Category

Large

Large-caps are typically the most stable companies on the market. They are big companies with long histories and a lot of market recognition. Large-caps are more likely to pay out stock dividends and make good on bonds. Investors that focus on large-caps will try to use this stability to produce measured, consistent growth for their clients.

Mid

A mid-cap company usually carries a lot of weight in its particular industry, but is not as widespread as the large-cap companies are. Investors that predominantly use mid-caps aim to have higher gains from growth than large-caps, but put themselves at slightly more risk. During times of economic decline, mid-cap investors will usually lose more than large-cap investors.

Small

Most small-cap companies are well established, but individually, have a minor role in the market. Their functions are usually non-essential, but they have plenty of room to expand and might possibly move into the mid-cap range. Small-cap investors try to harness this growth potential, but cannot be certain of success. These funds often have years of significant gain broken up with occasional years of loss. Small-caps will often boom during economic recovery.

Choosing a Market Cap Style

There is no “right answer” when it comes to choosing a type of cap for investing. Although any single type of market-cap might outperform any other type, success in the future is ultimately unknowable. Large and mid-caps might weather economic downturns better, but are less likely to grow quickly when things are good.

When investing, whether in bonds or stocks, it is important to get all the information. Risk and return must be balanced properly in every portfolio and the means to do it is not always clear. If you are consider adjusting your investments, contact Tufton Capital Management with all your questions and concerns.

Last Week’s Highlights:

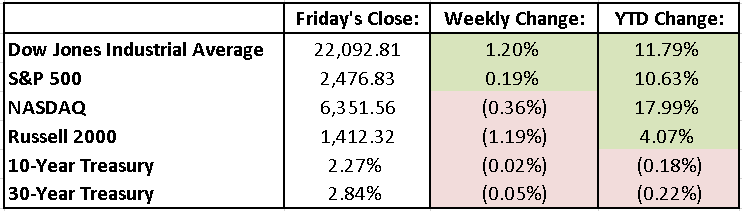

There was a flurry of activity during the week as strong earnings continued to drive the major indices higher. The Dow set a new high water mark above 22,000 and the S&P 500 continues to march towards 2500. A particular Cupertino phone company continues to be the apple of the markets eye, as AAPL had a large earnings beat. The stock finished the week with a 4.5% gain and is up 34.5% YTD. Tesla had a strong quarter on unexpected revenue growth and continues to trek higher into even frothier levels. The market values Tesla $15B more than Ford motor company and $7B more than General Motors.

There was positive economic data this week as employers added 209,000 jobs in July and brought the unemployment rate down to 4.3%. In political news, General Kelly replaced Reince Preibus as White House Chief of Staff and fired Director of Communications Anthony Scarramucci, who only held the position for 10 days.

Looking Ahead:

Earnings are starting to slow down, but Disney and Home Depot, along with younger companies, like Snap Inc., are reporting. It’s supposed to be a quiet week in Washington D.C. as no major bills or testimonies are scheduled. These truly are the dog days of summer…