U.S. Shale Boom Impacts Oil Prices

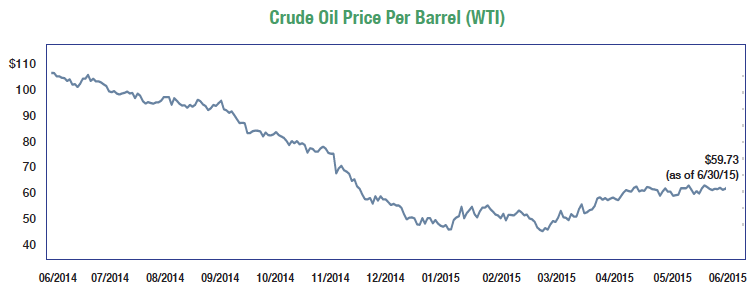

The U.S. Shale Revolution has proved to be nothing short of remarkable. Through the use of horizontal drilling and hydraulic fracturing, also known as “fracking,” the U.S. has become one of the world’s largest oil producers with production of 9.7 million barrels per day, representing approximately 10% of global production. However, many investors believe that the recent decline in oil prices to $60 per barrel has posed a threat to many U.S. shale producers.

The U.S. Shale Revolution has proved to be nothing short of remarkable. Through the use of horizontal drilling and hydraulic fracturing, also known as “fracking,” the U.S. has become one of the world’s largest oil producers with production of 9.7 million barrels per day, representing approximately 10% of global production. However, many investors believe that the recent decline in oil prices to $60 per barrel has posed a threat to many U.S. shale producers.

Although prior oil crashes have imposed drastic effects on oil producers, the dynamics of shale drilling offer a different production scenario. While production from a conventional well can produce a steady volume for several decades, production from the average shale well typically declines an estimated 60% to 70% after the first year. This drop forces companies to have more flexibility in well development in addition to well production. Unlike conventional drillers that can take years to develop and complete a well, shale drillers can now prepare a well in as little as two months. Once up and running, operating costs can be as low as $10-$20 per barrel for the most efficient shale drillers, which is why U.S. producers have continued their operations in 2015.

Currently, there are over 4,000 oil wells that have been drilled but are not completed and thus not yet producing. Collectively known as the “fracklog,” these wells will likely begin production when the price of oil rises to $65-$70 per barrel. Overall, this production process is much like today’s modern manufacturing model with the ability to react quickly to changes in supply and demand.

We had previously forecasted the price of oil to decline due to this supply glut created by the U.S. shale boom. We sold our heavily oil-weighted investments after the oil price began the rapid decline from $107 to the mid-$90s. Many investment returns were hurt by managers attempting to “catch a falling knife” and buying energy stocks in the fourth quarter. Their misfortune could be our opportunity.