Last Week’s Highlights:

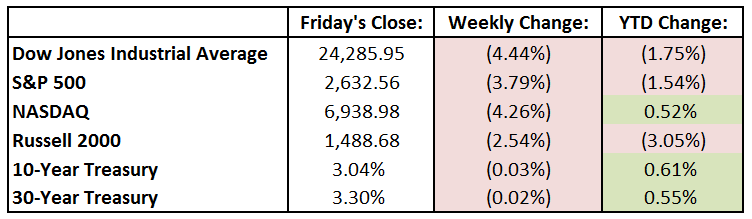

Last week’s trading activity was shortened due to the Thanksgiving holiday. There were only three and a half days of trading, as the market was closed Thursday and open until 1 PM on Friday. Nevertheless, the major indices were on the move as the Dow Jones Industrial Average fell 4.4%, the S&P 500 fell 3.8% and the tech-heavy NASDAQ declined 4.3%. The Dow Jones, which is a price-weighted index, was weighed down by some of its largest components, including Apple (AAPL), Boeing (BA) and Goldman Sachs (GS). In addition to these stocks, the S&P 500 was also affected by a 3% decline in the energy sector as West Texas Intermediate (WTI) crude oil dropped nearly 8% on Friday, closing at about $50 per barrel. WTI is now off 35% from a 4-year high of $77 per barrel set this past June. Energy investors have growing concerns about oversupply, declining demand and slowing global growth.

On the economic-front, Building Permits and Housing Starts results for October were released on Tuesday, each coming in around consensus estimates. There were 1.263 million Building Permits filed in October. As the Federal Reserve has continued to raise rates, the trend has been downward since the 10-year high of 1.3 million set in May. Housing starts were also about 1.2 million in October and slightly up from the 9-month low set in June.

Looking Ahead:

Earnings season continues to wind down this week, as most companies in the S&P have reported. Cracker Barrel (CBRL) and Salesforce (CRM) will report on Tuesday. Retail will be back in focus on Wednesday when Dick’s Sporting Goods (DKS) and Tiffany & Co (TIF) report before the opening bell. La-Z-Boy (LZB) will report after the market closes. On Thursday, Dollar Tree (DLTR) and Abercrombie & Fitch (ANF) will release their quarterly results.

Housing will be on the minds of investors again this week with the S&P/Case-Shiller Housing Price Index being released on Tuesday. Wall Street is expecting growth of 0.3% month-over-month. Information on New Homes Sales and Pending Homes will be provided to Wall Street on Wednesday and Thursday, respectively. The minutes from the most recent Federal Open Market Committee meeting will also be in focus on Thursday.

Last Week’s Highlights:

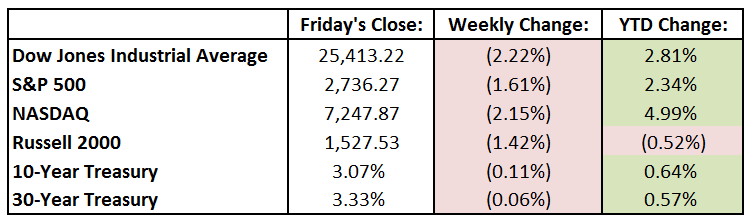

U.S. stocks were lower on the week, as volatility continued along with plenty of news and economic data for investors to digest. Fears that business growth is ebbing and the U.S. economy may be in for a slowdown next year weighed on domestic equities. The Dow Jones Industrial Average (DJIA) dropped 575 points, or 2.2%, to 25,413.22, while the S&P 500 fell 1.6% to 2736.27. The tech-heavy NASDAQ continued its recent weakness, dropping 2.1% for the week to 7247.87. Technology stocks were down following warnings from Apple (AAPL), supplier Lumentum Holdings (LITE) and dismal guidance from Nvidia (NVDA). The tech sector, which is up 7.9% for the year, has now been replaced as the top-performing sector by health care, which has gained 11% in 2018. Internationally, a draft deal for England’s withdrawal from the European Union was reached, but the plan needs to survive vetting in Parliament.

Looking Ahead:

It’s a short week for the markets, as exchanges are closed all day Thursday for Thanksgiving and will close at 1pm Friday. On Monday, we’ll see earnings from Intuit (INTU), JD.com (JD) and L Brands (LB). The National Association of Home Builders’ November Housing Market Index is expected to show a slight decline from October when it releases numbers Monday. Several retailers, including Best Buy (BBY), Lowe’s (LOW), TJX (TJX) and Target (TGT), will report earnings on Tuesday. Deere (DE) releases results on Wednesday, and we’ll get a reading on existing-home sales (expectations call for continued weakness as mortgage rates continue their climb). Black Friday is the retail industry’s Super Bowl, and a strong consumer is expected to help increase this year’s holiday spending by 4.8% from last year.

The Tufton Capital Team wishes you and your family a very Happy Thanksgiving!

Last Week’s Highlights:

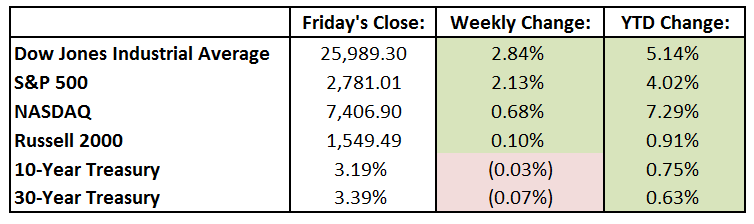

The major indices were all up last week following the midterm elections as the results did not catch many investors by surprise. It was widely predicted that the Democrats were going to take the majority in the House while the Republicans held on to the majority in the Senate. The Dow Jones rose 2.8% and the S&P 500 rose 2.1%. The tech-heavy Nasdaq lagged with returns of 0.7%. Health Care names led to the upside – the ballot-box was favorable to the expansion of Medicaid in many states leading to gains in several Managed Care stocks. The Communication Services sector led to the downside as Facebook (FB) dragged the sector lower. The Energy sector also underperformed as oil declined for the tenth day in a row. Since oil futures were launched 35-years ago, oil has never been down this many days consecutively.

On the economic front, the JOLTS Job Openings Survey reported that there were about 7 million open jobs. Consumer Credit rose $10.9 billion in the month of October. This was under the consensus estimate of $16.5 billion. The Federal Reserve also affirmed current views that another interest rate hike will be coming in December.

Looking Ahead:

Earnings season is winding down as about 90% of S&P 500 companies have reported. Retail stocks will be in focus this week as they finish off reports for the third calendar quarter. On Tuesday, Home Depot (HD) and Advanced Auto Parts (AAP) release results before the opening bell. Macy’s (M) will provide their earnings on Wednesday before the open, while Cisco (CSCO) the technology company will report after the market closes. Thursday will bring results from Walmart (WMT), JCPenney (JCP) as well as Nordstrom (JWN).

For economic releases, investors will be watching inflation and retail sales. For inflation, the growth in the Consumer Price Index (CPI) will be released on Wednesday. Estimates are for growth of 2.5% year-over-year. Retail sales for the month of October will be disclosed on Thursday. Wall Street is expecting growth of 0.6% for the month.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

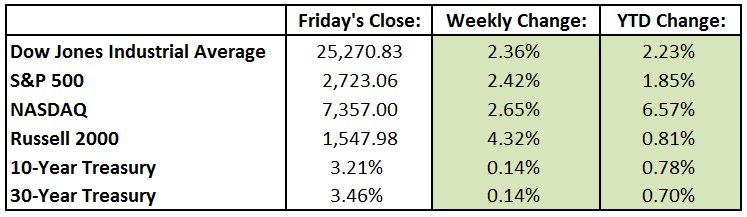

Stocks finished higher last week, as the equity markets experienced positive earnings, improved investor sentiment and progress in China trade talks. The Dow Jones Industrial Average (DJIA) rose 582 points, or 2.4%, to 25,270.83 last week, while the S&P 500 gained 2.4%, to 2723.06. The tech-heavy NASDAQ climbed 2.6%, to 7356.99. Volatility continued last week and was capped off by Friday’s huge reversal, when the Dow turned a 198 point gain into a 109 point loss. Apple stock (AAPL) was off 6.6% Friday after reporting weaker-than-expected guidance, and the payroll data that was released was strong (good news for the economy but further indication that the Federal Reserve will almost certainly hike rates again in December). Earnings season is winding down as nearly 75% of the S&P 500 companies have reported their Q3 results. Overall, quarterly profits appear to be growing at their best pace in eight years, and together with the market decline, have resulted in lower valuations. We happily bid farewell to October, as it was a tough month for stocks: the DJIA and S&P 500 declined 5.1% and 6.9%, respectively.

Looking Ahead:

Although earnings season is winding down, we’ll still see a flurry of results this week. On Monday, Loews (L), Marriott International (MAR), PG&E (PCG) and Sysco (SYY) report their third quarter results. Don’t forget to vote on Tuesday, as November 6th marks the mid-term elections. We’ll also see earnings from Eli Lilly (LLY), AmerisourceBergen (ABC), Martin Marietta Materials (MLM) and CVS Health (CVS) that day. The Federal Open Market Committee (FOMC) meeting begins Wednesday, and Cardinal Health (CAH) and KLA-Tencor (KLAC) host their annual shareholder meetings. On Thursday, the FOMC will announce its latest interest rate decision – it is widely expected that the federal-funds rate will remain unchanged at 2% to 2.25%. Friday is World Freedom Day, but the day will not be free of more economic reports. The Bureau of Labor Statistics releases the producer price index (PPI) for October (estimates are for a 0.2% gain). The University of Michigan reports its Consumer Sentiment Survey for November – expectations are for a 98 reading, down from last month’s 98.6.

The Tufton Capital Team hopes that you have a wonderful week!