The Weekly View (11/12/18)

Last Week’s Highlights:

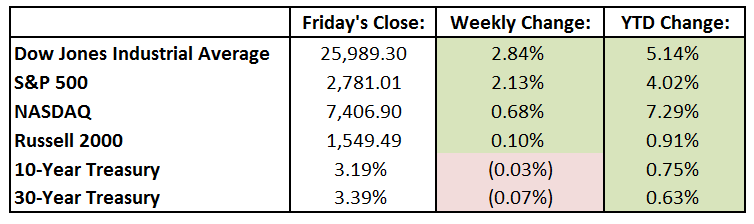

The major indices were all up last week following the midterm elections as the results did not catch many investors by surprise. It was widely predicted that the Democrats were going to take the majority in the House while the Republicans held on to the majority in the Senate. The Dow Jones rose 2.8% and the S&P 500 rose 2.1%. The tech-heavy Nasdaq lagged with returns of 0.7%. Health Care names led to the upside – the ballot-box was favorable to the expansion of Medicaid in many states leading to gains in several Managed Care stocks. The Communication Services sector led to the downside as Facebook (FB) dragged the sector lower. The Energy sector also underperformed as oil declined for the tenth day in a row. Since oil futures were launched 35-years ago, oil has never been down this many days consecutively.

On the economic front, the JOLTS Job Openings Survey reported that there were about 7 million open jobs. Consumer Credit rose $10.9 billion in the month of October. This was under the consensus estimate of $16.5 billion. The Federal Reserve also affirmed current views that another interest rate hike will be coming in December.

Looking Ahead:

Earnings season is winding down as about 90% of S&P 500 companies have reported. Retail stocks will be in focus this week as they finish off reports for the third calendar quarter. On Tuesday, Home Depot (HD) and Advanced Auto Parts (AAP) release results before the opening bell. Macy’s (M) will provide their earnings on Wednesday before the open, while Cisco (CSCO) the technology company will report after the market closes. Thursday will bring results from Walmart (WMT), JCPenney (JCP) as well as Nordstrom (JWN).

For economic releases, investors will be watching inflation and retail sales. For inflation, the growth in the Consumer Price Index (CPI) will be released on Wednesday. Estimates are for growth of 2.5% year-over-year. Retail sales for the month of October will be disclosed on Thursday. Wall Street is expecting growth of 0.6% for the month.

The Tufton Capital Team hopes that you have a wonderful week!