Last Week’s Highlights:

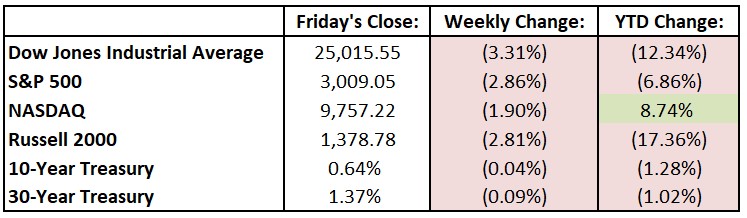

U.S. equities started the week on a positive note, as business re-openings continued throughout the country and solid economic news helped boost investors’ moods. The rally was short-lived, however, as rising COVID-19 case numbers were reported across the Sunbelt. Bank stocks were hit late in the week after an unfavorable result in the Federal Reserve’s latest stress test. An advertiser boycott at Facebook (FB) dragged down the market and especially hurt large technology stocks. For the week, the Dow Jones Industrial Average (DJIA) fell 855.91 points to 25,015.55, while the S&P 500 dropped 2.9% to 3009.05. The tech-heavy NASDAQ declined 1.9%, closing at 9757.22.

Looking Ahead:

Micron Technology (MU) releases fiscal third-quarter numbers on Monday. The National Association of Realtors reports its Pending Home Sales Index for May – economists forecast a sharp rebound of 25%, to an 89 reading. Conagra Brands (CAG) and FedEx (FDX) announce their financial results on Tuesday. The Conference Board releases its Consumer Confidence Index for June – expectations call for a 90 level, up from 86.6 in May. Wednesday brings earnings reports from General Mills (GIS) and Constellation Brands (STZ). The Federal Open Market Committee reports the minutes of its June monetary-policy meeting. ADP releases its National Employment Report from June – economists expect a gain of 2.9 million private-sector jobs, a large improvement over May’s 2.8 million drop. On Thursday, the Department of Labor reports on initial jobless claims for the week ended on June 27th – jobless claims have fallen for 12 consecutive weeks since peaking at 6.9 million in late March. U.S. equity and fixed-income markets are closed Friday in observance of Independence Day.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

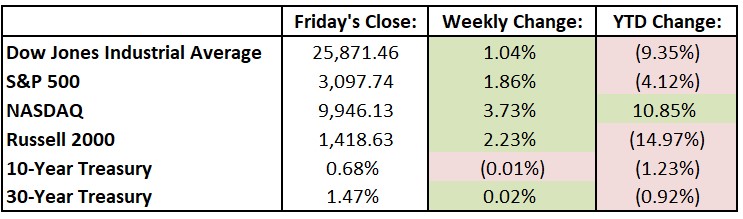

U.S. equities rallied early in the week after the Federal Reserve said it would expand its bond buying program. Strong retail sales numbers and news of a promising steroid for severely ill COVID-19 patients also helped boost stocks. The market wavered later in the week on renewed virus fears. On Friday, Apple (AAPL) announced that it was closing stores in four states that were experiencing an increase in coronavirus cases. Concerns that other companies could follow suit sent the major exchanges falling to end the week. Last week, the Dow Jones Industrial Average (DJIA) rose 265.92 points to 25,871.46, while the S&P 500 advanced 1.9% to 3097.92. The tech-heavy NASDAQ gained 3.7%, closing at 9946.12.

Looking Ahead:

Bristol-Myers Squibb (BMY) hosts a virtual investor meeting on Monday – the company’s management team will discuss drugs in the pipeline, with a focus on its immune-oncology portfolio. The National Association of Realtors reports existing-home sales for May – consensus estimates call for a seasonally adjusted annual rate of 4.2 million homes sold, down from 4.3 million in April. On Tuesday, Kansas City Southern (KSU) webcasts an investor meeting. IHS Markit announces its Manufacturing Purchasing Managers’ Index and Services PMI for June – expectations call for a 44 reading for both indexes. The Federal Housing Finance Agency releases its U.S. House Price Index for April on Wednesday – prices rose 5.7% year-over-year in the first quarter. Thursday brings earnings reports from spice maker McCormick (MKC) as well as Accenture (ACN) and Nike (NKE). The Census Bureau announces the durable goods report for May – new orders for manufactured durable goods are expected to rise by 9.8%, to $186 billion. On Friday, the Bureau of Economic Analysis reports personal income and spending for May – expectations call for a 6% decline in income, after an unexpected 10.5% jump in April.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

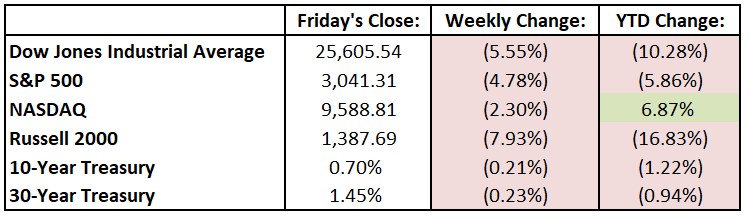

U.S. equities posted their worst weekly decline since March as fears of a second wave of infections and doubts about a speedy economic recovery dampened investor sentiment. The Federal Reserve indicated that interest rates are likely to remain near zero until 2022 and issued a cautious outlook for the economy. For the week, the Dow Jones Industrial Average (DJIA) fell 1505.44 points to 25,605.54, while the S&P 500 dropped 4.8% to 3041.31. The tech-heavy NASDAQ declined 2.3%, closing at 9588.81.

Looking Ahead:

The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for June on Monday – economists forecast a -27.5 reading, an improvement from May’s -48.5 print. Groupon (GRPN), Oracle (ORCL) and H&R Block (HRB) report quarterly earnings on Tuesday. Federal Reserve Chairman Jerome Powell is scheduled to testify before Congressional hearings on the central bank’s semiannual monetary policy report. The Census Bureau releases new residential construction data for May on Wednesday – economists forecast housing starts at a seasonally adjusted annual rate of 1.12 million. Thursday brings financial results from Kroger (KR) and At Home Group (HOME). The Department of Labor reports seasonally adjusted initial jobless claims for the week ending June 13th – weekly claims have been falling from their unprecedented high levels earlier this year. Lyft (LYFT), Slack Technologies (WORK) and Deutsche Telekom (DTEGY) are among the companies holding virtual shareholder annual meetings on Friday. CarMax (KMX) and Jabil (JBL) host quarterly earnings conference calls.

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

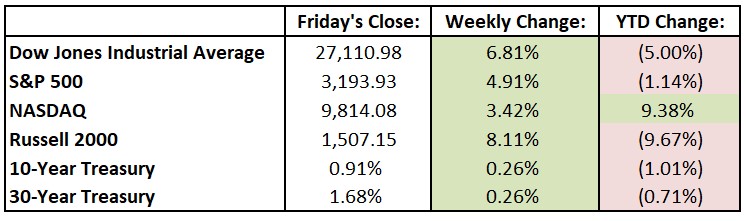

U.S. equities soared higher Friday after the May employment report showed that the country added 2.5 jobs last month, well above economists’ estimates for a loss of 8 million. The Dow Jones Industrial Average (DJIA) jumped over 800 points, or 3.2%, extending its gain for the week to 6.8% and marking the best week for the Dow in over two months. Investors continue to be encouraged by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow rose 1727.87 points to 27,110.98, while the S&P 500 rallied 4.9% to 3193.93. The tech-heavy NASDAQ advanced 3.4%, closing at 9814.08. Since its bottom on March 23rd, the S&P has shot up almost 40% – the highest return over such a short period since 1933. Year-to-date, the S&P is down less than 3%, including dividends.

Looking Ahead:

Coupa Software (COUP) and Casey’s General Stores (CASY) report earnings on Monday. Look for financial results from Brown-Forman (BF), Chewy (CHWY) and HD Supply Holdings (HDS) on Tuesday. Nvidia (NVDA), Omnicom Group (OMC) and TJX Cos. (TJX) hold their annual shareholder meetings. The Bureau of Labor Statistics (BLS) releases its Job Openings and Labor Turnover Survey for April – economists forecast 5.9 million job openings on the last business day of April, down from 6.2 million in March. American Airlines (AAL), Caterpillar (CAT) and Target (TGT) hold shareholder meetings on Wednesday. The Federal Open Market Committee announces its monetary policy decision – the FOMC is sure to face questions about possible negative interest rates in the U.S. Adobe (ADBE) and Lululemon Athletica (LULU) release financials on Thursday. The BLS reports the producer price index (PPI) for May – consensus estimates call for a 0.1% uptick in the PPI, while the core PPI is expected to gain 0.2%. PVH (PVH) and Centene (CNC) hold investor calls on Friday to discuss earnings. The University of Michigan releases its Consumer Sentiment Index for June – economists forecast a 72.3 reading, about even with the previous two months’ data, and well below the recent peak of 101 reached in February (which occurred shortly before the COCID-19 outbreak).

All of us at Tufton Capital wish you a safe and healthy week.

Last Week’s Highlights:

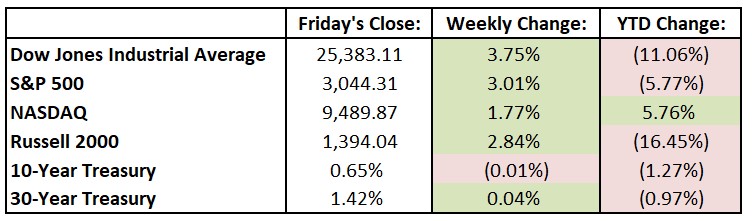

U.S. equities notched a second consecutive week of strong gains, as the S&P 500 recorded its best two-month performance in over ten years. Investors continue to be encouraged recently by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow Jones Industrial Average (DJIA) rose 917.95 points, or 3.8%, to 25,383.11, while the S&P rallied 3.0% to 3044.31. The tech-heavy NASDAQ advanced 1.8%, closing at 9489.87. For the month of May, the S&P and DJIA both climbed by over 4%, building on April’s robust rally when the indexes posted their best monthly percentage gains since 1987. A market rotation has occurred in recent days, as market leadership has shifted from the tech giants (including Microsoft (MSFT), Amazon.com (AMZN) and Facebook (FB)) to industries that should benefit as the economy continues to rebound. These industries and their companies, led by the financials and the energy sector, have outperformed recently as this rotation continues.

Looking Ahead:

Monday is June 1st (rabbit! rabbit!). The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for May – economists forecast a rebound to a 43 reading from April’s 41.5 print. Tuesday brings earnings results from Dick’s Sporting Goods (DKS) and Zoom Video Communications (ZM). Campbell Soup (CPB) announces financials on Wednesday. Alphabet (GOOG), Biogen (BIIB), Comcast (CMCSA) and Walmart (WMT) hold their annual shareholder meetings. ADP releases its National Employment Report for May – private-sector employment is expected to decrease by 9.5 million after 20.2 million jobs were lost in April. Broadcom.com (AVGO), Gap (GPS) and Slack Technologies (WORK) hold conference calls on Thursday to discuss quarterly results. The Department of Labor announces initial jobless claims for the week ending May 30th – weekly claims continue to fall from their unprecedented levels. On Friday, the Bureau of Labor Statistics releases the jobs report for May – estimates call for a seven-million drop in nonfarm payrolls after April’s record 20.5 million decline. The unemployment rate is expected to rise to 19% from April’s 14.7%.

All of us at Tufton Capital wish you a safe and healthy week.