The Weekly View (6/15/20)

Last Week’s Highlights:

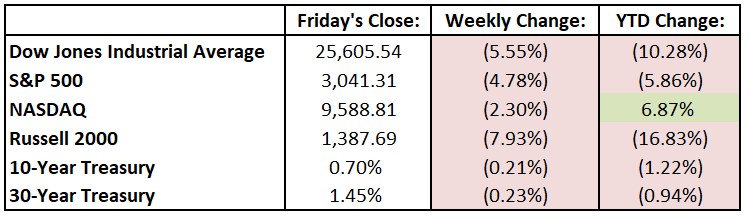

U.S. equities posted their worst weekly decline since March as fears of a second wave of infections and doubts about a speedy economic recovery dampened investor sentiment. The Federal Reserve indicated that interest rates are likely to remain near zero until 2022 and issued a cautious outlook for the economy. For the week, the Dow Jones Industrial Average (DJIA) fell 1505.44 points to 25,605.54, while the S&P 500 dropped 4.8% to 3041.31. The tech-heavy NASDAQ declined 2.3%, closing at 9588.81.

Looking Ahead:

The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for June on Monday – economists forecast a -27.5 reading, an improvement from May’s -48.5 print. Groupon (GRPN), Oracle (ORCL) and H&R Block (HRB) report quarterly earnings on Tuesday. Federal Reserve Chairman Jerome Powell is scheduled to testify before Congressional hearings on the central bank’s semiannual monetary policy report. The Census Bureau releases new residential construction data for May on Wednesday – economists forecast housing starts at a seasonally adjusted annual rate of 1.12 million. Thursday brings financial results from Kroger (KR) and At Home Group (HOME). The Department of Labor reports seasonally adjusted initial jobless claims for the week ending June 13th – weekly claims have been falling from their unprecedented high levels earlier this year. Lyft (LYFT), Slack Technologies (WORK) and Deutsche Telekom (DTEGY) are among the companies holding virtual shareholder annual meetings on Friday. CarMax (KMX) and Jabil (JBL) host quarterly earnings conference calls.

All of us at Tufton Capital wish you a safe and healthy week.