The Weekly View (6/22/20)

Last Week’s Highlights:

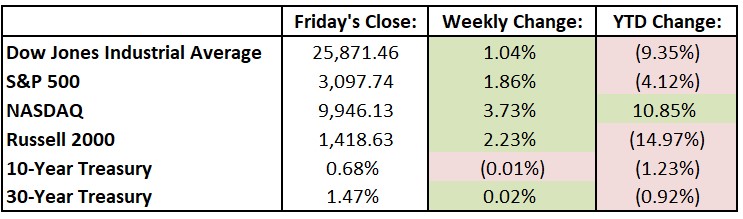

U.S. equities rallied early in the week after the Federal Reserve said it would expand its bond buying program. Strong retail sales numbers and news of a promising steroid for severely ill COVID-19 patients also helped boost stocks. The market wavered later in the week on renewed virus fears. On Friday, Apple (AAPL) announced that it was closing stores in four states that were experiencing an increase in coronavirus cases. Concerns that other companies could follow suit sent the major exchanges falling to end the week. Last week, the Dow Jones Industrial Average (DJIA) rose 265.92 points to 25,871.46, while the S&P 500 advanced 1.9% to 3097.92. The tech-heavy NASDAQ gained 3.7%, closing at 9946.12.

Looking Ahead:

Bristol-Myers Squibb (BMY) hosts a virtual investor meeting on Monday – the company’s management team will discuss drugs in the pipeline, with a focus on its immune-oncology portfolio. The National Association of Realtors reports existing-home sales for May – consensus estimates call for a seasonally adjusted annual rate of 4.2 million homes sold, down from 4.3 million in April. On Tuesday, Kansas City Southern (KSU) webcasts an investor meeting. IHS Markit announces its Manufacturing Purchasing Managers’ Index and Services PMI for June – expectations call for a 44 reading for both indexes. The Federal Housing Finance Agency releases its U.S. House Price Index for April on Wednesday – prices rose 5.7% year-over-year in the first quarter. Thursday brings earnings reports from spice maker McCormick (MKC) as well as Accenture (ACN) and Nike (NKE). The Census Bureau announces the durable goods report for May – new orders for manufactured durable goods are expected to rise by 9.8%, to $186 billion. On Friday, the Bureau of Economic Analysis reports personal income and spending for May – expectations call for a 6% decline in income, after an unexpected 10.5% jump in April.

All of us at Tufton Capital wish you a safe and healthy week.