The Weekly View (6/29/20)

Last Week’s Highlights:

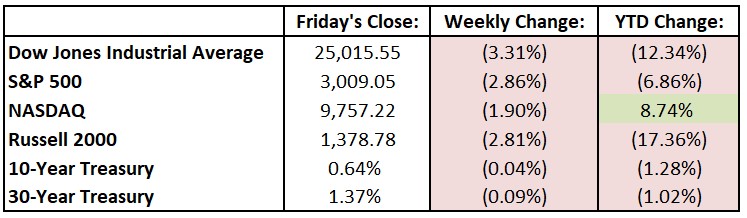

U.S. equities started the week on a positive note, as business re-openings continued throughout the country and solid economic news helped boost investors’ moods. The rally was short-lived, however, as rising COVID-19 case numbers were reported across the Sunbelt. Bank stocks were hit late in the week after an unfavorable result in the Federal Reserve’s latest stress test. An advertiser boycott at Facebook (FB) dragged down the market and especially hurt large technology stocks. For the week, the Dow Jones Industrial Average (DJIA) fell 855.91 points to 25,015.55, while the S&P 500 dropped 2.9% to 3009.05. The tech-heavy NASDAQ declined 1.9%, closing at 9757.22.

Looking Ahead:

Micron Technology (MU) releases fiscal third-quarter numbers on Monday. The National Association of Realtors reports its Pending Home Sales Index for May – economists forecast a sharp rebound of 25%, to an 89 reading. Conagra Brands (CAG) and FedEx (FDX) announce their financial results on Tuesday. The Conference Board releases its Consumer Confidence Index for June – expectations call for a 90 level, up from 86.6 in May. Wednesday brings earnings reports from General Mills (GIS) and Constellation Brands (STZ). The Federal Open Market Committee reports the minutes of its June monetary-policy meeting. ADP releases its National Employment Report from June – economists expect a gain of 2.9 million private-sector jobs, a large improvement over May’s 2.8 million drop. On Thursday, the Department of Labor reports on initial jobless claims for the week ended on June 27th – jobless claims have fallen for 12 consecutive weeks since peaking at 6.9 million in late March. U.S. equity and fixed-income markets are closed Friday in observance of Independence Day.

All of us at Tufton Capital wish you a safe and healthy week.