The Weekly View (7/6/20)

Last Week’s Highlights:

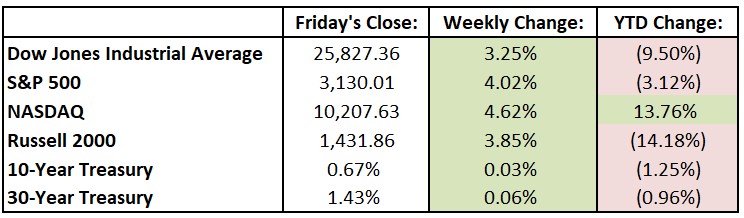

U.S. equities finished higher, capping the shortened July 4th holiday week. The second quarter came to a close on Tuesday with stocks all-but reversing the pandemic-related weakness experienced earlier in the year. The Dow Jones Industrial Average (DJIA) had its best quarter on record since 1987, closing up 17.8% in Q2. For the week, the DJIA rallied 811.81 points to 25,827.36, while the S&P 500 rose 4.0% to 3130.01. The tech-heavy NASDAQ increased 4.6%, closing at 10,207.63, an all-time high.

Looking Ahead:

The Institute for Supply Management releases its Non-Manufacturing Purchasing Managers’ Index for June on Monday – economists forecast a 54.5 reading, a return above the expansionary level of 50 after two months below it. Levi Strauss (LEVI) and Paychex (PAYX) report quarterly results on Tuesday. The Bureau of Labor Statistics announces its Job Openings and Labor Turnover Survey for May – estimates call for 4.9 million job openings on the last business day of May, down from five million in April. Wednesday brings earnings results from Bed Bath & Beyond (BBBY) and MSC Industrial Direct (MSM). Costco Wholesale (COST) releases sales results for June. The Federal Reserve reports consumer credit data for May – forecasters expect outstanding consumer credit to decline for a third month in a row. Walgreens Boots Alliance (WBA) reports fiscal third-quarter results on Thursday. On Friday, the Bureau of Labor Statistics releases its producer price index (PPI) for June – estimates call for a 0.4% monthly gain, which would match May’s increase.

All of us at Tufton Capital wish you a safe and healthy week.