The Weekly View (7/27/20)

Last Week’s Highlights:

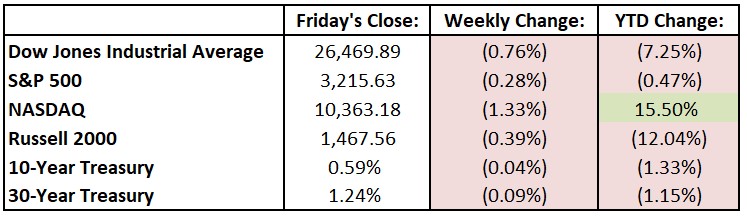

U.S. equities declined modestly last week, while long-term bond yields approached record lows. The S&P 500 turned positive for 2020 briefly before pulling back on escalating concerns over U.S/Chinese trade tensions. Initial jobless claims increased last week (to 1.4 million) for the first time since March, raising worries that the economic recovery may be starting to stall. For the week, the Dow Jones Industrial Average (DJIA) slipped 202.06 points, or 0.8%, to 26,469.89, while the S&P 500 declined 0.3% to 3215.63. The NASDAQ fell 1.3%, closing at 10,363.18.

Looking Ahead:

We’re in the thick of second-quarter earnings season, as many S&P 500 components release results this week beginning with F5 Networks (FFIV), Hasbro (HAS) and SAP (SAP) on Monday. The Census Bureau reports the Durable Goods number for June – expectations call for a 5.5% rise in new orders for durable manufactured goods, to $205 billion, after a 15.7% jump in May. Tuesday is packed with earnings as we’ll see financial results from 3M (MMM), Advanced Micro Devices (AMD), Altria Group (MO), Mondelez International (MDLZ), Raytheon Technologies (RTX) and others. The Conference Board releases its Consumer Confidence Index for June – economists look for a 95.5 reading, slightly below May’s 98.1 print. Wednesday brings earnings from Boeing (BA), Crown Castle International (CCI), General Electric (GE), Qualcomm (QCOM), among others. Alphabet (GOOG), Amazon.com (AMZN), Apple (AAPL), Ford Motor (F) and Procter & Gamble (PG) are among many companies releasing second-quarter financial results on Thursday. The Bureau of Economic Analysis reports gross domestic product (GDP) for the second quarter – consensus estimates call for a decline of 34% after a 5% decline in the first quarter. The business week ends with earnings reports from AbbVie (ABBV), Caterpillar (CAT), Chevron (CVX) and Exxon Mobil (XOM) on Friday. The Institute for Supply Management reports its Chicago Purchasing Manager Index for July – economists look for a 42 reading, above June’s 36.6 print but still below the expansionary level of 50, which the index hasn’t surpassed since last summer.

All of us at Tufton Capital wish you a safe and healthy week.