The Weekly View (6/8/20)

Last Week’s Highlights:

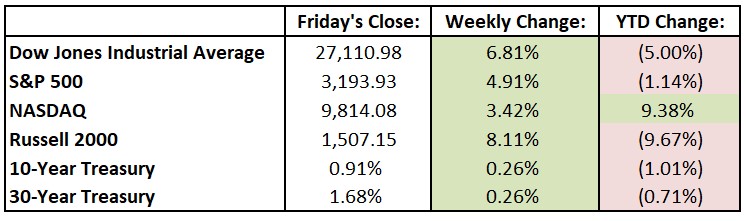

U.S. equities soared higher Friday after the May employment report showed that the country added 2.5 jobs last month, well above economists’ estimates for a loss of 8 million. The Dow Jones Industrial Average (DJIA) jumped over 800 points, or 3.2%, extending its gain for the week to 6.8% and marking the best week for the Dow in over two months. Investors continue to be encouraged by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow rose 1727.87 points to 27,110.98, while the S&P 500 rallied 4.9% to 3193.93. The tech-heavy NASDAQ advanced 3.4%, closing at 9814.08. Since its bottom on March 23rd, the S&P has shot up almost 40% – the highest return over such a short period since 1933. Year-to-date, the S&P is down less than 3%, including dividends.

Looking Ahead:

Coupa Software (COUP) and Casey’s General Stores (CASY) report earnings on Monday. Look for financial results from Brown-Forman (BF), Chewy (CHWY) and HD Supply Holdings (HDS) on Tuesday. Nvidia (NVDA), Omnicom Group (OMC) and TJX Cos. (TJX) hold their annual shareholder meetings. The Bureau of Labor Statistics (BLS) releases its Job Openings and Labor Turnover Survey for April – economists forecast 5.9 million job openings on the last business day of April, down from 6.2 million in March. American Airlines (AAL), Caterpillar (CAT) and Target (TGT) hold shareholder meetings on Wednesday. The Federal Open Market Committee announces its monetary policy decision – the FOMC is sure to face questions about possible negative interest rates in the U.S. Adobe (ADBE) and Lululemon Athletica (LULU) release financials on Thursday. The BLS reports the producer price index (PPI) for May – consensus estimates call for a 0.1% uptick in the PPI, while the core PPI is expected to gain 0.2%. PVH (PVH) and Centene (CNC) hold investor calls on Friday to discuss earnings. The University of Michigan releases its Consumer Sentiment Index for June – economists forecast a 72.3 reading, about even with the previous two months’ data, and well below the recent peak of 101 reached in February (which occurred shortly before the COCID-19 outbreak).

All of us at Tufton Capital wish you a safe and healthy week.