Inflation is Scary! Value Investing Can Help

By: Alex Olshanskiy

The COVID-19 pandemic that started in 2020 sparked an unprecedented flow of money from the government. This broadly based stimulus flowed into every area of the market, sending the market on a wild ride—spurring inflation—and eventually giving rise to a bear market. Investors will find that our value investing strategy will help with soaring inflation and market performance.

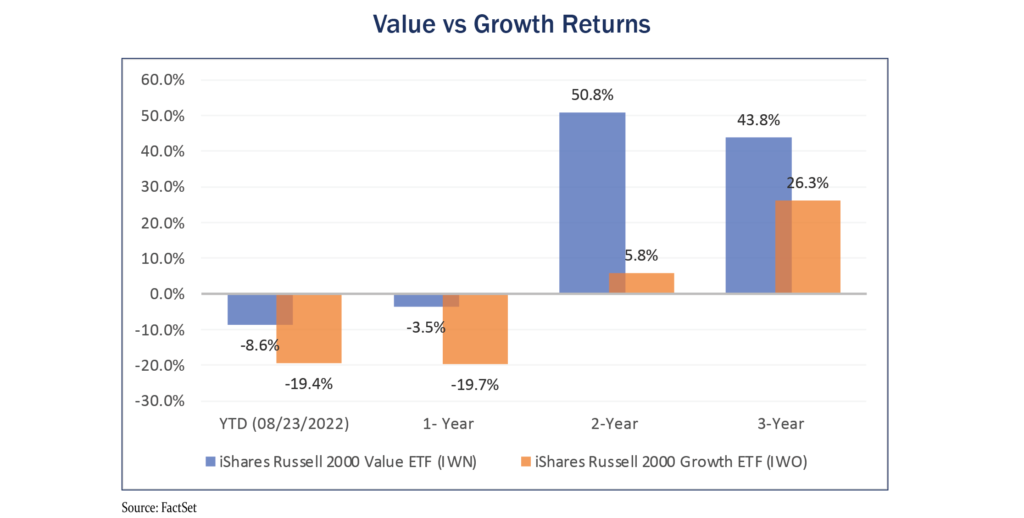

Value Investing Outperforms

In 2022, valuations and fundamentals again became important and, as a result, we saw one of the fastest declines in the market since 1970, with U.S. stocks falling into a bear market in June 2022. Performance statistics show that value investing has outperformed growth investing over the past three years, as well as for the year-to-date period that ended August 23, 2022, as measured by two exchange-traded funds (ETFs). The iShares Russell 2000 Value ETF is down only 8.55% versus a 19.42% decline for the iShares Russell 2000 Growth ETF.

Irving Kahn, a champion of value investing, said “Considering the downside is the single most important thing an investor must do. This task must be dealt with before any consideration can be made for gains. The problem is that people nowadays think they’re pretty smart because they can do something quite rapidly. You can make the horse gallop. But are you on the right path? Can you see where you’re going?”

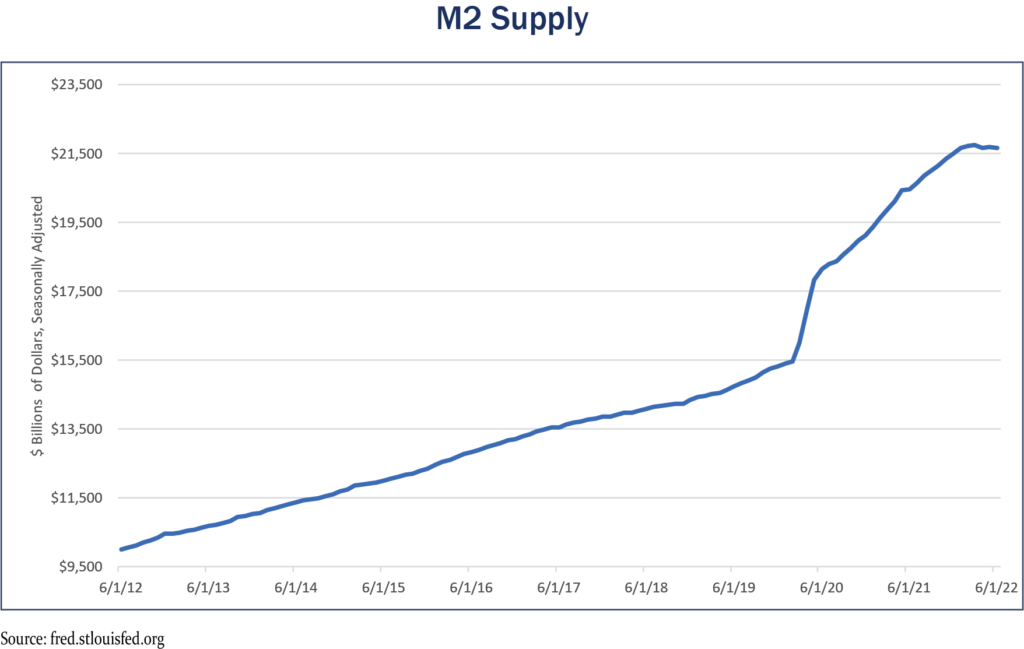

It is in down markets that value investors show their mettle. This is because value investors are contrarians who understand risk and buy stocks at a low price relative to their intrinsic value. They understand that preservation of capital requires a careful, methodical and thorough analysis of a stock’s fundamentals. The influx of stimulus money into the economy led many investors to believe that no one investor could lose money, but 2022 showed that this was certainly not the case. The excess stimulus unleashed during the past three years sent M2 (the amount of money in an economy, including cash, checking deposits and money market securities) skyrocketing to historic levels (see “M2 Supply”). This money significantly increased demand as it poured into stocks, cryptocurrencies, nonfungible tokens, cars and houses, driving up prices without care for valuations or risk.

During the past three years, the stock market’s rise has signaled to a value investor that there was greed on the street, providing a perfect opportunity to sell and wait for a buying opportunity. An intelligent value investor is prepared to buy the right asset at a good price, but only after evaluating the value and the downside risks within the stock.

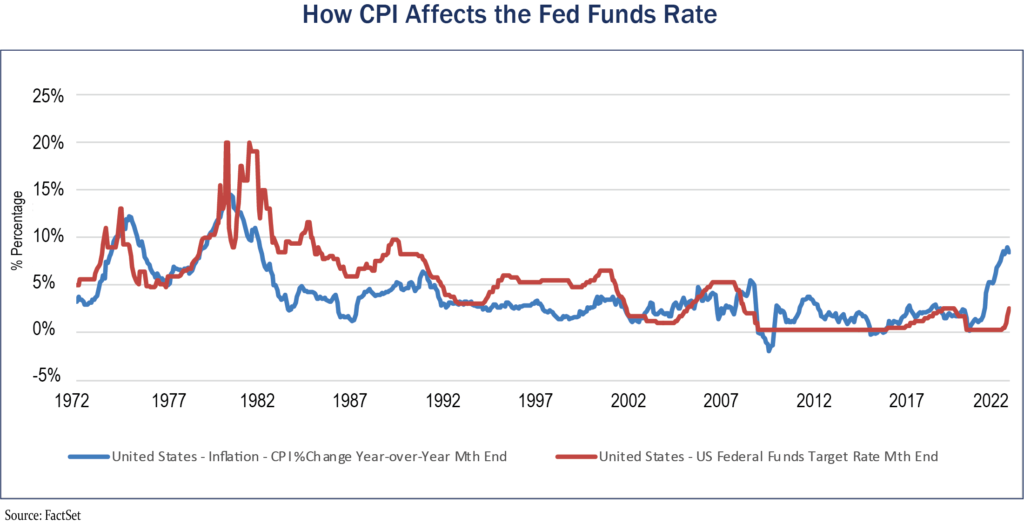

Continuing inflation is a problem

The Consumer Price Index (CPI) has hit levels untouched since 1981—over 40 years ago. Since 1972, the Fed has combated any inflation over 5% by increasing the federal funds target rate to over 5% as well (see “How CPI Affects the Fed Funds Rate”). We had an 8.48% year-over-year CPI percentage change and a U.S. fed funds target rate of 2.50% as of July 31, 2022. This rate is still well below what the Fed has implemented in the past to combat inflation.

The longer the Fed takes to increase rates, the longer investors will be potentially confronted by inflation. Increasing rates from the September 2022 level of 2.25%–2.50% to over 5% would inflict further pain on the market, lower valuations, increase credit card interest rates and make mortgages and loans costlier. This potential for further downside due to inflation might warn investors to rebalance and rethink their holdings within their portfolios.

The case for value investing

With inflation unlikely to disappear soon—and the stock market under siege, at least as of September 2022—it’s a good time for investors to turn to value investing. They might be able to buy some high-quality companies at attractive prices.

Benjamin Graham, the father of value investing, said, “An investment operation is one which, upon thorough analysis promises safety of principal and an adequate return.” Instead of fearing a bear market, investors should embrace it. Value investors should get just as excited having the opportunity to invest in a high-quality business at a 50% discount as they do when their favorite sweater goes on sale.

The two key principles of value investing are buying assets below their intrinsic value and conducting fundamental analysis. A security trading at a significant discount to its intrinsic value can offer a margin of safety to provide downside protection. The company might be temporarily out of favor in the financial market due to some solvable company problem, external factors or another investor misunderstanding. This provides an opportunity to buy a high-quality security at a discount and the chance to receive a good return. Conducting fundamental analysis can be achieved by understanding the company’s financial performance, financial strength, growth attributes, valuations, cautionary signs and annual reports. A grasp of these metrics will allow a value investor to make a reasonable and sound investment decision.

Investors today are seeking a sense of security, which is reflected in the outperformance of value companies. Value stocks can act as a hedge against inflation because they are measured more by their current earnings, unlike growth stocks which are valued more on their future earnings. Here at Tufton, we remain focused on seeking companies with good fundamentals that are selling at attractive prices.