Third Quarter 2022: Putting the Toothpaste Back in the Tube

By: Eric Schopf

The third quarter was an extension of the second. Red-hot inflation, tight labor markets, war in Ukraine and sporadic Covid-related shutdowns in China all weighed on the financial markets. The Federal Reserve responded to inflationary market conditions with two more 75 basis point interest rate increases, and the result was additional drawdowns in the stock and bond markets. The Standard & Poor’s 500 index delivered at total return of -5.9% while the Bloomberg US Intermediate Government/Credit index declined 3.1% during the quarter. For the year, the S&P 500 has declined 23.9% and the intermediate-term Bloomberg fixed income index is down 9.6%. Longer term fixed income returns have fared even worse, with the Standard & Poor’s Treasury Bond Current 10-year index down 16.7% year-to-date.

The current bear market, like all others, is not enjoyable. No one likes seeing the value of their portfolio fall, and we at Tufton Capital Management hate to see this happen on our watch. The depth and duration of bear markets are difficult to determine, which makes market timing nearly impossible. But we can analyze and understand the events confronting the markets and make good long-term investment decisions while recognizing the short-term obstacles.

The Fed has a dual mandate to promote price stability and full employment. Over-accommodative monetary and fiscal policy during the pandemic, combined with other macro factors such as shifting demographics, the war in Ukraine and China Covid policies, have resulted in inflation reaching 9% per year as measured by the Consumer Price Index. At the same time, the unemployment rate has dropped to just 3.5%, and corporate profits remain strong. The Fed hopes to extract the excesses created over the past two years and bring inflation down to a manageable level. These goals are about as easy as putting toothpaste back in the tube—it just takes time and it is very messy. The Fed’s primary tool is the manipulation of short-term interest rates, and higher rates result in both lower bond prices and lower stock valuations. This inflation fight will continue even at the risk of increased unemployment.

Despite five interest rate increases over the past seven months, inflation continues to show little signs of abating. Higher prices for energy, gasoline, food, new vehicles and rent are evidence of the ongoing problem. The federal funds rate now stands at 3.25%, up from just 0.25% in March. The Fed will continue raising interest rates until they achieve their goal of getting inflation under control.

The Fed believes that an increase in unemployment is essential to relieving inflationary pressure. Notwithstanding these increases in interest rates, the labor market continues to show remarkable resilience. Job growth was strong every month during the quarter. June payrolls expanded by 293,000, while August and September added 537,000 and 315,000 jobs, respectively. Wages have in turn moved higher, and according to the Federal Reserve Bank of Atlanta, the three-month moving average of median wage growth for August was 6.7%. The Fed claims to be data-dependent in their decision making process, but the current set of data does not support an end to the tightening cycle since we are a long way from the 2% inflation target set by the Fed.

While the Fed continues to target aggregate demand through their monetary policy, supply issues still persist. The war in Ukraine, now in its eighth month, shows no signs of easing. Commodity price inflation, due to disruptions in energy and food supplies, is being felt throughout the world. Inflationary pressures are especially acute in Europe due to their reliance on Russian gas supplies. Nord Stream 1, a sub-Baltic Sea natural gas pipeline running from Russia to Germany, was taken offline in September following an explosion at the hands of an unidentified saboteur. Restrictive monetary policy will have no impact on Russian military policy nor on constrained supply chains due to China’s zero-Covid policy. This issue flares up with each new Covid outbreak, leading to product shortages and continued inflationary pressure.

The great retirement continues to drain the employee pool as many baby boomers head for the exits. The shrinking pool of workers compels companies to offer higher wages as they compete for the same talent. Until claims for unemployment begin to move higher, the tight labor market will continue to drive wages higher.

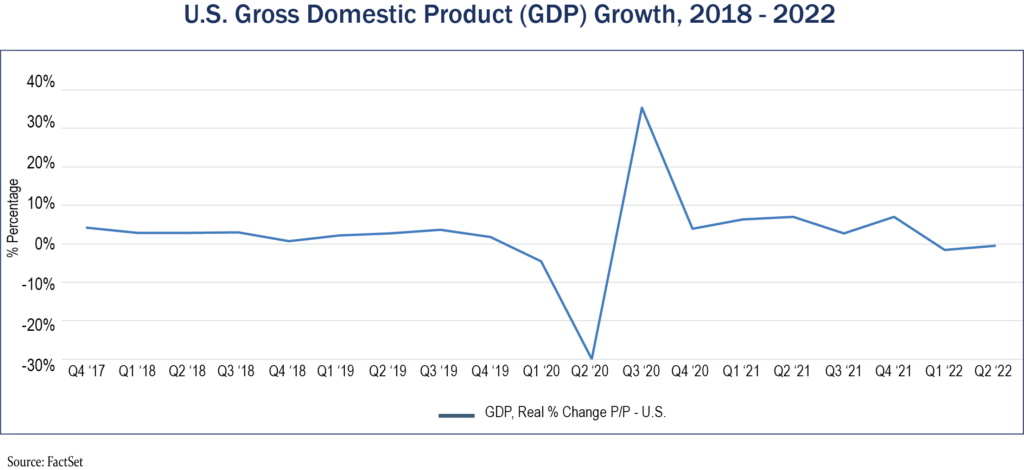

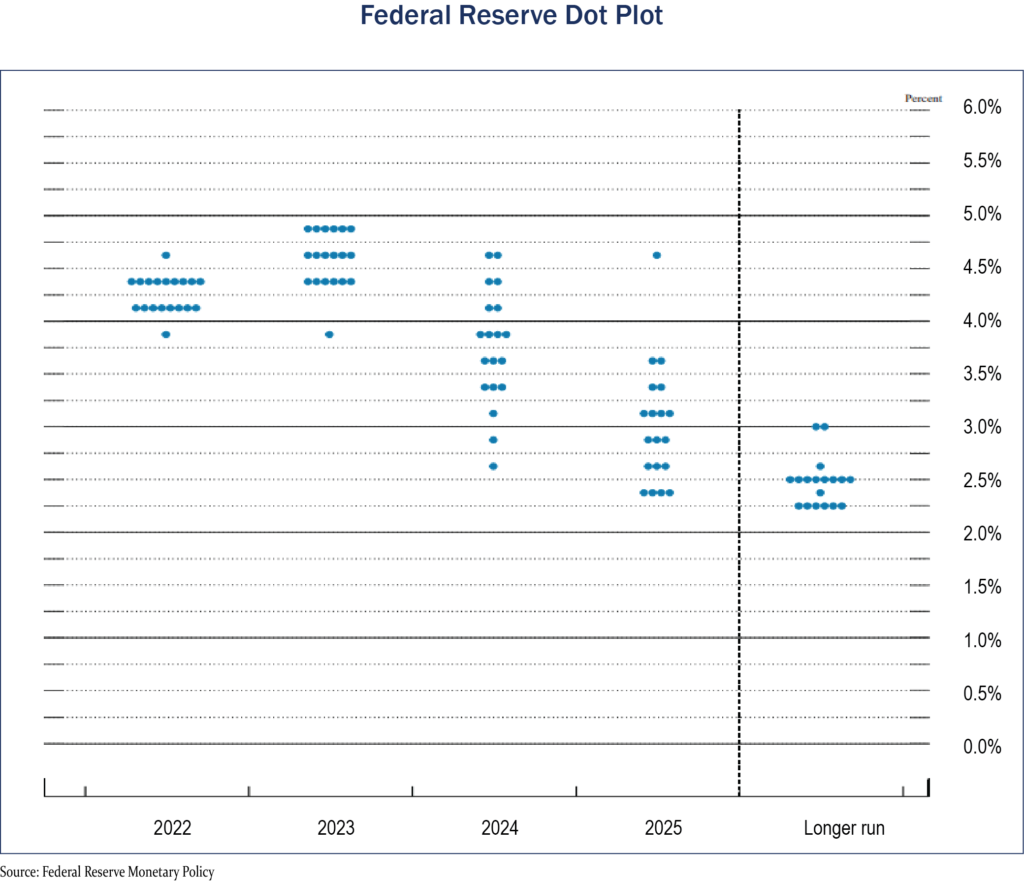

How much further must the Fed go to accomplish their goal? Much of the heavy lifting has already been done. Interest rate hikes in 75 basis point increments are almost unheard of from a Fed that typically moves 25 basis points at a time. The impact of the hikes has been subject to debate, with some analysts pointing to the two consecutive quarters of gross domestic product (GDP) contraction to start the year as proof that the economy has already entered recession. Others point out that the definition of recession used by the National Bureau of Economic Research (NBER), the official arbiter of recessions in the United States, has not been met. The NBER needs to see “a significant decline in economic activity spread across the economy for more than a few months.” Any debate about whether we have already entered recession is academic. Gross domestic product figures clearly indicate that the economy is slowing. Furthermore, higher mortgage rates have taken the air out of residential and commercial real estate. Using the Fed’s dot plot chart as a gauge for future interest rates, indications are for rates to peak in 2023. After maintaining the higher rates for a period of as long as twelve months, rates will then gradually be reduced by the Fed as the economy weakens.

As we have written in the past, there is risk to maintaining the tight policy for too long. The economy reacts to changes in policy with a lag, and by the time economic indicators flash caution, the damage has already been done. It is now obvious that easy monetary policy was left in place for too long, and we are now dealing with the consequences. As recently as March, the Fed was still holding interest rates at close to zero and engaging in bond purchases through their quantitative easing program. The impact of tight monetary policy is now stretching beyond our borders. High interest rates in the United States have resulted in an extraordinarily strong U.S. dollar. Commodities such as oil, wheat and copper, all traded in U.S. dollars, require greater numbers of euros, pounds, yen and yuan to satisfy payments. Economies with weak currencies are getting a dose of their own inflation. The response of the Central Bank is to raise interest rates to support their currencies and reduce the inflationary pressures. The higher interest rates further weaken local economies and risk creating financial cracks.

The higher rates have exposed cracks in the United Kingdom pension market. Liability-driven investments —a leveraged derivative security created to offer pension plans protection from declining interest rates, have dropped in value due to the steep increase in U.K. rates. The contractual obligation of the derivative instruments requires cash payments by the pension portfolios, and in most cases, this cash was generated by the sale of long-term U.K. bonds, called gilts. The mass sale of billions of dollars’ worth of the gilts has put further pressure on U.K. interest rates, leading to government intervention. The longer that interest rates remain high, the greater the likelihood of the formation of further financial cracks. The Fed is trying to get the toothpaste back in the tube, and it is quite messy.

Mike Tyson, the former heavyweight boxing champion of the world, responding to a reporter’s question about an opponent’s plan for an upcoming bout, once said “Everyone has a plan until they get punched in the mouth.” Mr. Tyson was implying that just one of his punches was enough to derail the best laid plans. The market has delivered a painful shot to investors, but do not let the current market volatility derail the investment plan you have in place. With most of the interest rate increases in the rear-view mirror, we are beginning to see greater upside potential in stocks and bonds rather than additional downside risk.