The Fourth Quarter of 2021: The Great Unwind Begins

By Eric Schopf

After limping to a close in the third quarter, the stock market came roaring back in the fourth. The Standard and Poor’s 500 provided a total return of 9.8% and closed the year with a gain of 28.7%. The ten-year U.S. Treasury yield treaded water during the quarter with a move from 1.53% to 1.51%. Stock market returns were buoyed by low interest rates courtesy of the Federal Reserve’s accommodative monetary policy.

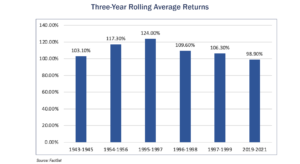

The year 2021 delivered the fourth best annual performance for the stock market in the past twenty-five years. The three-year run from the beginning of 2019 through the end of 2021 provided a total return of almost 100%. Three-year returns have only been this strong on five other occasions since 1928: 1943-1945, 1954-1956, 1995-1997, 1996-1998 and 1997-1999.

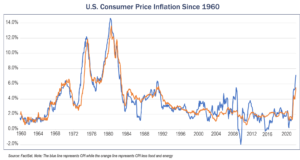

The greatest obstacles facing investors are surging inflationary pressures and the measures that the Federal Reserve will take to dampen these pressures. Inflation, originally dubbed “transitory” by the Fed, can no longer be dismissed as a short-term, pandemic induced occurrence. Inflation registered a year-over-year gain of 6.9% in November, the highest reading since the early 1980s. The Fed’s inflation target of 2% has been exceeded every month since March. The unemployment rate dropped to just 3.9% in December. Easy monetary policy is under the microscope and warrants a change. The Fed has now placed inflation abatement ahead of job creation as their top priority.

The original strategy to begin unwinding the accommodative policies involved three steps: tapering asset purchases, raising interest rates and decreasing portfolio assets. The tapering of asset purchases was accelerated even before the initial strategy was even initiated. The Fed engaged in quantitative easing during the pandemic to keep the economy afloat. This strategy, coupled with fiscal policies from Congress to provide financial support to individuals and small businesses, was essential. More than twenty-five million people were thrown out of work in the early days of the pandemic. The monthly purchase of $120 billion of United States Treasuries and mortgage-backed securities kept liquidity high and interest rates low. The initial plan was to reduce asset purchases by $15 billion per month beginning in December. However, due to inflationary pressures, the Fed increased the amount of the taper to $30 billion per month. This acceleration will allow them to end the policy by the second quarter of 2022.

The end of new asset purchases will set the stage for actual increases in interest rates during the year. The market is anticipating three or four rate hikes, and higher interest rates have wide ranging implications for the economy and the security markets. Interest rates reflect a cost of capital – the higher the cost, the less attractive financed items become. Rising interest rates eventually slow economic activity. Valuations for equity investments contract as future cash flows are discounted to a present value at higher interest rates. Fixed income investments also suffer during periods of rising rates. Simply put, when rates go up, bond prices go down. However, the need for higher interest rates to help cool a hot economy is not always a bad thing. The challenge is to raise rates high enough to take the edge off inflation without throwing the economy into recession.

The Fed will maintain influence over interest rates through the reinvestment of maturity proceeds from their existing portfolio. They have amassed $8.5 trillion in securities. The reinvestment of the bonds as they come due still leaves the Fed as the largest market participant.

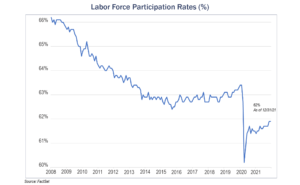

There is a risk if the Fed moves too quickly or too far. Their job is made more difficult by the circumstances that led up to the current situation. Prior to the pandemic, growth was moderate and inflation was minimal despite an unemployment rate of just 3.5%. In fact, the Fed was most worried about deflationary pressures. The sharp two-month recession from March through April of 2020 was accompanied by a 31.2% contraction in gross domestic product. Unemployment spiked to 14.7%. However, this was a recession like no other. The contraction in demand was brief, and unemployment benefits kept consumers flush with cash. Unable to spend on services such as restaurants, movies, live events and travel, consumers spent on hard goods. Peloton Interactive (PTON), a company that provides at-home fitness products and classes, boomed. Supply fell short of demand in many different markets. Staffing shortages made the problem worse as companies simply lacked the labor required to increase production. Pricing pressures created by the demand exceeding the supply were most noticeable in the new and used automobile market. The inability to source parts through traditional supply chains was exacerbated by transportation bottlenecks. People started dropping out of the work force, and the civil labor force participation rate is still well below pre-pandemic levels. Inflation, stable for the better part of the past forty years, has reemerged.

Given the circumstances, it is easy to understand why the Fed concluded that inflation would be transitory. We may find out that it was indeed short-lived. After all, how long is transitory? There has been a noticeable disconnect between interest rates and inflation. The lack of movement in interest rates is an indication that investors do not believe that inflation will become an intractable problem. Prices at the gas pump and the cost of a basket of groceries have become too painful, and Washington wants answers. The political pressure is building.

The steady hand shown by Fed Chairman Jerome Powell throughout his first term in office has been rewarded with his nomination by President Biden for a new four-year term. His deliberate and well-communicated approach has been embraced by the market.

Covid-19 certainly remains constantly on our radar. No one likes Covid math; the virus keeps carrying the “1”. Hopefully, 2022 will bring an end to the math and the virus will become more endemic in nature. We can also take solace that the Omicron variant, while more transmissible, seems to be less virulent. The rapid spread may offer the herd immunity to bring us closer to the end of this pandemic.

Change is certain and risk is rising. At Tufton Capital, wealth creation is perhaps the most important part of our job. The past three years have been some of the best on record for accomplishing the task. During the period, we have allowed equities to reach the upper bounds of policy guidelines. However, wealth preservation is equally as important. We addressed the riskier environment by rebalancing portfolios from stocks into bonds to get closer to a neutral investment policy allocation. We also favored value stocks over growth stocks. We continue to invest for the long term and recognize that the short term may get a little bumpy.