The Third Quarter of 2019: Resilience

By Eric Schopf

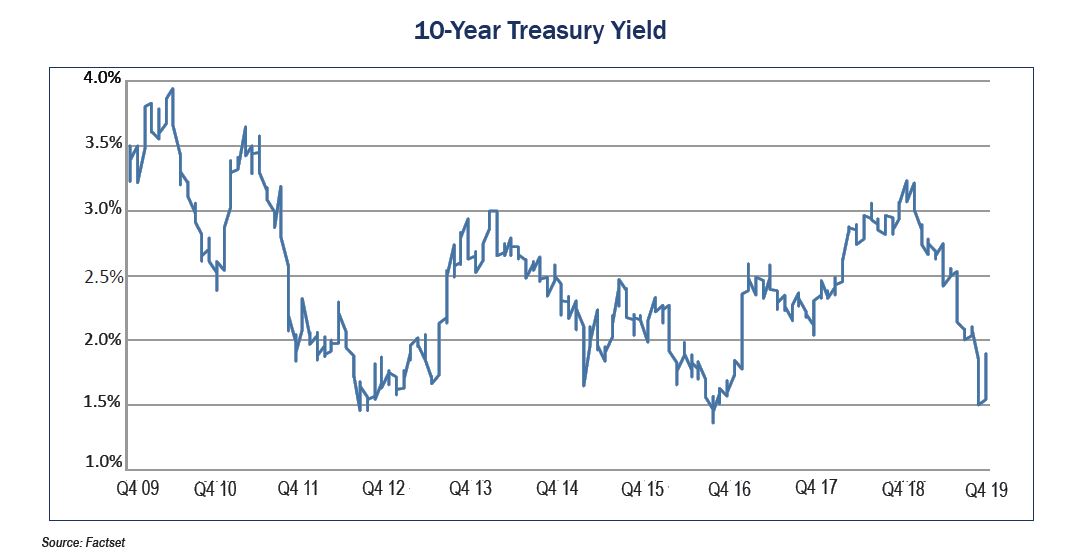

The third quarter provided positive returns for both stock and bond investors. The Standard and Poor’s 500 delivered a 1.7% total return, and the index reached an all-time high of 3025 on July 30. The index closed the quarter at 2977, just 1.6% below its record level. The 10-year U.S. Treasury yield fell from 2.00% on June 30 to 1.68% at the quarter’s end. Intra-quarter, the 10-year yield Treasury touched a low of 1.46% on September 3.

Positive stock market returns demonstrate resilience in the face of myriad global and national events. The Venezuelan economy has imploded, and the Italian government has collapsed all while the Brexit saga continues. A nuclear-powered Russian cruise missile exploded at a test site. Drone attacks on two Saudi Arabian oil facilities resulted in a temporary reduction in oil and natural gas production. Over 46,000 General Motors employees went on strike, and Boeing still has not resolved its 737 MAX issues which have reduced production of their most important model. The repurchase (repo) market became dysfunctional during the quarter leading to a spike in borrowing rates for financial institutions which led to Federal Reserve intervention. The trade war with China intensified when additional tariffs were put in place. Speaker of the House Nancy Pelosi opened an impeachment inquiry of President Trump. We even had the President float the idea of acquiring Greenland! With all this tumult, we’ll take the modest quarterly advance.

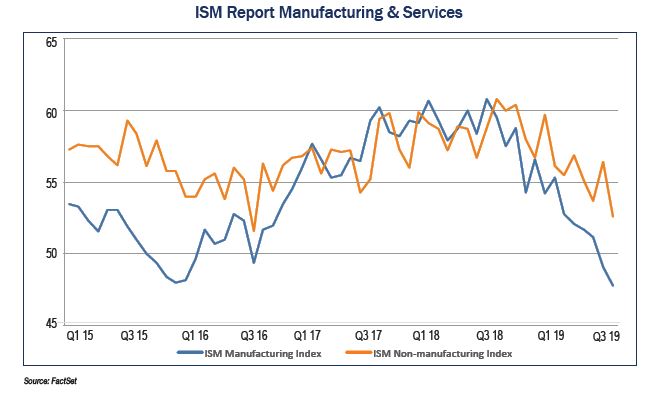

Of all these events, our relations with China are our biggest concerns. Global economies are measurably straining under the heightened tariffs, and the U.S. is no exception. The Institute for Supply Management (ISM), the oldest and largest supply management association in the world, publishes monthly survey data to gauge economic activity of both manufacturing and serviced-based (non-manufacturing) firms. Manufacturing data has been particularly weak and reached a ten-year low in September. Activity has trended lower since the first quarter of 2018. The much larger services sector of our economy has also trended lower and now sits at a three-year low. Employment growth slowed as well during the quarter. Job growth, as reported by the Bureau of Labor Statistics, was 224,000 in June, while we closed the quarter with job gains of only 136,000 in September. This was a strong report but a deceleration nonetheless. The Federal Reserve acknowledged the weakness and reduced their estimates for third-quarter growth from 1.5% to 1.3%

This is not the first time we have experienced a slowdown during this historic economic expansion, which has now entered its eleventh year. We confronted similar situations from 2011 into 2012 and from 2015 into 2016. In both instances, stock prices dropped and bond yields fell. Both episodes did not end in recession. However, the most recent weakness is different in two important ways. First, the trade war with China is bad and getting worse. Posturing has now included potential investment restrictions in Chinese companies and travel bans for certain Chinese officials. The secondary effects throughout Europe have left the continent on the brink of recession and have disrupted our own exports. The second difference has been monetary easing by the Federal Reserve. The Fed reduced interest rates in August by 25 basis points (.25%) and signaled additional moves if necessary. This was their second cut following the nine interest rate increases from December 2015 through December 2018. The Fed has room to cut rates further but may be reluctant to do so with the unemployment rate now at just 3.5%. The state of trade negotiations is very difficult to measure. Additional tariffs announced by President Trump in early August were postponed just until December, while he simultaneously announced a new two-stage process for imposing additional tariffs on imports from China. China, meanwhile, once again reinstituted imports of soybeans from the United States. President Trump doesn’t want to spoil the holiday, and President Xi wants to keep his people fed. Trade tensions with Europe escalated when the World Trade Organization (WTO) found in favor of the U.S. in a long-running dispute involving the export of the Airbus aircraft. The WTO has authorized levies on approximately $7.5 billion of European exports to the U.S. in order to recover the damage. New tariffs ranging from 10% to 25% are scheduled to be imposed on a wide range of products beginning in October.

Our base case has always been that a fair trade agreement will be reached. Fair trade, by definition, is an agreement that benefits all sides. Therefore, there is no reason not to come to terms, especially given the consequences of mutual harm. The impeachment inquiry may further delay the negotiations if China senses a vulnerable Trump, thus placing our economy at greater risk. China has taken a go-slow approach to the discussions because of the upcoming U.S. election. A Trump loss would rid them of a tough negotiating partner. The impeachment process could take anywhere from four months to almost two years, which could stretch beyond the 2020 elections. Therefore, even if the president is reelected, China could continue to drag its feet. The European Union is fully expected to impose its own tariffs on U.S. imports once the WTO announces allowable sanctions based on its own case.

Our investment strategy in the face of the uncertainty has been one of caution. The market is clearly flashing yellow lights, and we are not ignoring them. The economic slowdown has done little to deter stock investors with the market poised at near-record levels. Many stocks are not trading at discounted values. Nevertheless, we continue to search for quality companies that meet our valuation and dividend parameters.

You will notice that our company spotlight is on Microsoft (MSFT). We typically use the newsletter space to review the largest (in terms of dollars invested) company-wide purchase that we made during the past quarter. Given our paucity of purchases during the third quarter, we have decided to review the largest holding across our client base. Microsoft has made some transformational changes to remain relevant in the fast-changing technology world.