Company Spotlight: Kraft Heinz Corp. (Ticker: KHC)

There are very few Americans who would not recognize the brand names “Kraft” and “Heinz.” Formed in a merger in 2015, Kraft Heinz Company (KHC) is a manufacturer of many popular food brands such as Heinz Ketchup, Kraft cheeses, Oscar Mayer meats, Philadelphia Cream Cheese, and Planters Peanuts. Prior to the Kraft and Heinz merger, there were several acquisitions and companies that were spun off. Kraft and Mondelez International (MDLZ) were a combined company before splitting up in 2011. Mondelez took the snack business with an international focus, while Kraft took the core brands with a North American focus. In 2013, H.J. Heinz Company was taken private by Warren Buffett’s Berkshire Hathaway and 3G Capital (a Brazilian private equity firm) for $23 billion. Today, Berkshire and 3G own about 50% of Kraft Heinz common stock.

Buffett and 3G both have excellent track records of successfully managing companies. 3G is a proven cost cutter and has improved margins at companies such as Ambev, Anheuser Busch InBev (BUD), and Burger King. Since the merger, the cost cuts have increased profitability dramatically at KHC with operating margins growing from a low of 11% in 2014 to 28% this past year.

At current levels, we believe KHC shares are significantly undervalued with respect to the company’s long-term growth potential and strong brands. Our investment rationale is predicated on management’s ability to take the brands to international markets in order to boost growth. Also, we believe KHC may lead consolidation in the packaged food sector, which could be a potential catalyst for the stock.

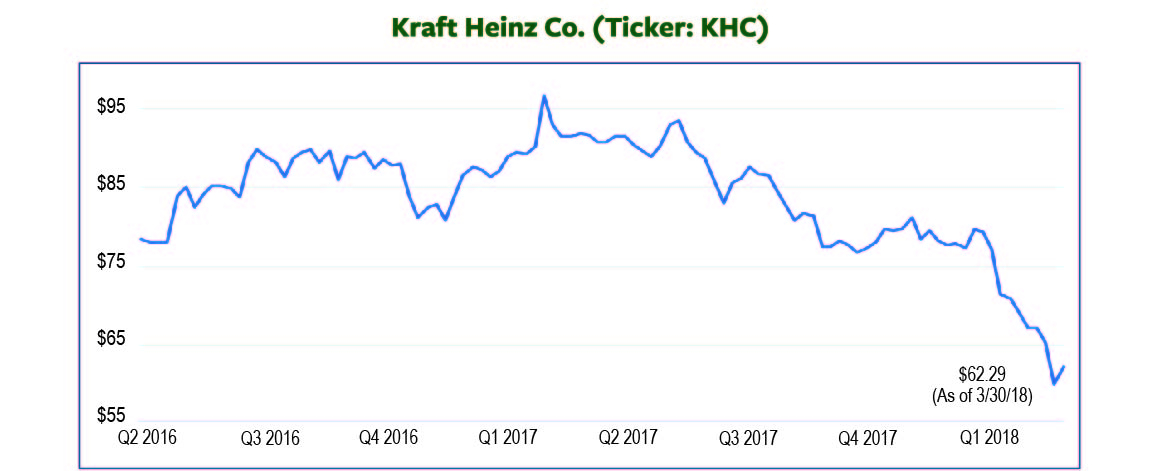

Along with other food companies’ shares, KHC stock has been hit by declining sales as consumers look to private label brands, fresh foods, and locally sourced products. Also, we acknowledge other issues for food companies, including consolidation of U.S. retailers and the significant growth of Amazon. That said, we believe investors are getting paid to wait for KHC’s turnaround; the stock currently yields above 4%.