Company Spotlight: NXP Semiconductors NV (Ticker: NXPI)

By Ted Hart

NXP Semiconductors NV (NXPI) is a semiconductor company based in the Netherlands. It operates in the business of producing High-Performance Mixed Signals (HPMS) in four distinct lines. These lines include Automotive, Industrial & Internet of Things and Mobile and Communication Infrastructure. The company holds market leading positions within each of these business lines, and despite softer sales guidance due to the coronavirus, future growth for their products is still expected to outpace their respective markets. During the 1950s until 2006, the company was the semiconductor segment of Philips before it was sold to a private equity group. Though the spread of the coronavirus may temporarily slow growth, we believe there is a buying opportunity while we wait for sales to rebound. Recently, we have initiated positions in NXPI with the intention of achieving a full size position of 2% of equities.

After a merger with Freescale Semiconductor in 2015, NXPI is now the largest semiconductor supplier to the automotive industry, with strong positions in Car Entertainment, In-Vehicle Networking, Secure Car Access, Chassis & Safety and Powertrain. The Automotive segment accounts for nearly half of the company’s sales as the number of semiconductors per car continues to grow. According to Deloitte, electronic systems as a percent of the total car cost should be nearly 50% by 2030. This is up from 35% in 2010 and 22% in 2000. Looking at the period from 2018 to 2021, management previously expected their automotive revenue to grow 7% to 10% per year while the automotive semiconductor market was expected to grow 5% to 7%. The company continues to invest in targeted growth areas which include Advanced Driver-Assistance Systems, Secure Connected Car and Powertrain Electrification.

Beyond Automotive, the company’s other main growth driver is their Industrial and Internet of Things business, which represents 19% of sales. Products include, but are not limited to, semiconductors for Factories and Building Automation, Smart Home and Building Control, Home Entertainment and Smart Appliances. Sales in this segment were expected to grow 8% to 11% per year from 2018 to 2021 versus market growth of 3% to 5%. The last two segments, Mobile and Communication Infrastructure & Other, are secondary growth drivers with lower market growth rates.

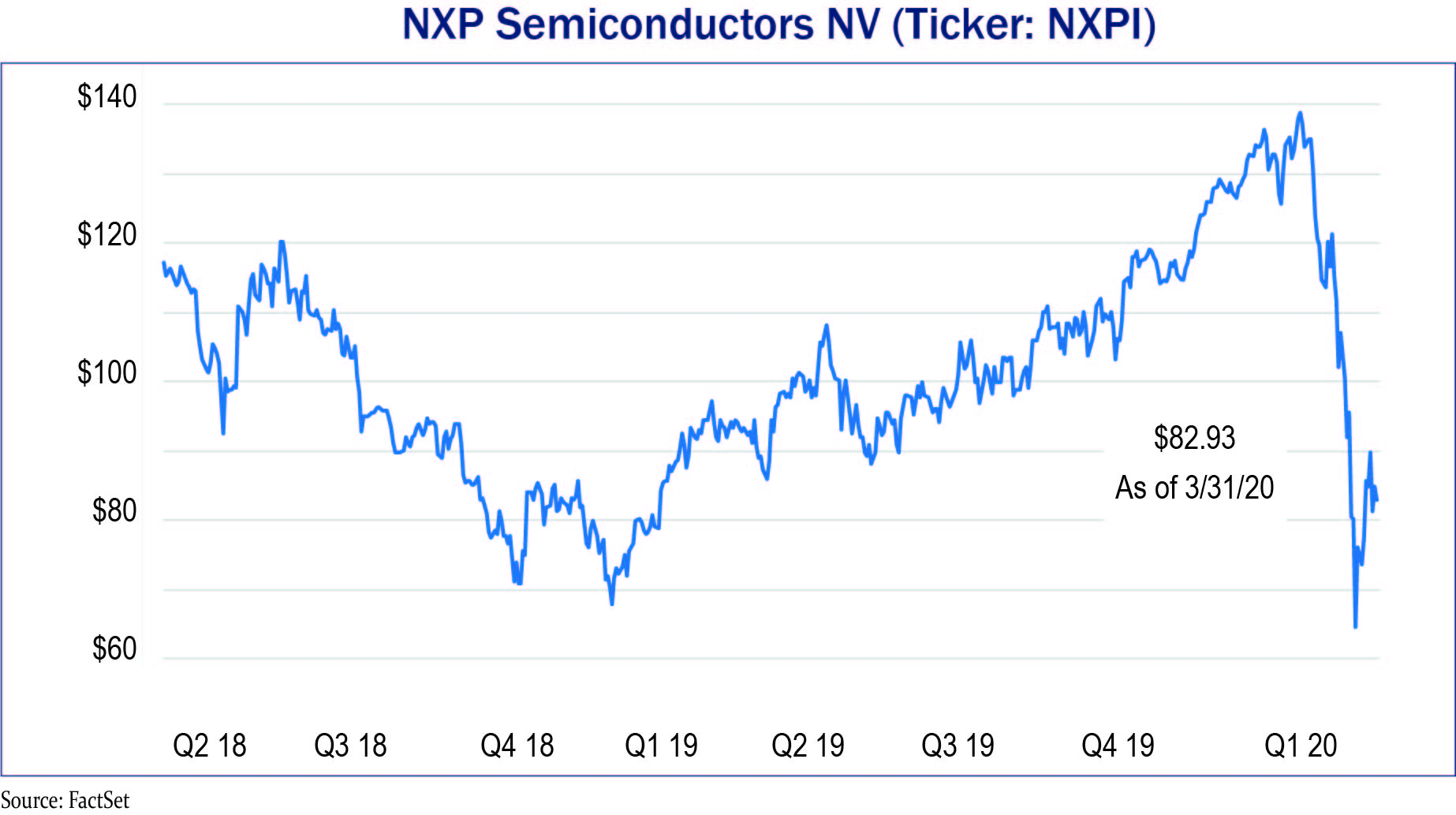

Because of its growth potential, NXPI continues to be a target for acquisition. In the fall of 2016, rival Qualcomm (QCOM) made an offer to acquire the company for a market value of $44 billion. However, the transaction was cancelled due to a dissident shareholder wanting a higher valuation and for a failed regulatory approval from China. As of March 31st, the market value of the company is $24 billion. Assuming the company is worth more now than it was during that transaction, we feel we have a significant margin of safety with potential for a notable upside for investment in NXPI.