The First Quarter of 2020: The Bridge to Somewhere

By Eric Schopf

The first quarter will be long remembered as the coronavirus of 2019 that developed into a full-blown pandemic. Measures to slow the virus’s spread have thrown the economy into recession and securities markets into collapse. Fear has replaced greed and investors headed for the exits. On February 20th, the Standard & Poor’s 500 was up 4.7% for the year and stood at an all-time high. The stock market needed just 22 trading days to shed 33.5%, and seven of those 22 trading days resulted in losses in excess of 4%. The single worst day was March 16th when the stock market fell 12%. The 325-point drop in the S&P 500 is the single largest point decline and the third largest percentage decline in the history of the index. For the quarter, the loss was a more modest 19.6% due to a rally into the end of the quarter.

Dislocations in the stock market were almost matched by those disruptions in the bond market. Corporate credit came under great pressure as the market responded to the threat of potential defaults. Corporate bond prices fell, and liquidity became an issue. With the prospect of declining tax revenue, municipal bonds also came under pressure. At the same time, prices for United States government securities surged, and interest rates fell due to an increased demand in a flight to quality.

The U.S. economy entered the year on solid footing. Low unemployment levels and strong consumer confidence remained the driving forces. Existing home sales, new home starts and building permits all registered healthy gains. President Trump signed Phase One of the trade deal with China which included additional Chinese purchases of U.S. goods and a reduction of duties on some imports. An easing of trade tensions left us hopeful for improvements in business investment – the one sore spot in the economy. The Senate voted to acquit the president on both articles of impeachment, and the Federal Reserve was steady at the wheel.

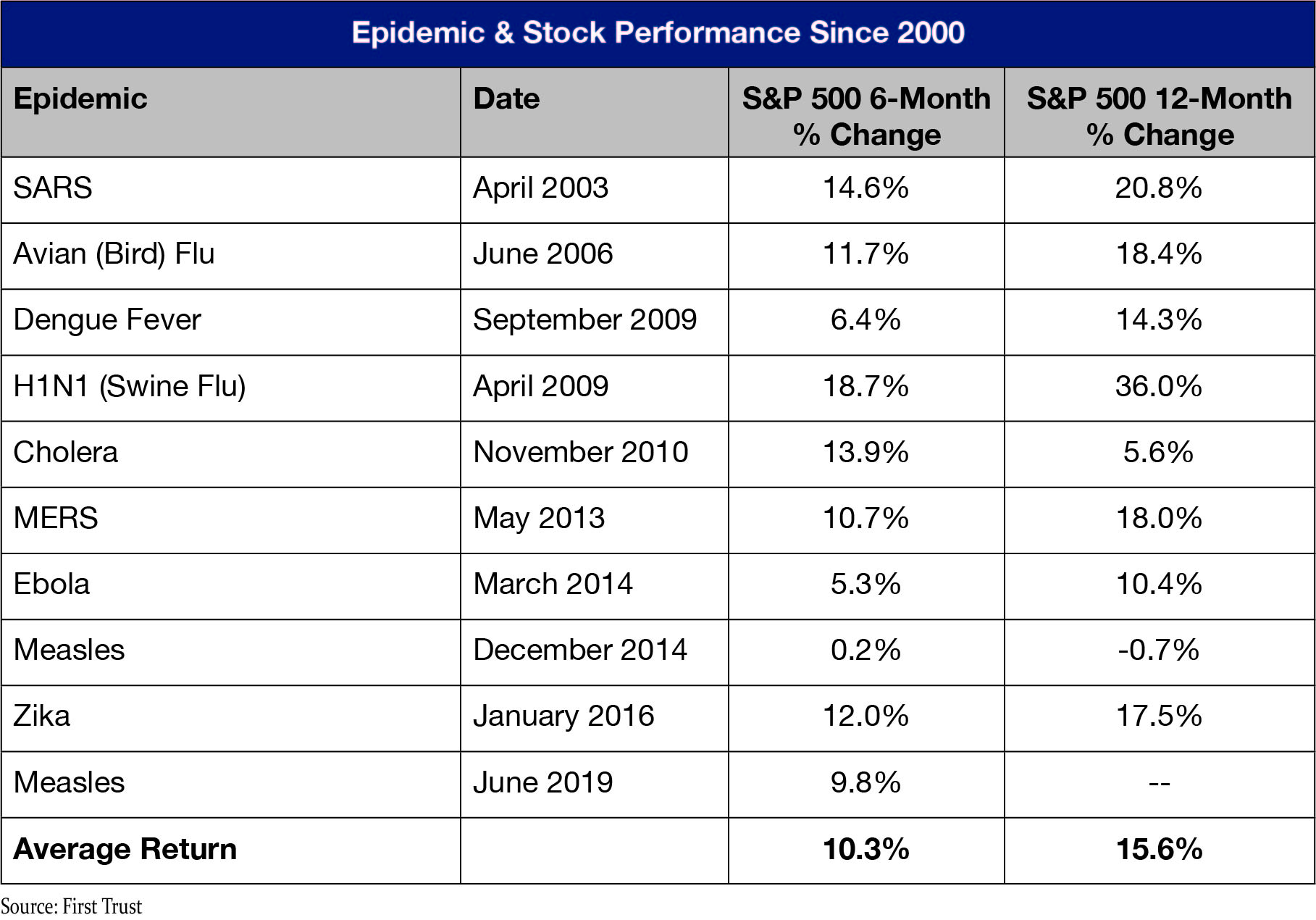

The economic impact of the virus began slowly with supply disruptions from China. Early reports indicated that the virus was less contagious and less fatal than the 2002 Severe Acute Respiratory Syndrome (SARS). COVID-19, while less fatal than SARS, is far more contagious. It wasn’t until the end of February that the broad stock market began to incorporate the risk presented by a possible pandemic. Uncertainty about infection rates, transmission, fatality rates and containment led to selling pressure. Measures were put in place to flatten the curve in order to relieve pressure on our health care system. Self-quarantine, isolation, social and physical distancing and stay-at-home orders, while all essential, quickly impacted the economy. The contraction that will surely be felt as a result of the closure of segments of our economy will be record-setting. This is one of the few times in our history that health has been put ahead of commerce.

As shocking and disruptive as the health crisis has been, our response at Tufton Capital has been to stay the course and maintain well-planned investment policies. Rebalancing portfolios is extremely important. The drop in share prices may have left some portfolios underweight to their equity objectives. Rebalancing and buying shares at depressed levels will pay off over the long term. The basis for the “stay the course” strategy is twofold. First, we see the virus as a relatively short-term event. Second, fatality rates are low, meaning that the aggregate demand for goods and services will not be permanently impaired and may be restored relatively quickly. Asset prices incorporate future cash flows into present values, and investment time horizons beyond one to three years take us well past the current crisis. Those portfolios with shorter time horizons will need to be evaluated.

We believe that market improvements hinge on two key variables. First, we need to see a plateau in new cases. Such cases are currently demonstrating the exponential growth forecasted by experts. Countries with earlier outbreaks are showing material reductions in reported new cases, which indicates that there is light at the end of the tunnel. Second, we need a strong monetary and fiscal response. The response will determine how deep the recession will be and how quickly the economy will be restored. Although the federal government was initially slow, it is now rolling out a dizzying array of programs.

The Federal Reserve implemented programs to stabilize the markets as well as the economy. Interest rates were cut twice – by 50 basis points on March 6th and by 1.00% on March 17th. Quantitative easing, the purchase of bonds in the market to manage interest rates and provide liquidity, was put into overdrive. The Fed committed to purchasing $500 billion in U.S. Treasuries and $200 billion in mortgage backed securities. Other programs included foreign exchange swap facilities with foreign central banks and loan offerings to support the issuance of asset backed securities and commercial paper funding facilities to support cash flow to households and individuals. Finally, numerous banking regulations were relaxed to make sure the money spigot remains wide open. For example, reserve requirements, or the amount of cash banks must hold in reserve, were cut to zero. The Fed learned many lessons during the Financial Crisis of 2008 and is in “whatever it takes” mode.

Congress was also busy and passed a $2 trillion economic relief package. The Coronavirus Aid, Relief, and Economic Security Act offers something for employees and employers, including one-time direct payments to some individuals and tax credits for employers who retain their employees. Other benefits include enhanced unemployment benefits, expanded sick leave and deferred tax deadlines. The relief package is an excellent start and is proportionate to stimulus bills passed during prior recessions at about 9% of gross domestic product. Although $2 trillion is a lot of money, it will not prevent a deep economic contraction. It is designed, however, to serve as a bridge to the other side of the pandemic.

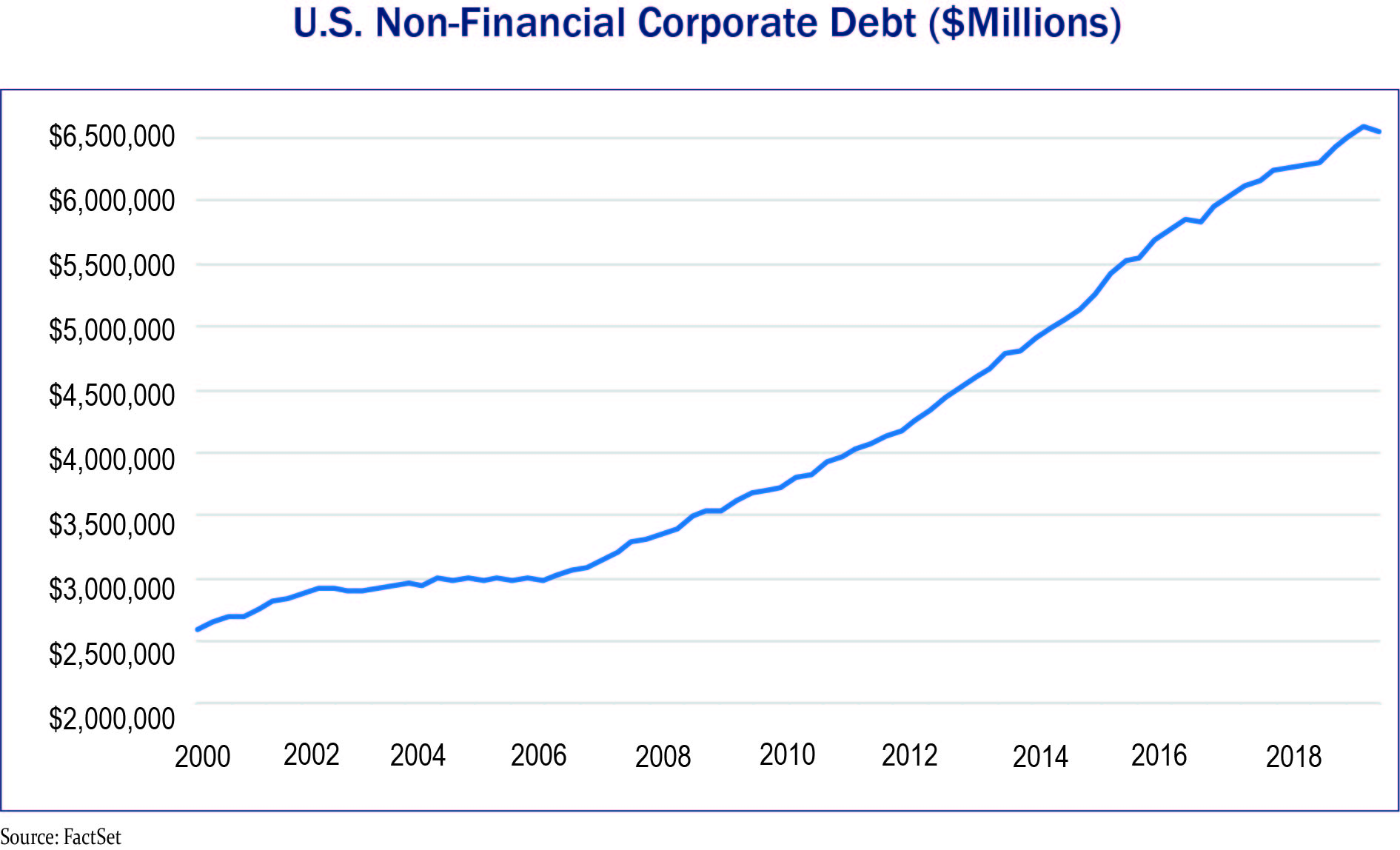

The length of the bridge is unknown, but structural integrity is required. The bridge serves as a replacement for the abrupt halt in commerce by putting cash into the hands of individuals and businesses. We need to keep our heads above water as the virus runs its course. The circulation of cash is critical to prevent a spiral into depression. What the other side of the bridge will look like is certainly subject to debate. An event like this pandemic and the sacrifices made by everyone may profoundly impact the way we do everything from working to shopping to delivering healthcare in the future. The level of debt within a company’s capital structure will also come under greater scrutiny. In the years following the Financial Crisis, companies issued record amounts of debt to take advantage of low interest rates, and in many cases the credit proceeds were used to repurchase stock. At the same time, households significantly reduced their debt. While the final word will not be written on this crisis for a long time, some change is certain.

As we emerge from this crisis, risks remain. Reopening the economy may drag on longer than anticipated, resynchronization of the global economy will take time, and stimulus measures put in place may need to be expanded – both conventional and unconventional. Additional measures such as infrastructure spending, national sales tax holidays and other assorted tax credits could be in the offing. During the Financial Crisis, a novel cash-for-clunkers incentive program was launched to aid the auto industry by encouraging the purchase of new and more fuel-efficient vehicles. Targeted programs such as tax incentives on travel could be introduced to assist the hard-hit airline and hospitality industries.

The introduction and availability of COVID-19 testing will be crucial for getting people back and ensuring a safe work environment. A vaccine is the clear long-term solution, but it will not be available for at least a year. The threat of a second and possible third wave of the virus poses additional risks if the economy is reopened too soon. We will also be monitoring for policy risk. The floodgates have been opened to minimize economic damage, but at some point the gates will again be closed and excess liquidity will be drained from the system. Moving too soon and too fast will have negative consequences.

Tufton Capital has several centenarians as clients. These men and women were born just as the great influenza of 1918 was ending. Our country survived then, and we will now. Advances in medicine and healthcare, along with improvements in monetary and fiscal controls, allow for far greater management of the crisis. There is great hope for the future, and as I have been reminded on numerous occasions, this too shall pass.