The Second Quarter of 2020: Lies, Damn Lies and Statistics

By Eric Schopf

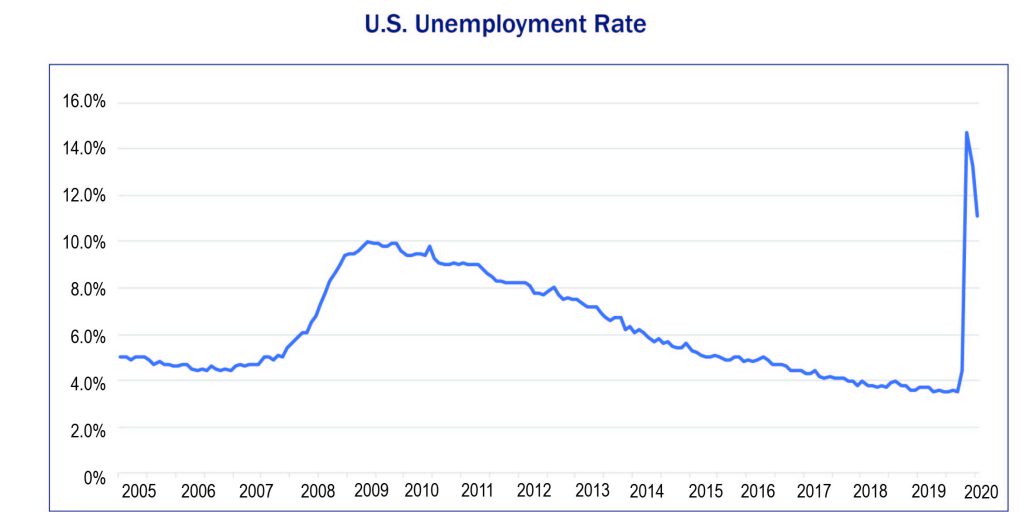

“There are three kinds of lies: lies, damned lies and statistics.” This phrase, popularized by Mark Twain, was right on point during the second quarter. Unbiased and accurate information regarding the coronavirus has been diluted by myriad sources tainted by political, economic or self-interest motives. The confusion sowed by half-truths and lies has resulted in uncertainty and false starts in objectively moving from economic lockdown to open-for-business. COVID-19’s source, transmission, treatment and morbidity patterns have been just one aspect of this disinformation flow. A dearth of testing and the stealth nature of the virus have created an environment ripe for deceit. True infection rates remain unknown. Even unemployment data, gathered and disseminated by the United States Bureau of Labor Statistics, a unit of the U.S. Department of Labor, was corrupted when it classified many people as employed but absent from work when in fact they were actually unemployed. This misclassification resulted in a reported unemployment rate of 14.7%, although it actually reached 19.5% during the quarter.

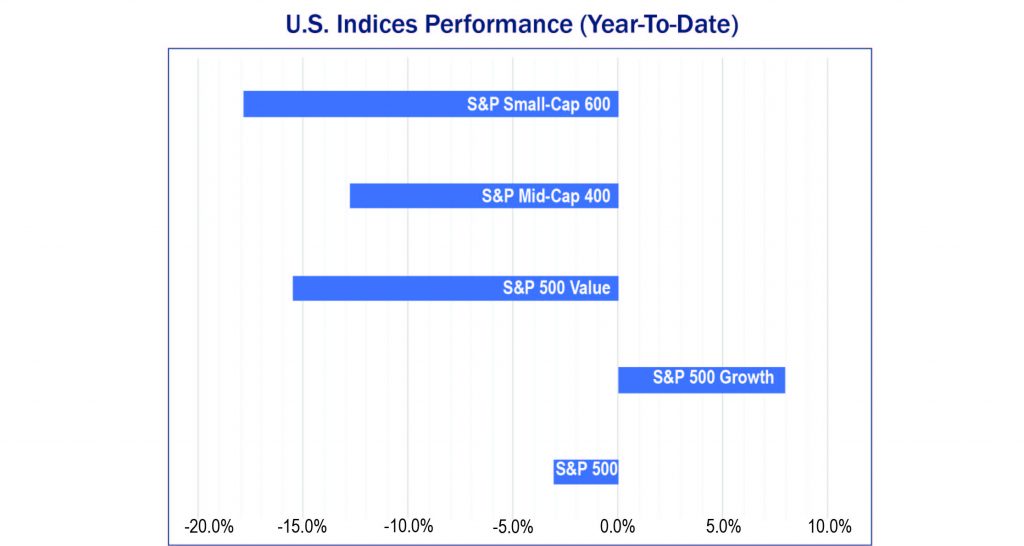

The uncertainty presented by the virus was reflected in the securities markets, although one might not have noticed at first glance. The Standard and Poor’s 500 closed the quarter with a gain of 20.5%, leaving the index at a loss of just 3.1% for the year. However, other equity indexes have not fared as well. As of June 30th, mid-cap stocks (companies with an average market capitalization of $5 billion) were down 12.8% for the year. Small-cap stocks (companies with an average market capitalization of $1.6 billion) were down 17.9%. Large stocks have done much better than their mid- and small-cap brethren. However, even within the large company universe, there are still big performance gaps. The average stock in the S&P 500 was down 10.9% for the year as of second quarter’s close. There has also been a divergence in value stocks (-15.5%) and growth stocks (+7.9%). Value stocks trade at lower valuation levels and typically pay generous dividends. Growth stocks usually have higher valuation levels and pay little if anything in dividends. Because the stock market has been led by a handful of large growth stocks, diversification has not been your friend.

The broad stock market, beyond the select handful of stocks mentioned above, reflects a very weak economy. Retail sales and industrial production sank to record lows during the quarter. The Purchasing Manager’s Composite Index of manufacturing and services touched an all-time low, and more people lost jobs in April than in all the previous recessions in the past fifty years combined. The anticipated drop in gross domestic product (GDP) will be twice that experienced during the financial crisis.

Despite the grim economic data and near-term uncertainty, there are some positive signs. Aggressive fiscal and monetary policies have helped limit the potential damage. Fiscal policy has been crafted through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The far-reaching $2.1 trillion Act provides support to many different areas with portions of the Act executed by the Federal Reserve. Highlights of the Act include:

- $130 billion allocated to the medical and hospital industries.

- $500 billion Economic Stabilization Fund (assist businesses, states, and municipalities).

- $669 billion Paycheck Protection Program (small business loan program).

- Employer deferral of employees share of social security tax for up to two years.

- Credits against 2020 personal income tax (direct cash payments of $500 – $2,400).

- Federal Pandemic Unemployment Compensation (additional $600/week in unemployment).

- Pandemic Emergency Unemployment Compensation (13-week unemployment extension).

- Suspension on required minimum distributions from certain retirement accounts.

The Federal Reserve’s monetary policy has focused on providing liquidity through asset purchases and lending facilities. The purchase of assets in the secondary market stabilizes prices and gives confidence to the market through their explicit support. Asset purchases now include corporate bonds as well as more traditional U.S. Treasury securities and mortgages. The Fed has also engaged in direct lending to small and midsized companies through their Main Street Lending Program. This is the first time the Fed has loaned money to companies outside of the banking industry since the Great Depression. The Municipal Liquidity Facility was established to help state and local governments by directly purchasing short-term notes from U.S. states as well as some counties and cities. The Fed has established nine different emergency lending facilities to make sure that the health crisis does not become a financial crisis. The Fed never normalized policy following the financial crisis, so they are deep into their play book.

The impact of the monetary and fiscal policies cannot be overstated. According to the Bureau of Economic Analysis, economic income has fallen by $85 billion through salary, wage, rent and dividend reductions or eliminations. However, $250 billion of economic aid has been injected through the various stimulus programs. The net effect has been a 10.8% annual increase in income. This increase in income has been met with precipitous reductions in consumer spending and a spike in the savings rate. Money is not being spent the way it has been in the past. The reduction in consumer spending reflects economic uncertainty and eroding consumer confidence. As a result, stimulus measures are not trickling down to the real economy.

The banking and credit industries have also climbed onboard the support wagon. Banks, vilified during the financial crisis, are more willing to extend forbearance to lenders. Forbearance defers loan payments while keeping the interest accrual meter running. Insurance companies are reducing premiums, and in some cases are accepting late payments without canceling coverage. The idea is to buy time until some sense of normalcy returns.

Optimism is building as more states and municipalities move to reduce virus-related restrictions and more people return to work. Economic improvements are already evident. At this point, improvements are evident in the form of things being less bad. For example, consumer spending fell 12.2% in April and rose 8.1% in May. However, spending is still down 11.7% from February. Nonfarm payrolls rose by 4.8 million in June, but this is a drop in the bucket compared to the roughly 18 million still unemployed. The number of people unemployed one year ago was just 1.7 million.

Although we remain optimistic about the future, we temper our enthusiasm due to some very clear risks. The biggest risk, of course, is the additional spread of COVID-19 and potential subsequent waves of the virus through the fall and into next year. With no vaccine currently available, a regression to full economic closure would be very damaging. Virus cases are rising across the Sun Belt. The potential for temporary layoffs and furloughs to become permanent also poses a significant risk. The enhanced unemployment benefits that are part of the CARES Act begin to expire at the end of July. A reduction in benefits prior to broad economic improvements may lead to one giant step backward. The presidential election in November and political posturing is another concern. Recent polls have shown that Democrats are more likely to win the White House and Senate. Combined with their current House majority, the Democrats may be in no rush to pass stimulus legislation that would cast incumbents in a favorable light. A delay in additional stimulus, if needed, would be quite harmful. Finally, poor relations with China continue to simmer on the back burner. The Chinese economy is too big and too important to leave unaddressed.

The “Bridge to Somewhere” that we identified in our first quarter newsletter is still a work in process. Macadam has been set, and in some cases removed for new, improved layers. New lane lines have been painted. Progress is being made. What we do not know is the toll that must be charged to cross the bridge. It is too early to determine the total costs involved or who will bear the greatest financial burden. The long-term consequences of such a massive project are unknown. A clear cost in the short term has been low interest rates. Low rates are a sure tonic for economic instability but seriously impact risk-sensitive savers. With the Fed driving prices up and yields down through their asset purchase programs, we are left with miniscule income yields on our fixed income investments.

Throughout the pandemic, we continue managing portfolios in accordance with your investment policies and asset allocation targets. There is a certainty to uncertainty. No one plans for a pandemic, and we are not sure how or when things will unfold. However, the market volatility we are experiencing was contemplated and incorporated into your investment policies, and the current crisis will pass only to be replaced by new challenges in the future. It is important to stay focused on your long-term goals and maintain a sound investment strategy.