The Fourth Quarter of 2019: Looking a Gift Horse in the Mouth

By Eric Schopf

The stock market delivered a dazzling performance in the fourth quarter. The Standard and Poor’s 500 returned 9.07% and finished the year with a total return of 31.49%. The 10-Year U.S. Treasury yield closed the year at 1.92%. Although the rate had moved up from 1.68% at the beginning of the quarter, it is significantly below the 2.68% level where it started the year. Last year was a big departure from 2018. One year ago, I wrote that the Standard and Poor’s 500 turned in the worst fourth quarter performance since the depths of the financial crisis in 2008, and that the fourth quarter total return of -13.52% wiped out all performance gains for the year, which settled at -4.38%. What a difference a year makes!

The strong stock market results stand in stark contrast to much of the prevailing economic and geopolitical news. Economic fundamentals continued to weaken in the quarter. The Institute for Supply Management Manufacturing Index (ISM) dropped further in December. Employment growth, or the number of new jobs created every month, has slowed down, and retail sales were weaker than expected. The International Monetary Fund cut their global GDP forecast to 3%, which was the lowest in a decade.

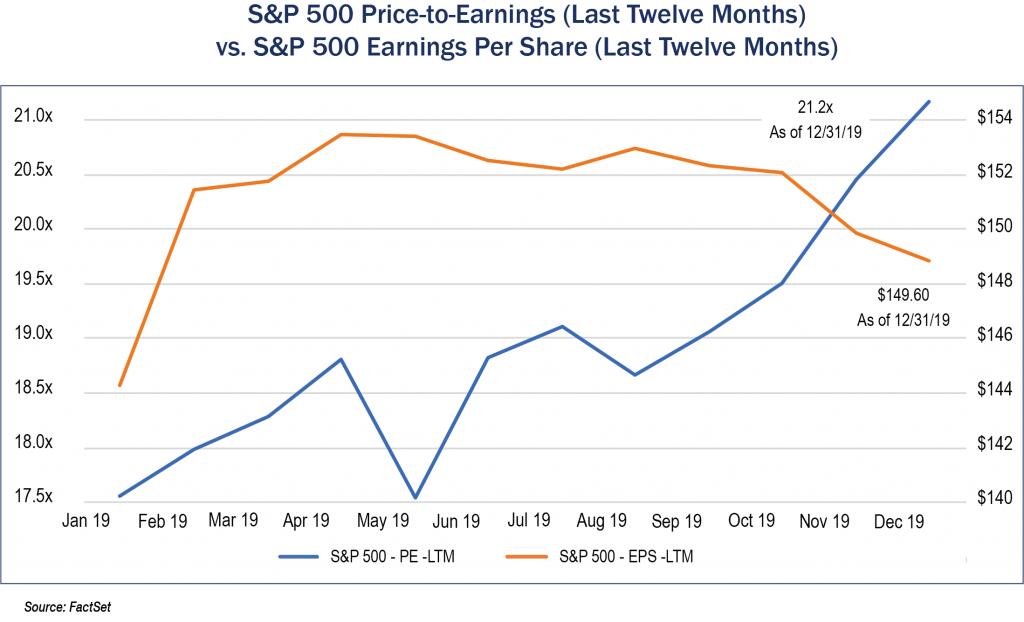

Although “phase one” of the trade agreement with China was reached, many tariffs still remain in place. Impeachment proceedings are dragging on. Corporate earnings have been in the tank. Earnings for companies in the S&P 500 show just a 2.5% increase for 2019. Production of the Boeing 737 Max has been halted, and suppliers are beginning to lay off employees. It is estimated that the suspension of the production of the 737 Max could shave 0.5% from GDP growth.

Then why was the stock market so strong? After all, this is only the third time in 23 years that the S&P 500 has provided a total return in excess of 30%. Perhaps we don’t need to look this gift horse in the mouth and just happily accept this momentous bounty. However, we must acknowledge that 2018 was a bad year, so some rebound was to be expected. Second, consumer confidence remains strong. Consumption represents all the goods and services that are purchased by households (individual consumers) which constitutes about 68% of the U.S. economy, so a strong consumer is paramount for a robust economy. There are also no signs of irrational consumer behavior as evidenced by their high savings rates. Although retail sales were weak and employment growth is slowing, the unemployment rate remains at historically low levels. Third, the trade negotiations are heading in the right direction as the U.S. and China have tempered their rhetoric. Optimism remains for a further easing of tensions, and “phase two” of the trade agreement is already in the works. There has also been some movement on the Brexit front, which is a welcome relief to the very battered Euro Zone. Additional good news is that the weakness in the manufacturing sector has not spilled into the service sector of our economy. The General Motors strike is behind us, and a resolution to the design issue at Boeing should eventually lead to the resumption of 737 Max production. Finally, the yield curve, which inverted during the year and was the subject of a great deal of our commentary, has normalized due to the Fed’s cutting of interest rates. Many of these issues are at an inflection point and are moving in a positive direction.

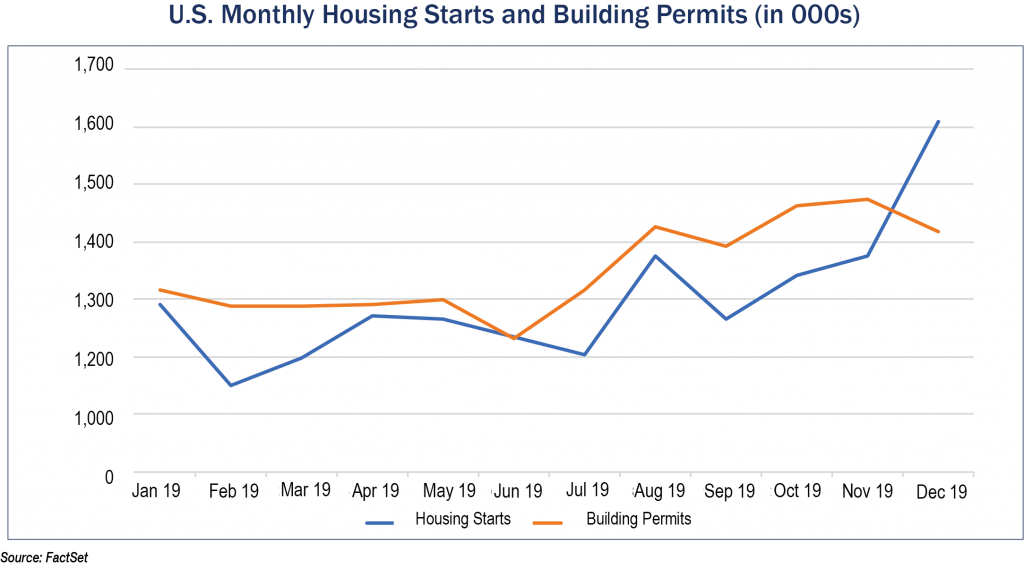

However, the real heavy lifting in the quarter and throughout the year was done by the Federal Reserve and the executive branch of our federal government. The Federal Reserve didn’t only cut interest rates three time during the year, but they also signaled that they will be more reactive, rather than proactive, to inflationary pressures. This change in stance reduces the likelihood of an overzealous Fed-induced recession. Lower interest rates have been a catalyst for the housing market, and both building permits and housing starts surged in the second half of the year. Fiscal policy has been characterized by deficit spending, and President Trump has run average annual budget deficits of $863 billion during his term. This compares to $600 billion of deficits during the Obama administration. The U.S. economy, as measured by Gross Domestic Product, is around $21.5 trillion, and an extra $275 billion is the equivalent of about 1% of GDP. While the monetary and fiscal stimulus has provided the fuel for the stock market fire, this $275 billion increase is a big deal.

How does the stock market push higher from here? The stock market climbed 31.5% on the back of earnings that grew by just 2.5%. The expansion in price/earnings multiples makes this a “show-me” market. The headwinds that prevailed in 2019 must become tailwinds, and corporate earnings need to achieve something close to the 10% growth forecast by market strategists. Improving trade relations with both China and Europe, sustained employment growth and a revival of corporate confidence to invigorate business investment will all be required. A lack of earnings growth, for whatever reason, would leave the market vulnerable.

The presidential election in the back half of the year also creates uncertainty. Emotions run high with this administration, and the outcome will have an impact on the markets. A Trump reelection will most likely bring more deficit spending, while any attempt by the Democrats to raise taxes and address the deficit could be detrimental. Additional infrastructure spending from either party would further drive growth without the need for Federal Reserve support.

We thoroughly looked this gift horse in the mouth and found that it is worth keeping. It may slow down a little after sprinting so hard last year, and we may need to replace the shoes from time to time. Nonetheless, we think there is more room to run as we transition into greener pastures.

Your team at Tufton Capital Management welcomes the New Year and the challenges it will present in managing your portfolios.