The Weekly View (10/23/17)

What’s On Our Minds:

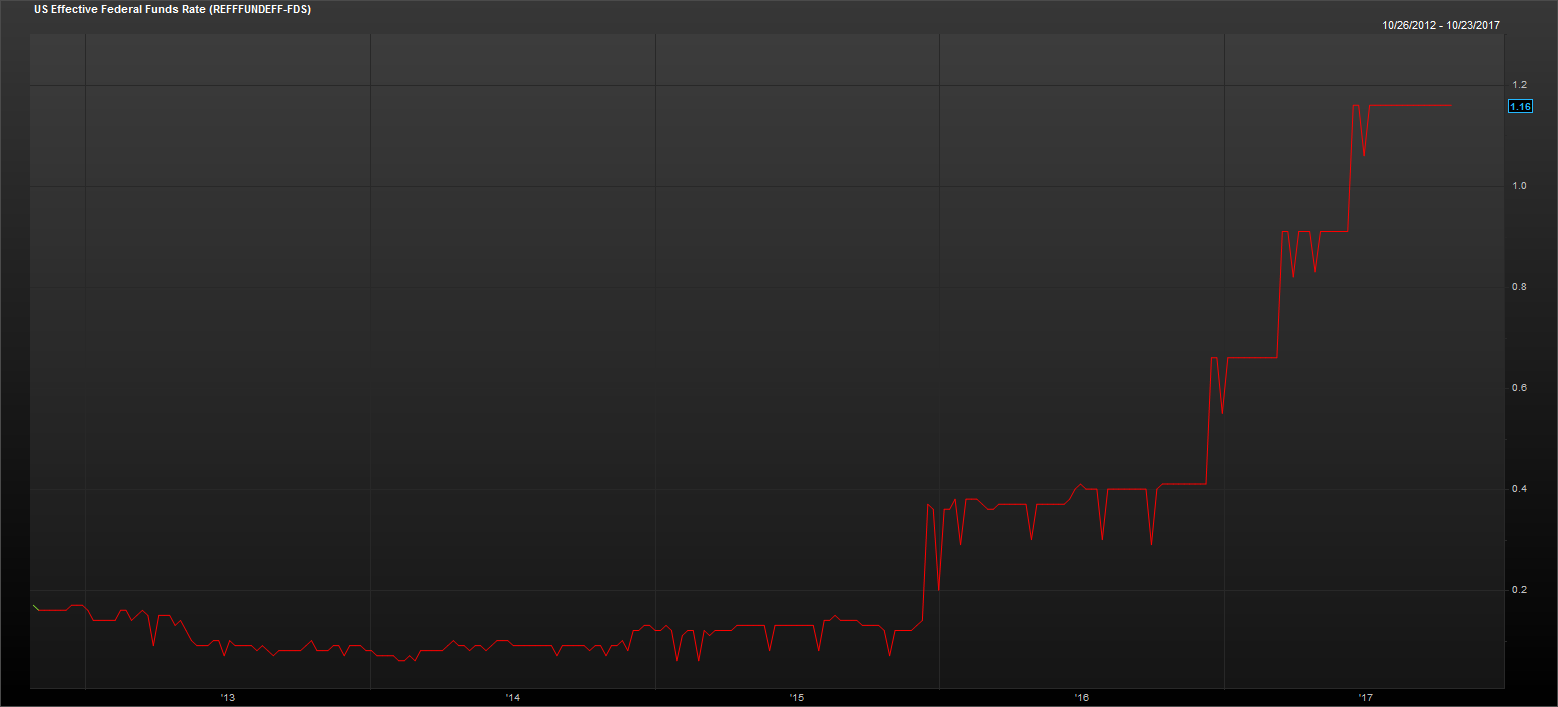

Equity markets have been on a roll lately, but don’t forget about interest rates!

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects. We’ve tried to break down these levers without getting too granular or using financial jargon.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rate raise, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for me to want to buy its stock now for a $10 million valuation. But if interest rates are higher, I’d be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

Whenever you hear about Janet Yellen attending a big Federal Reserve meeting, they have to think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. And… This gives rise to the “pushing on a string” phenomenon that was one of our investment committee’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash. This illustrates, in part, one of the major limitations of monetary policy (setting interest rate, money supply, etc.) vs. fiscal policy (where and how the government spends their money). But fiscal policy is a topic for another post.

Last Week’s Highlights:

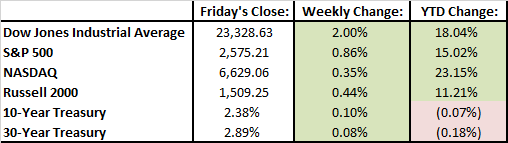

Equity markets enjoyed their 6th consecutive week in the green. The Dow Jones and S&P 500 recorded record highs on Thursday on the 30th anniversary of Black Monday. The Dow Jones had a great week and was up 2%. So far, we have seen strong third quarter earnings reports that has investors pushing equity market ever higher. General Electric was an exception to the news of strong earnings figures. GE’s CEO opened earnings remarked by saying, “The results I’m about to share with you are completely unacceptable.” He telegraphed big changes ahead for the company. According to the numbers, American companies appear strong and the economy continues to improve. Investors were also supportive of the news that Jerome Powell could be nominated to replace Janet Yellen.

Looking Ahead:

Can stocks continue steaming upward? That’s the question on everybodys’ minds.

Politicians in Washington seem to be getting closer to proposing a tax reform plan. Equity analyst will be busy listening to earnings calls this week. CNBC provided the chart below highlighting key earnings releases coming from blue chip companies this week.