The Weekly View (11/18/19)

Last Week’s Highlights:

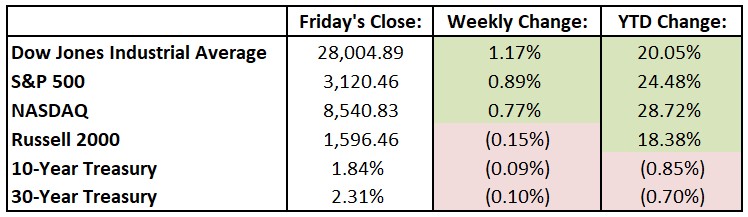

U.S. stocks hit new records as investors grew more confident that the economic cycle has more room to run. The Dow Jones Industrial Average (DJIA) crossed the 28,000 level for the first time as fading recession fears extended the bull-market rally. Trade optimism also helped fuel market strength, as U.S.-China negotiations looked to be moving toward a phase-one deal that may include both sides rolling back some existing tariffs. Fresh data on Friday showed that U.S. retail sales rebounded in October, rising 0.3% after a decline the previous month. This report reflected continued confidence in the U.S. consumer, an integral ingredient in domestic growth. Walmart’s (WMT) strong financial report on Thursday also supported a healthy consumer environment, as the retail giant reported its fifth consecutive year of quarterly sales gains. For the past week, the Dow rose 323.65 points, or 1.2%, to 28,004.89, while the S&P advanced 0.9% to 3120.46. The tech-heavy NASDAQ was up 0.8%, closing at 8540.83.

Looking Ahead:

A bevy of retailers will report earnings this week as third-quarter earnings season nears its end. On Monday, the National Association of Home Builders releases its Housing Market Index for November – economists call for a 72 reading, up from October’s 71 print. Tuesday brings earnings results from Home Depot (HD), TJX (TJX) and Alcon (ALC). Oracle (ORCL) holds its annual shareholders meeting in Redwood City, CA. Retail earnings continue Wednesday, with results expected from Lowe’s (LOW), Target (TGT) and L Brands (LB). The Federal Open Market Committee (FOMC) releases minutes from its previous monetary-policy meeting from late October. Gap (GPS), Intuit (INTU) and Ross Stores (ROST) announce earnings results on Thursday. The National Association of Realtors reports existing-home sales for October – consensus estimates call for a seasonally adjusted annual rate of 5.5 million, up 2.2% from September’s 5.4 million. The business week ends with financial results from Foot Locker (FL) and J.M. Smucker (SJM) on Friday. The Federal Reserve Bank of Kansas City reports its Manufacturing Survey for November – expectations are for a reading of +1, up from October’s -3.

The Tufton Capital Team hopes that you have a wonderful week!