The Weekly View (11/11/19)

Last Week’s Highlights:

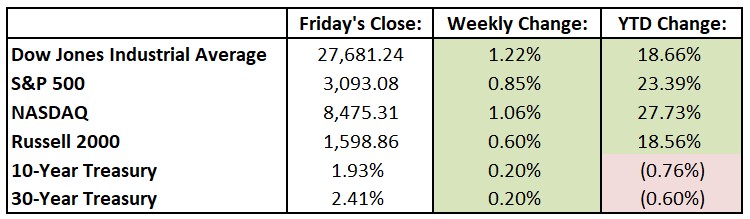

U.S. stocks hit new records and government-bond yields notched their biggest weekly gain in over a month as investors grew more confident that the economic cycle has more room to run. Trade optimism also helped fuel market strength, as U.S.-China negotiations looked to be moving toward a phase-one deal that may include both sides rolling back some existing tariffs. For the past week, the Dow Jones Industrial Average (DJIA) rose 333.88 points, or 1.2%, to 27,681.24, while the S&P advanced 0.8% to 3093.08. The tech-heavy NASDAQ was up 1.1%, closing at 8475.31. Investors appeared to be unravelling bets on investments that are traditionally safer, such as U.S. Treasurys, and buying riskier parts of the market. This “risk-on” atmosphere helped boost the yield on the 10-year Treasury note to its highest level since July, as it ended the week at 1.930%. (Bond yields and bond prices move in opposite directions). Let’s look at market valuations: with the stock market strength this year (the S&P 500 is up 23% YTD), the index sells for a forward price/earnings ratio of 17.2 times. Yes, this looks expensive, as the index has traded for 14.4 times forward estimates, on average, since 1986 (excluding the dot-com bubble). However, with continued strong economic growth (especially for the U.S. consumer), more trade progress and an accommodative Federal Reserve, a case can be made that stocks, while perhaps not cheap, still have room to move higher.

Looking Ahead:

Third-quarter earnings season winds down this week with just 14 S&P 500 companies reporting their financial results. Monday is Veterans Day, and U.S. bond markets and banks are closed in honor of this very important holiday. DXC Technology (DXC) and Tencent Music Entertainment Group (TME) report quarterly results. Advance Auto Parts (AAP), CBS (CBS) and Tyson Foods (TSN) release financials on Tuesday. The National Federation of Independent Business announces its Small Business Optimism Index for October – consensus estimates call for a 102 reading, about even with September’s print. Look for earnings reports from Canada Goose Holdings (GOOS), Cisco Systems (CSCO) and NetApp (NTAP) on Wednesday. Fed Chairman Jerome Powell heads to Capitol Hill, where he’s scheduled to testify on the economic outlook before the Joint Economic Committee. Applied Materials (AMAT), Nvidia (NVDA) and Walmart (WMT) announce financials on Thursday. The Bureau of Labor Statistics (BLS) releases the producer-price index (PPI) for October – economists call for a 1% year-over-year rise. Helmerich & Payne (HP) and JD.com (JD) report earnings results on Friday. The Census Bureau announces retail-sales data for October – consensus estimates are for a 0.2% gain. Excluding the more volatile auto and gas inputs, retail sales are expected to rise 0.3%.

The Tufton Capital Team hopes that you have a wonderful week!