The Weekly View (11/4/19)

Last Week’s Highlights:

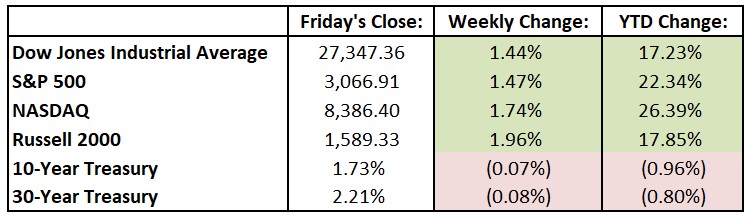

The S&P 500 and tech-heavy NASDAQ Composites closed at new highs Friday after a strong October jobs report (the U.S. added 128,000 jobs for the month) reassured investors about the pace of economic growth. Wall Street also welcomed continued solid corporate earnings reports and a quarter point rate cut by the Federal Reserve (as expected). For the past week, the Dow Jones Industrial Average (DJIA) rose 389.30 points, or 1.4%, to 27,347.36, while the S&P advanced 1.5% to 3066.91. The NASDAQ was up 1.7%, closing at 8386.40. More than three-quarters of companies in the S&P 500 that have reported earnings results through the end of last week have beaten analysts’ expectations. For the month of October (which ended last Thursday), the S&P 500 rose 2%, setting a new high and undermining the month’s reputation for havoc. Though most Octobers pass without incident, the market’s biggest crashes (most notably in 1929 and 1987) have occurred in October.

Looking Ahead:

Third-quarter earnings season continues this week, with Sysco (SYY), Consolidated Edison (ED), Marriott International (MAR) and Uber Technologies (UBER) reporting financial results Monday. On Tuesday, look for results from Becton Dickinson (BDX), Emerson Electric (EMR) and Newmont Goldcorp (NEM). It’s also Election Day across much of the country. The Institute for Supply Management reports its Non-Manufacturing PMI for October – estimates call for a 53.5 reading, up from September’s 52.6 print. CVS Health (CVS), Qualcomm (QCOM) and Humana (HUM) report earnings on Wednesday. The Bank of Japan releases minutes from its monetary policy meeting held in September. Thursday is a busy one for more financial reports, including numbers from Amerisource-Bergen (ABC), Cardinal Health (CAH), Walt Disney (DIS) and Zoetis (ZTS). The Bank of England announces its monetary policy decision – the central bank is widely expected to keep its key short-term rate unchanged at 0.75%. Duke Energy (DUK) and Honda Motor (HMC) release quarterly results on Friday. The University of Michigan reports its November Consumer Sentiment Survey – economists expect a 96.3 reading, up from October’s 95.5.

The Tufton Capital Team hopes that you have a wonderful week!